Answered step by step

Verified Expert Solution

Question

1 Approved Answer

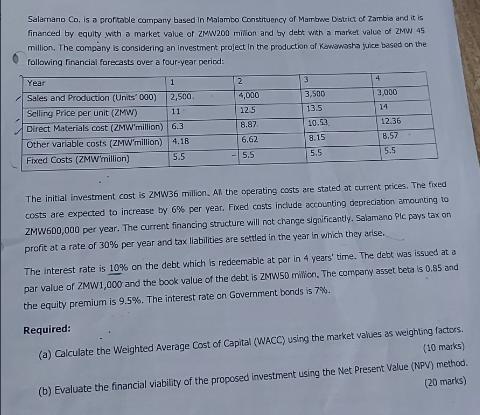

Salamano Co, is a profitable company based in Malambo Constituency of Mambwe District of Zambia and it is financed by equity with a market

Salamano Co, is a profitable company based in Malambo Constituency of Mambwe District of Zambia and it is financed by equity with a market value of ZMWV200 million and by debt with a market value of ZMW 45 million. The company is considering an investment project in the production of Kawawasha juice based on the following financial forecasts over a four-year period: Year Sales and Production (Units 000) 1 2,500 Selling Price per unit (ZMW) 11 Direct Materials cost (ZMW'million) 6.3 Other variable costs (ZMW'million) 4.18 Fixed Costs (ZMW'million) 5.5 2 4,000 125 8.87 6.62 5.5 3 3,500 13.5 10.53 8.15 5.5 4 3,000 14 12.36 8.57 5.5 The initial investment cost is ZMW36 million. All the operating costs are stated at current prices. The fixed costs are expected to increase by 6% per year. Fixed costs include accounting depreciation amounting to ZMW600,000 per year. The current financing structure will not change significantly. Salamano Plc pays tax on profit at a rate of 30% per year and tax liabilities are settled in the year in which they arise. The interest rate is 10% on the debt which is redeemable at par in 4 years' time. The debt was issued at a par value of ZMW1,000 and the book value of the debt is ZMW50 million. The company asset beta is 0.55 and the equity premium is 9.5%. The interest rate on Government bonds is 7%. Required: (a) Calculate the Weighted Average Cost of Capital (WACC) using the market values as weighting factors. (10 marks) (20 marks) (b) Evaluate the financial viability of the proposed investment using the Net Present Value (NPV) method. (c) Calculate the Internal Rate of Return (IRR) of the investment and advise whether the proposed investment is acceptable. (10 marks) (d) Discuss the reasons Net Present Value investment appraisal technique is superior to other investment appraisal methods such as Payback, Accounting Rate of Return and Internal Rate of Return. (15 marks) (e) Discuss how the wealth of shareholders can be maximised in the context of Salamano Plc. (15 marks) (f) Discuss the reasons maximisation of shareholder wealth is the primary objective of profit-oriented organisations compared with other financial objectives such as profit maximisation, expansion of and market increased share share. earnings per (15 marks) (g) Identify and explain the possible stakeholder conflicts and how you could minimize them at Salamano Plc. (15 marks) [Total=100

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started