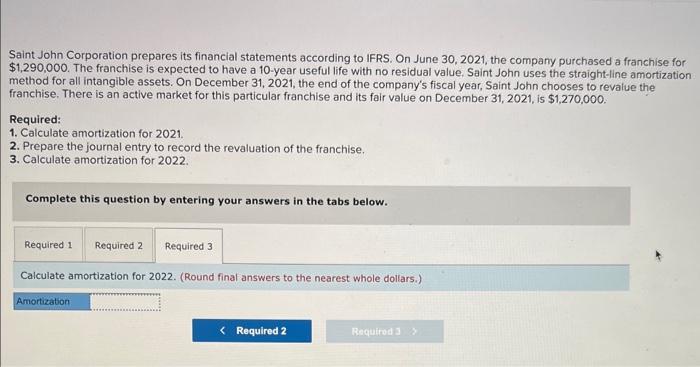

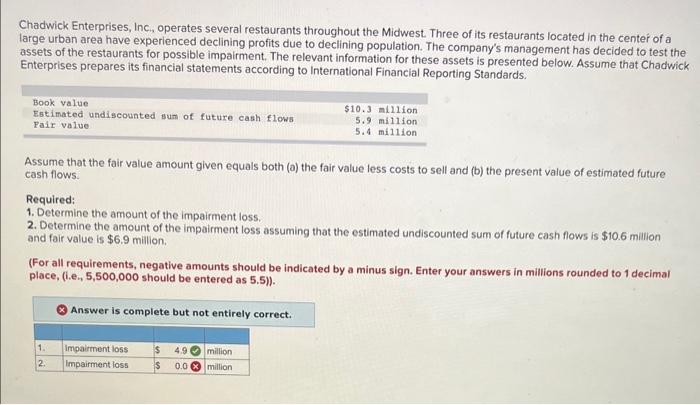

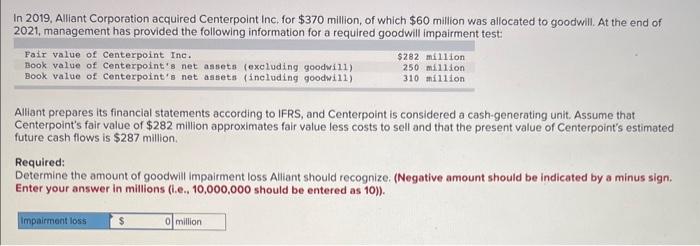

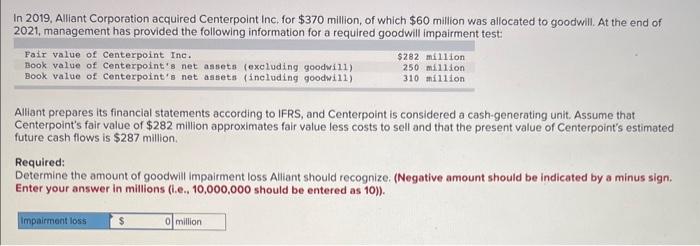

Saint John Corporation prepares its financial statements according to IFRS. On June 30, 2021, the company purchased a franchise for $1,290,000. The franchise is expected to have a 10-year useful life with no residual value. Saint John uses the straight-line amortization method for all intangible assets. On December 31,2021 , the end of the company's fiscal year, Saint John chooses to revalue the franchise. There is an active market for this particular franchise and its fair value on December 31,2021 , is $1,270,000. Required: 1. Calculate amortization for 2021. 2. Prepare the journal entry to record the revaluation of the franchise. 3. Calculate amortization for 2022 . Complete this question by entering your answers in the tabs below. Calculate amortization for 2022 . (Round final answers to the nearest whole dollars.) Chadwick Enterprises, Inc, operates several restaurants throughout the Midwest. Three of its restaurants located in the center of a large urban area have experienced declining profits due to declining population. The company's management has decided to test the assets of the restaurants for possible impairment. The relevant information for these assets is presented below. Assume that Chadwick Enterprises prepares its financial statements according to International Financial Reporting Standards. Assume that the fair value amount given equals both (a) the fair value less costs to sell and (b) the present value of estimated future cash flows. Required: 1. Determine the amount of the impairment loss. 2. Determine the amount of the impairment loss assuming that the estimated undiscounted sum of future cash flows is $10.6 million and fair value is $6.9 million. (For all requirements, negative amounts should be indicated by a minus sign. Enter your answers in millions rounded to 1 decimal place, (i.e, 5,500,000 should be entered as 5.5)). Answer is complete but not entirely correct. In 2019, Alliant Corporation acquired Centerpoint Inc, for $370 million, of which $60 million was allocated to goodwill. At the end of 2021, management has provided the following information for a required goodwill impairment test: Alliant prepares its financial statements according to IFRS, and Centerpoint is considered a cash-generating unit. Assume that Centerpoint's fair value of $282 million approximates fair value less costs to sell and that the present value of Centerpoint's estimated future cash flows is $287 million. Required: Determine the amount of goodwill impairment loss Alliant should recognize. (Negative amount should be indicated by a minus sign. Enter your answer in millions (i.e., 10,000,000 should be entered as 10))