Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dick sold off some of his assets during the financial year so he could buy a new house for himself and his new wife

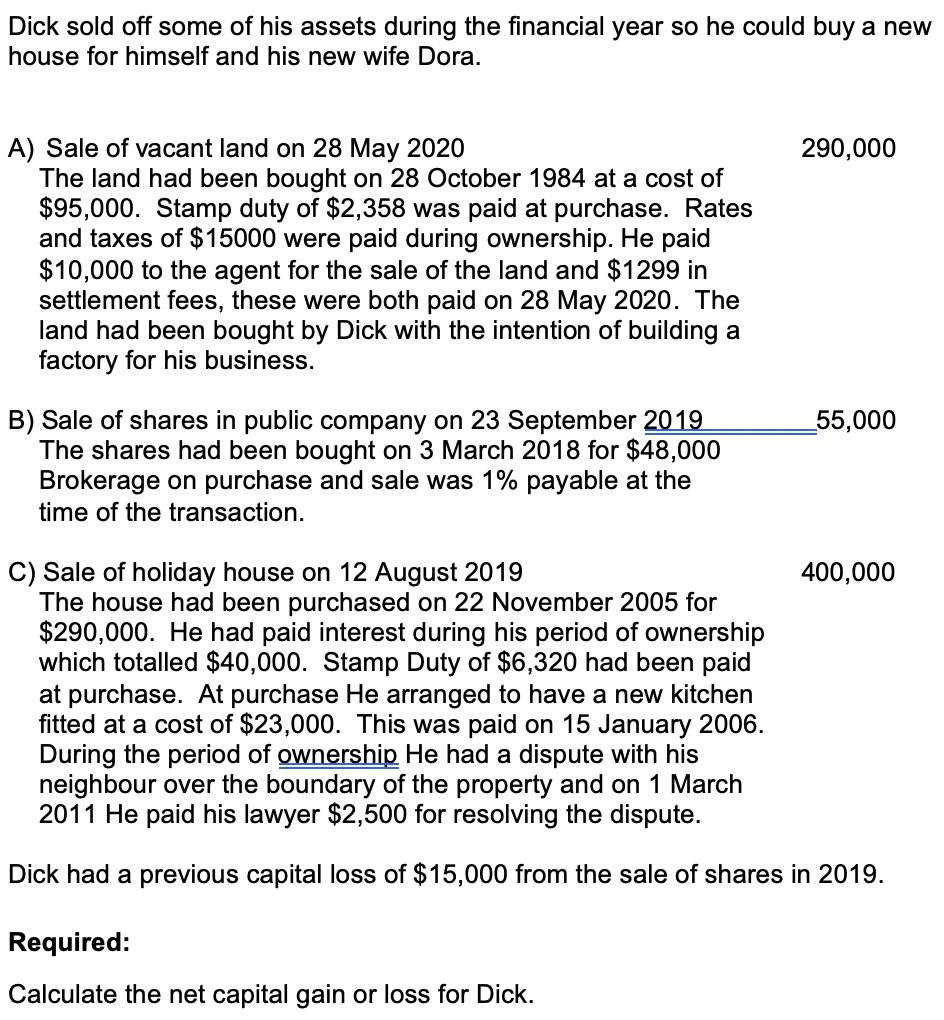

Dick sold off some of his assets during the financial year so he could buy a new house for himself and his new wife Dora. A) Sale of vacant land on 28 May 2020 The land had been bought on 28 October 1984 at a cost of $95,000. Stamp duty of $2,358 was paid at purchase. Rates and taxes of $15000 were paid during ownership. He paid $10,000 to the agent for the sale of the land and $1299 in settlement fees, these were both paid on 28 May 2020. The land had been bought by Dick with the intention of building a factory for his business. 290,000 B) Sale of shares in public company on 23 September 2019 The shares had been bought on 3 March 2018 for $48,000 Brokerage on purchase and sale was 1% payable at the 55,000 time of the transaction. C) Sale of holiday house on 12 August 2019 The house had been purchased on 22 November 2005 for $290,000. He had paid interest during his period of ownership which totalled $40,000. Stamp Duty of $6,320 had been paid at purchase. At purchase He arranged to have a new kitchen fitted at a cost of $23,000. This was paid on 15 January 2006. During the period of ownership He had a dispute with his neighbour over the boundary of the property and on 1 March 2011 He paid his lawyer $2,500 for resolving the dispute. 400,000 Dick had a previous capital loss of $15,000 from the sale of shares in 2019. Required: Calculate the net capital gain or loss for Dick.

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

ASale value of land 290000 Agents fees 10000 Settlement fees 1299 Net sale proceeds 278701 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started