Answered step by step

Verified Expert Solution

Question

1 Approved Answer

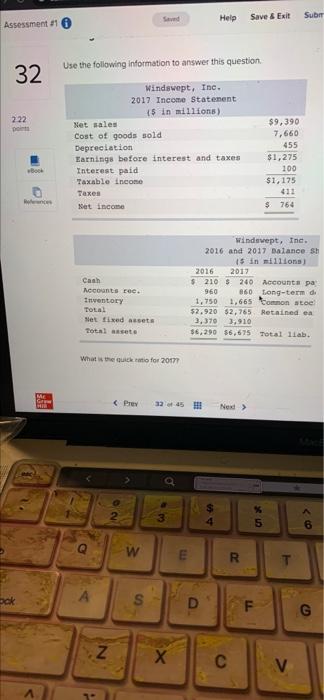

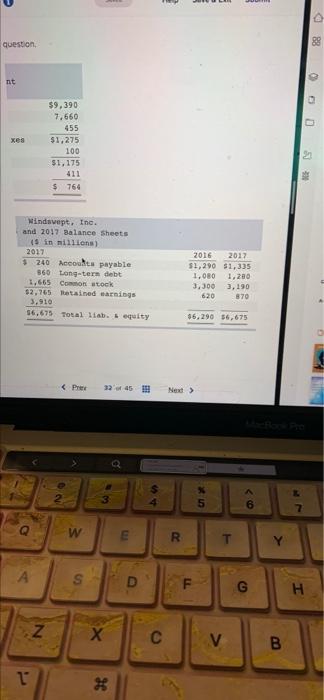

Sad Help Sub Save & Exit Assessment #16 Use the following information to answer this question 32 222 D Windswept, Ine. 2017 Income Statement 15

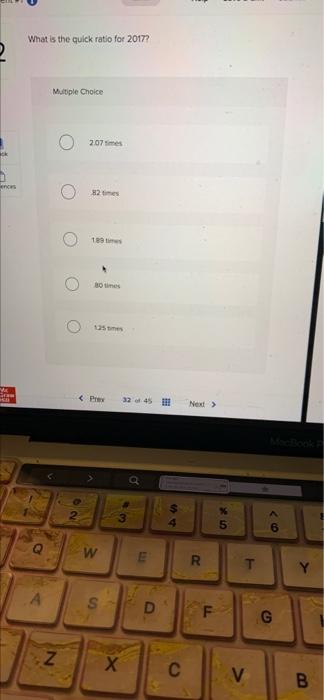

NO 3 $ 4 5 6 Q w R T A S D F G H N Z C V B * What is the quick ratio for 2017? Multiple Choice 2.07 mes cos 2 Botines nes 3245 Next > 2. 2 3 4 8 % 5 200 W E R T Y S D F G N V B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started