Answered step by step

Verified Expert Solution

Question

1 Approved Answer

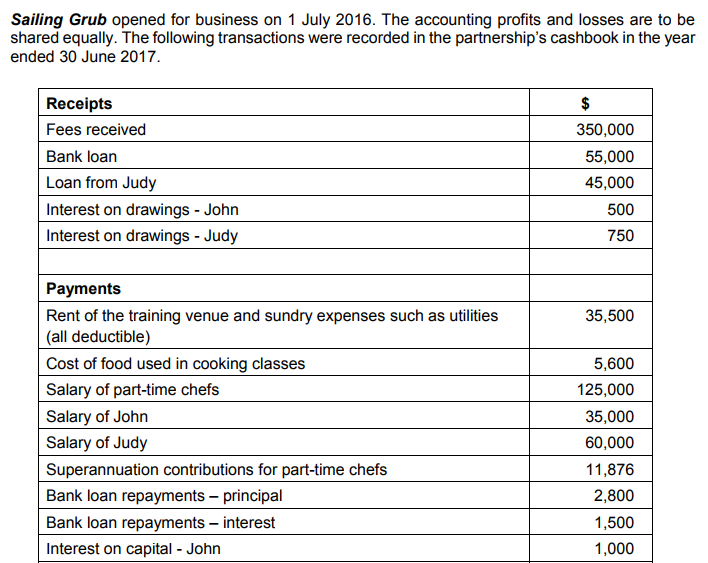

Sailing Grub opened for business on 1 July 2016. The accounting profits and losses are to be shared equally. The following transactions were recorded in

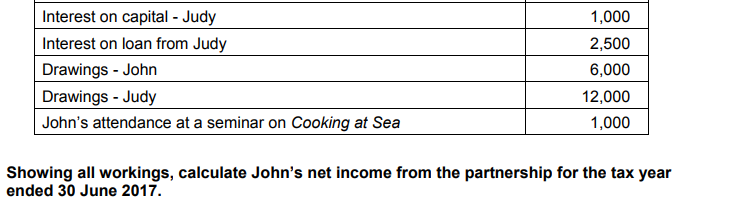

Sailing Grub opened for business on 1 July 2016. The accounting profits and losses are to be shared equally. The following transactions were recorded in the partnership's cashbook in the year ended 30 June 2017 Receipts Fees received Bank loan Loan from Judy Interest on drawings - John Interest on drawings - Judy 350,000 55,000 45,000 500 750 Payments Rent of the training venue and sundry expenses such as utilities (all deductible) Cost of food used in cooking classes Salary of part-time chefs Salary of John Salary of Judy Superannuation contributions for part-time chefs Bank loan repayments - principal Bank loan repayments - interest Interest on capital John 35,500 5,600 125,000 35,000 60,000 11,876 2,800 1,500 1,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started