Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SABM Co. reported net income of P2,100,000 for 2020 . It incurred operating expenses other than interest expense , at 40% of cost of sales

4.CAC Co. provided these information for 2020: Inventory - January 1 : P400,000; Freight in : P300,000; Purchase Returns : P900,000; Inventory - December 31 : P500,000; Selling expenses: P1,250,000; Sales Discount: P250,000. The cost of sales is six times the selling expenses. How much is the gross purchases for 2020?

5.Data taken from the records of XYZ Co. revealed the following for 2020: Inventory - January 1 :P2,000,000; Net purchases : P7,000,000; Inventory - December 31 : P2,800,000; Sales Returns and allowances: P750,000. Gross profit based on net sales is 20%. How much is the gross sales for 2020?

6.MBA Corporation reported net income of P7,410,000 for 2020, which included the following items: Unrealized loss on financial assets at FVOCI (P540,000); Loss from fire (P1,400,000); Gain on early retirement of long term debt: P2,200,000; Gain from change in fair value attributable to credit risk of financial liability designated at FVPL : P500,000; Prior period adjustment for depreciation, net of tax (P750,000). How much is the true net income for 2020?

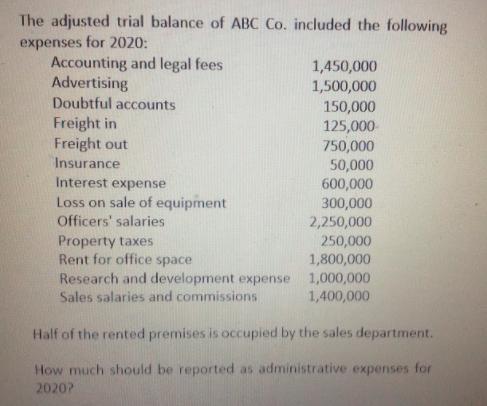

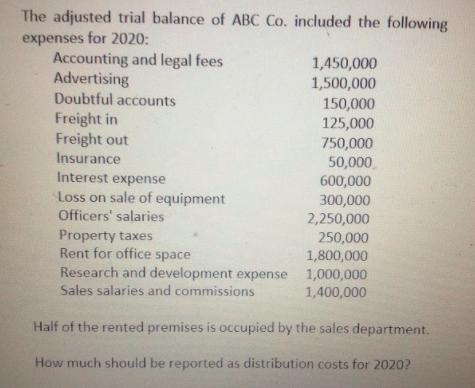

The adjusted trial balance of ABC Co. included the following expenses for 2020: Accounting and legal fees Advertising Doubtful accounts Freight in Freight out Insurance Interest expense Loss on sale of equipment Officers' salaries Property taxes Rent for office space Research and development expense Sales salaries and commissions 1,450,000 1,500,000 150,000 125,000- 750,000 50,000 600,000 300,000 2,250,000 250,000 1,800,000 1,000,000 1,400,000 Half of the rented premises is occupied by the sales department. How much should be reported as administrative expenses for 2020?

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

1 To determine the administrative expenses for 2020 we need to identify the expenses that fall under administrative expenses The expenses that are considered administrative expenses are accounting and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started