Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sabres Limited, a Canadian-controlled private corporation whose fiscal year end is December 31 , ITA: 89(1) provides you with the following data concerning its tax

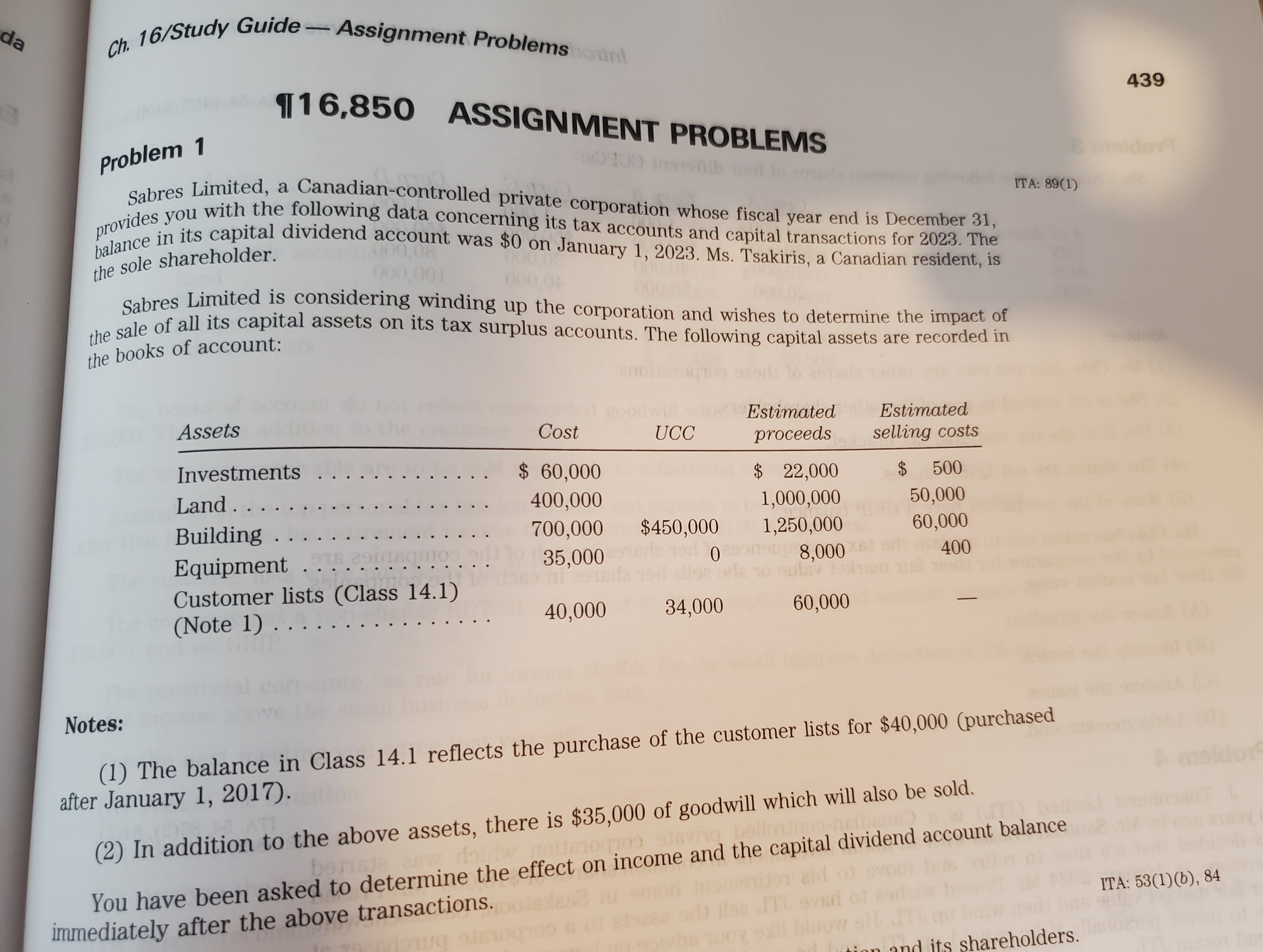

Sabres Limited, a Canadian-controlled private corporation whose fiscal year end is December 31 , ITA: 89(1) provides you with the following data concerning its tax accounts and capital transactions for 2023. The balance in its capital dividend account was $0 on January 1,2023 . Ms. Tsakiris, a Canadian resident, is the sole shareholder. Sabres Limited is considering winding up the corporation and wishes to determine the impact of the sale of all its capital assets on its tax surplus accounts. The following capital assets are recorded in the books of account: Notes: (1) The balance in Class 14.1 reflects the purchase of the customer lists for $40,000 (purchased after January 1, 2017). (2) In addition to the above assets, there is $35,000 of goodwill which will also be sold. You have been asked to determine the effect on income and the capital dividend account balance immediately after the above transactions

Sabres Limited, a Canadian-controlled private corporation whose fiscal year end is December 31 , ITA: 89(1) provides you with the following data concerning its tax accounts and capital transactions for 2023. The balance in its capital dividend account was $0 on January 1,2023 . Ms. Tsakiris, a Canadian resident, is the sole shareholder. Sabres Limited is considering winding up the corporation and wishes to determine the impact of the sale of all its capital assets on its tax surplus accounts. The following capital assets are recorded in the books of account: Notes: (1) The balance in Class 14.1 reflects the purchase of the customer lists for $40,000 (purchased after January 1, 2017). (2) In addition to the above assets, there is $35,000 of goodwill which will also be sold. You have been asked to determine the effect on income and the capital dividend account balance immediately after the above transactions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started