Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sabon Corporation sells beauty products. The company's fiscal year ends on December 31. The following transactions occurred in 2017: a. Purchased $385,000 of soaps

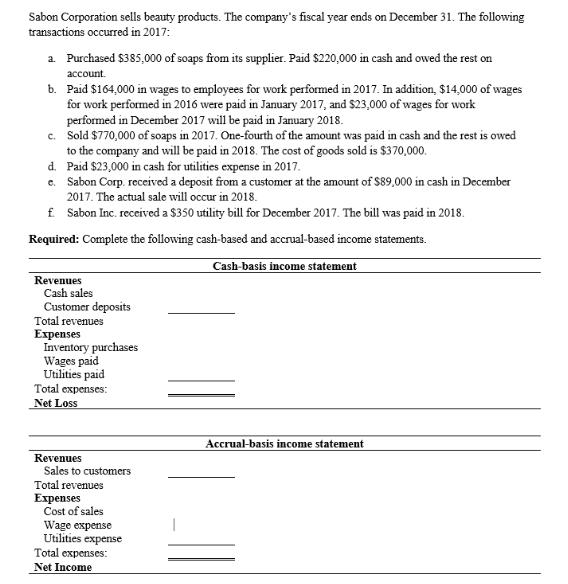

Sabon Corporation sells beauty products. The company's fiscal year ends on December 31. The following transactions occurred in 2017: a. Purchased $385,000 of soaps from its supplier. Paid $220,000 in cash and owed the rest on account. b. Paid $164,000 in wages to employees for work performed in 2017. In addition, $14,000 of wages for work performed in 2016 were paid in January 2017, and $23,000 of wages for work performed in December 2017 will be paid in January 2018. c. Sold $770,000 of soaps in 2017. One-fourth of the amount was paid in cash and the rest is owed to the company and will be paid in 2018. The cost of goods sold is $370,000. d. Paid $23,000 in cash for utilities expense in 2017. e. Sabon Corp. received a deposit from a customer at the amount of $89,000 in cash in December 2017. The actual sale will occur in 2018. f. Sabon Inc. received a $350 utility bill for December 2017. The bill was paid in 2018. Required: Complete the following cash-based and accrual-based income statements. Revenues Cash sales Customer deposits Total revenues Expenses Inventory purchases Wages paid Utilities paid Total expenses: Net Loss Cash-basis income statement Revenues Sales to customers Total revenues Expenses Cost of sales Wage expense Utilities expense Total expenses: Net Income Accrual-basis income statement

Step by Step Solution

★★★★★

3.39 Rating (183 Votes )

There are 3 Steps involved in it

Step: 1

Cashbasis Income Statement Revenues Cash sales 192500 Total Revenues 192500 Expenses Invent...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started