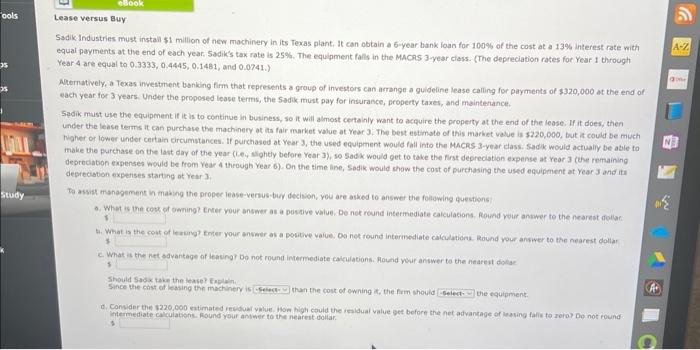

Sadik Industries must install 51 milion of new mochinery in its Texas plant. It can obtain a 6 -year bank loan for 100% of the cost at a 13% interest rate with equal payments at the end of each year, 5adik's tax rate is 25%. The equlpment falls in the MAchs 3 -year ciass. (The depreciation rates for Year 1 through Year 4 are equal to 0.3333,0.4445,0.1481, and 0.0741. ) Apernatively, a Texas investment benking firm that represents a group of investors can acrange a guldeline lease calling for payments of 3320 ;0oo at the end of each year for 3 vears. Under the proposed leace terms, the Sadik must pay for insurance, property taxes, and maintertance. Sadik. must use the equipment if it is to continue in business, so it will almost certainly want to acquire the property at the end of the lease, If it does, then under the lease temms it can purchase the machinery at its fair market value at vear 3. The best estimate of this market vatue is 3720 , Doo, but it could be much Wigher or lower under certain circumstances. If purchased at Year 3 , the used equipment would fall into the Macrs-3-year dass. Sadik would actualiy be able to make the purchase oo the last day of the year (1.e. Alohtly before Year 3 ), so sadk would get to take the first depreciation expense at year 3 (the romaining deprociabon experses would be from Year 4 through Year 6). On the time ane, Sadik would show the cost of purchasing the used equipment at Year 3 and it: deprecation experises startung ot Year 3 . Ta assist management in making the proper lease-versus-bior decition, you are asked to answer the foldwing questigns 6. What is the caut of owning? Emer your answer as a postive valiue. De net reund interinediate calculacions, Rownd roiar antwer to the nearest doliae. 4. What is the coit of lewung? Emter your anweer as a postwe value. Do net round intermediate calcalaticha. Round wour answer to the nearest doliar 3 5 Should Sas a take the lease? Enplain. Since the cost of leasing the machinery is Than the cost of owning is, the firt should the equipment. d. Consider the 1220,000 eatimated rewdoal yalue. Wow bigh could the realdual value get before the net adyantage of leswing falis to rofor Do not round intermediate calrulatiotis. nound your antwer to the nearest dollar