Answered step by step

Verified Expert Solution

Question

1 Approved Answer

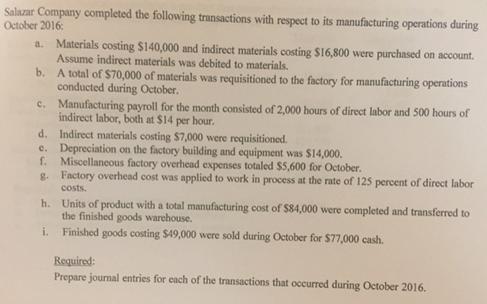

Salazar Company completed the following transactions with respect to its manufacturing operations during October 2016: a. Materials costing $140,000 and indirect materials costing $16,800

Salazar Company completed the following transactions with respect to its manufacturing operations during October 2016: a. Materials costing $140,000 and indirect materials costing $16,800 were purchased on account. Assume indirect materials was debited to materials. b. A total of $70,000 of materials was requisitioned to the factory for manufacturing operations conducted during October. c. Manufacturing payroll for the month consisted of 2,000 hours of direct labor and 500 hours of indirect labor, both at $14 per hour. d. Indirect materials costing $7,000 were requisitioned. e. Depreciation on the factory building and equipment was $14,000. f. Miscellaneous factory overhead expenses totaled $5,600 for October. g. Factory overhead cost was applied to work in process at the rate of 125 percent of direct labor costs. h. Units of product with a total manufacturing cost of $84,000 were completed and transferred to the finished goods warehouse. Finished goods costing $49,000 were sold during October for $77,000 cash. i. Required: Prepare journal entries for each of the transactions that occurred during October 2016.

Step by Step Solution

★★★★★

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Answer Given below Answee giuen below The Jouenal enteie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started