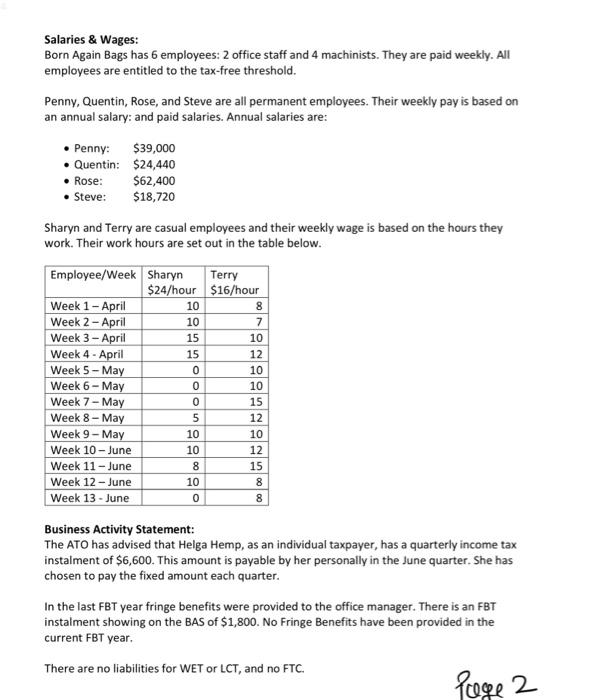

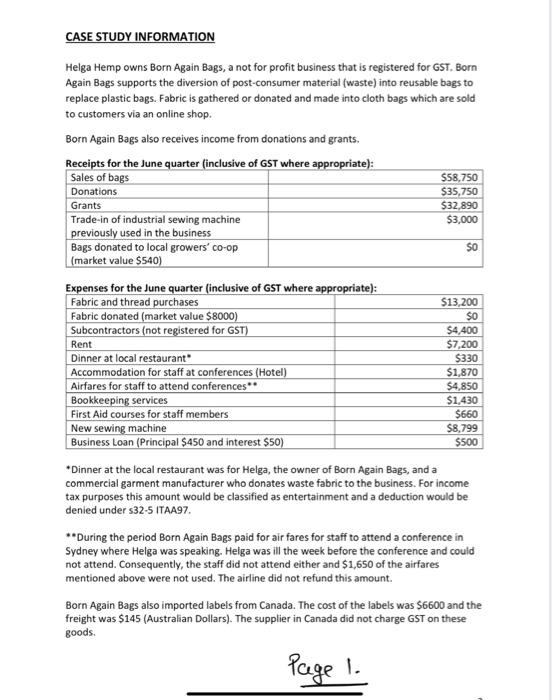

Salaries & Wages: Born Again Bags has 6 employees: 2 office staff and 4 machinists. They are paid weekly. All employees are entitled to the tax-free threshold. Penny, Quentin, Rose, and Steve are all permanent employees. Their weekly pay is based on an annual salary: and paid salaries. Annual salaries are: Penny: $39,000 Quentin: $24,440 Rose: $62,400 Steve: $18,720 Sharyn and Terry are casual employees and their weekly wage is based on the hours they work. Their work hours are set out in the table below. Employee/Week Sharyn Terry $24/hour $16/hour Week 1 - April 10 8 Week 2 - April 10 7 Week 3 - April 15 10 Week 4 - April 15 12 Week 5 - May 0 10 Week 6-May 0 10 Week 7 - May 0 15 Week 8 - May 12 Week 9 - May 10 10 Week 10 - June 12 Week 11 - June 15 Week 12 - June Week 13 - June 0 5 10 8 10 8 8 Business Activity Statement: The ATO has advised that Helga Hemp, as an individual taxpayer, has a quarterly income tax instalment of $6,600. This amount is payable by her personally in the June quarter. She has chosen to pay the fixed amount each quarter. In the last FBT year fringe benefits were provided to the office manager. There is an FBT instalment showing on the BAS of $1,800. No Fringe Benefits have been provided in the current FBT year. There are no liabilities for WET or LCT, and no FTC. Page 2 CASE STUDY INFORMATION Helga Hemp owns Born Again Bags, a not for profit business that is registered for GST. Born Again Bags supports the diversion of post-consumer material (waste) into reusable bags to replace plastic bags. Fabric is gathered or donated and made into cloth bags which are sold to customers via an online shop. Born Again Bags also receives income from donations and grants. Receipts for the June quarter (inclusive of GST where appropriate): Sales of bags $58,750 Donations $35,750 Grants $32,890 Trade-in of industrial sewing machine $3,000 previously used in the business Bags donated to local growers' co-op $0 (market value $540) Expenses for the June quarter (inclusive of GST where appropriate): Fabric and thread purchases $13,200 Fabric donated (market value $8000) $0 Subcontractors (not registered for GST) $4,400 Rent $7,200 Dinner at local restaurant $330 Accommodation for staff at conferences (Hotel) $1,870 Airfares for staff to attend conferences ** $4,850 Bookkeeping services $1,430 First Aid courses for staff members $660 New sewing machine $8,799 Business Loan (Principal $450 and interest $50) $500 *Dinner at the local restaurant was for Helga, the owner of Born Again Bags, and a commercial garment manufacturer who donates waste fabric to the business. For income tax purposes this amount would be classified as entertainment and a deduction would be denied under s32-5 ITAA97. ***During the period Born Again Bags paid for air fares for staff to attend a conference in Sydney where Helga was speaking. Helga was ill the week before the conference and could not attend. Consequently, the staff did not attend either and $1,650 of the airfares mentioned above were not used. The airline did not refund this amount. Born Again Bags also imported labels from Canada. The cost of the labels was $6600 and the freight was $145 (Australian Dollars). The supplier in Canada