Answered step by step

Verified Expert Solution

Question

1 Approved Answer

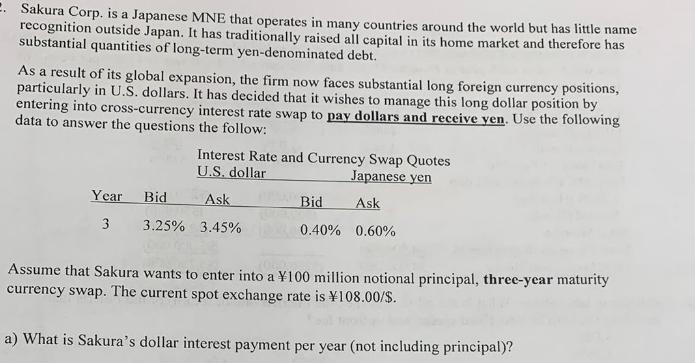

. Sakura Corp. is a Japanese MNE that operates in many countries around the world but has little name recognition outside Japan. It has

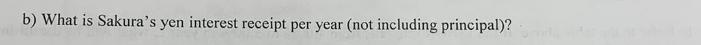

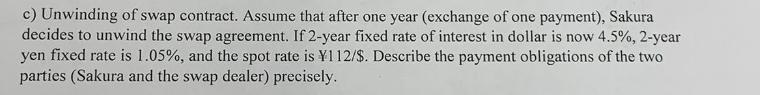

. Sakura Corp. is a Japanese MNE that operates in many countries around the world but has little name recognition outside Japan. It has traditionally raised all capital in its home market and therefore has substantial quantities of long-term yen-denominated debt. As a result of its global expansion, the firm now faces substantial long foreign currency positions, particularly in U.S. dollars. It has decided that it wishes to manage this long dollar position by entering into cross-currency interest rate swap to pay dollars and receive yen. Use the following data to answer the questions the follow: Year 3 Bid 3.25% Interest Rate and Currency Swap Quotes U.S. dollar Japanese yen Ask Bid Ask 3.45% 0.40% 0.60% Assume that Sakura wants to enter into a 100 million notional principal, three-year maturity currency swap. The current spot exchange rate is 108.00/$. a) What is Sakura's dollar interest payment per year (not including principal)? b) What is Sakura's yen interest receipt per year (not including principal)? Smila c) Unwinding of swap contract. Assume that after one year (exchange of one payment), Sakura decides to unwind the swap agreement. If 2-year fixed rate of interest in dollar is now 4.5%, 2-year yen fixed rate is 1.05%, and the spot rate is Y1 12/$. Describe the payment obligations of the two parties (Sakura and the swap dealer) precisely.

Step by Step Solution

★★★★★

3.51 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Given Notional principal 100 million The maturity of the currency swap 3 years Spot exchange rate 10...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started