Answered step by step

Verified Expert Solution

Question

1 Approved Answer

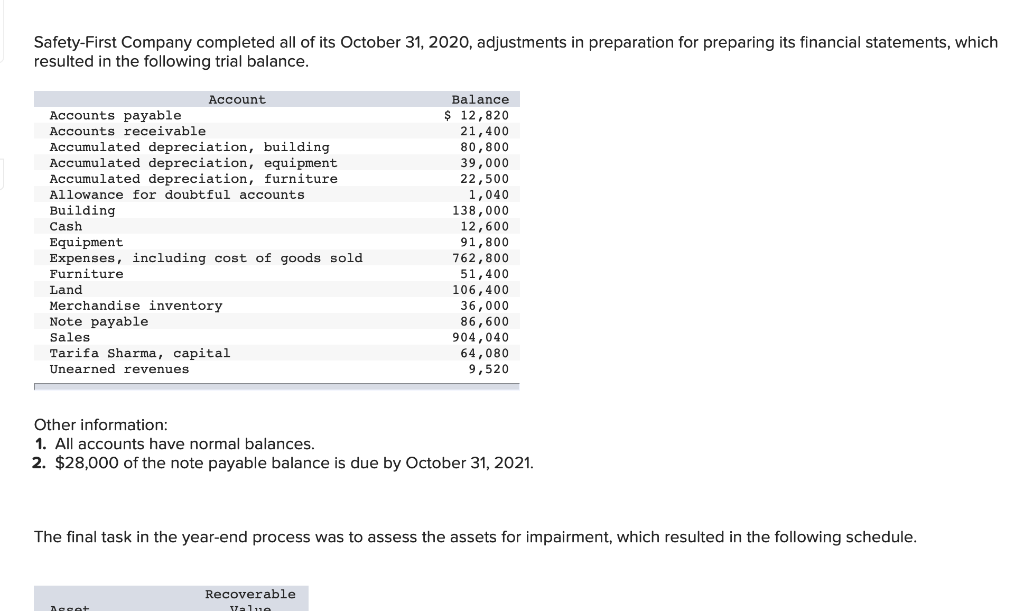

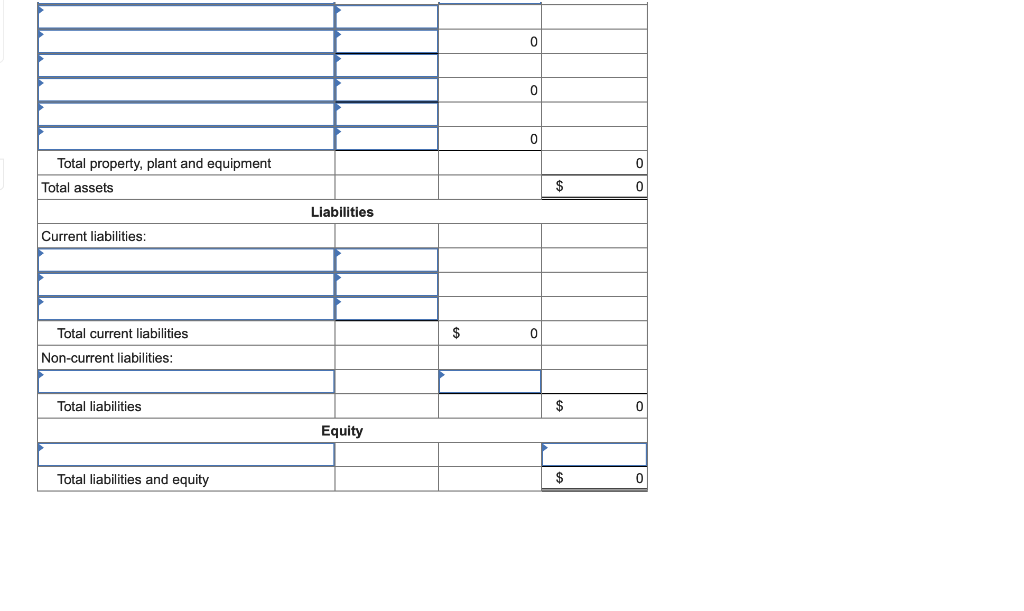

Safety-First Company completed all of its October 31, 2020, adjustments in preparation for preparing its financial statements, which resulted in the following trial balance. Account

Safety-First Company completed all of its October 31, 2020, adjustments in preparation for preparing its financial statements, which resulted in the following trial balance.

| Account | Balance | ||

| Accounts payable | $ | 12,820 | |

| Accounts receivable | 21,400 | ||

| Accumulated depreciation, building | 80,800 | ||

| Accumulated depreciation, equipment | 39,000 | ||

| Accumulated depreciation, furniture | 22,500 | ||

| Allowance for doubtful accounts | 1,040 | ||

| Building | 138,000 | ||

| Cash | 12,600 | ||

| Equipment | 91,800 | ||

| Expenses, including cost of goods sold | 762,800 | ||

| Furniture | 51,400 | ||

| Land | 106,400 | ||

| Merchandise inventory | 36,000 | ||

| Note payable | 86,600 | ||

| Sales | 904,040 | ||

| Tarifa Sharma, capital | 64,080 | ||

| Unearned revenues | 9,520 | ||

Other information:

- All accounts have normal balances.

- $28,000 of the note payable balance is due by October 31, 2021.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started