Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Salah and Omer become partners by inveting BD 60,000 and BD 90.000 respectively. They decided to share profit and loss equally. They also allowed

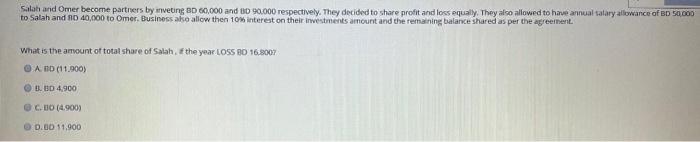

Salah and Omer become partners by inveting BD 60,000 and BD 90.000 respectively. They decided to share profit and loss equally. They also allowed to have annual salary allowance of BD 50,000 to Salah and RD 40,000 to Omer. Business also allow then 10% interest on their investments amount and the remaining balance shared as per the agreement. What is the amount of total share of Salah, f the year LOSS BD 16,8007 ABD (11.900) B. BD 4,900 C.00 (4.900) D.BD 11.900

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Reason Optionc RO 4900 Loss for the year Salary a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started