did not charge GST on these goods Page 1 Salaries & Wages: Born Again Bags has 6 employees: 2 office staff and 4 machinists. They are paid weekly. All employees are entitled to the tax-free threshold. Penny, Quentin, Rose, and Steve are all permanent employees. Their weekly pay is based on an annual salary: and paid salaries. Annual salaries are: Penny: $39,000 Quentin: $24,440 Rose: $62,400 Steve: $18,720 Sharyn and Terry are casual employees and their weekly wage is based on the hours they work. Their work hours are set out in the table below. Employee/Week Sharyn Terry $24/hour $16/hour Week 1 - April 10 8 Week 2 - April 10 7 Week 3 - April 15 10 Week 4 - April 15 12 Week 5 - May 0 10 Week 6-May 0 10 Week 7 - May 0 15 Week 8 - May 12 Week 9 - May 10 10 Week 10 - June 12 Week 11 - June 15 Week 12 - June Week 13 - June 0 5 10 8 10 8 8 Business Activity Statement: The ATO has advised that Helga Hemp, as an individual taxpayer, has a quarterly income tax instalment of $6,600. This amount is payable by her personally in the June quarter. She has chosen to pay the fixed amount each quarter. In the last FBT year fringe benefits were provided to the office manager. There is an FBT instalment showing on the BAS of $1,800. No Fringe Benefits have been provided in the current FBT year. There are no liabilities for WET or LCT, and no FTC. Page 2 CASE STUDY INFORMATION Helga Hemp owns Born Again Bags, a not for profit business that is registered for GST. Born Again Bags supports the diversion of post-consumer material (waste) into reusable bags to replace plastic bags. Fabric is gathered or donated and made into cloth bags which are sold to customers via an online shop. Born Again Bags also receives income from donations and grants. Receipts for the June quarter (inclusive of GST where appropriate): Sales of bags $58,750 Donations $35,750 Grants $32,890 Trade-in of industrial sewing machine $3,000 previously used in the business Bags donated to local growers' co-op $0 (market value $540) Expenses for the June quarter (inclusive of GST where appropriate): Fabric and thread purchases $13,200 Fabric donated (market value $8000) $0 Subcontractors (not registered for GST) $4,400 Rent $7,200 Dinner at local restaurant $330 Accommodation for staff at conferences (Hotel) $1,870 Airfares for staff to attend conferences ** $4,850 Bookkeeping services $1,430 First Aid courses for staff members $660 New sewing machine $8,799 Business Loan (Principal $450 and interest $50) $500 *Dinner at the local restaurant was for Helga, the owner of Born Again Bags, and a commercial garment manufacturer who donates waste fabric to the business. For income tax purposes this amount would be classified as entertainment and a deduction would be denied under s32-5 ITAA97. ***During the period Born Again Bags paid for air fares for staff to attend a conference in Sydney where Helga was speaking. Helga was ill the week before the conference and could not attend. Consequently, the staff did not attend either and $1,650 of the airfares mentioned above were not used. The airline did not refund this amount. Born Again Bags also imported labels from Canada. The cost of the labels was $6600 and the freight was $145 (Australian Dollars). The supplier in Canada did not charge GST on these goods Page 1