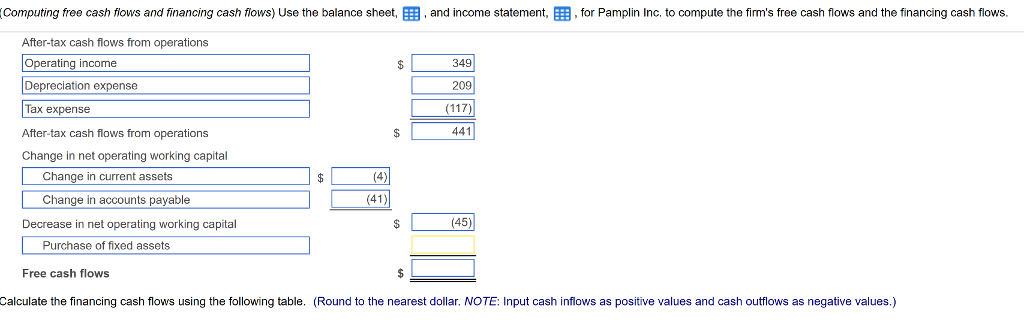

Question

Sales $1,200 $1,459 Cost of goods sold 700 853 Gross profit $500 $606 Selling, general and administrative expenses $30 $48 Depreciation 220 250 209 257

| Sales | $1,200 | $1,459 | ||||||

| Cost of goods sold | 700 | 853 | ||||||

| Gross profit | $500 | $606 | ||||||

| Selling, general and administrative expenses | $30 |

| $48 |

| ||||

| Depreciation | 220 | 250 | 209 | 257 | ||||

| Operating income | $250 | $349 | ||||||

| Interest expense | 50 | 56 | ||||||

| Net income before taxes | $200 | $293 | ||||||

| Taxes (40%) | 80 | 117 | ||||||

| Net income |

|

| $120 |

|

|

| $176 |

|

| Pamplin Inc. Balance Sheet at 12/31/2014 and 12/31/2015 | ||||

| ASSETS | ||||

|

| 2014 |

| 2015 |

|

| Cash | $200 | $160 | ||

| Accounts receivable | 450 | 425 | ||

| Inventory | 550 | 619 | ||

| Current assets | $1,200 | $1,204 | ||

| Plant and equipment | $2,200 | $2,610 | ||

| Less accumulated depreciation | (1,000) | (1,209) | ||

| Net plant and equipment | $1,200 | $1,401 | ||

| Total assets | $2,400 | $2,605 | ||

| LIABILITIES AND OWNER'S EQUITY | ||||

|

| 2014 |

| 2015 |

|

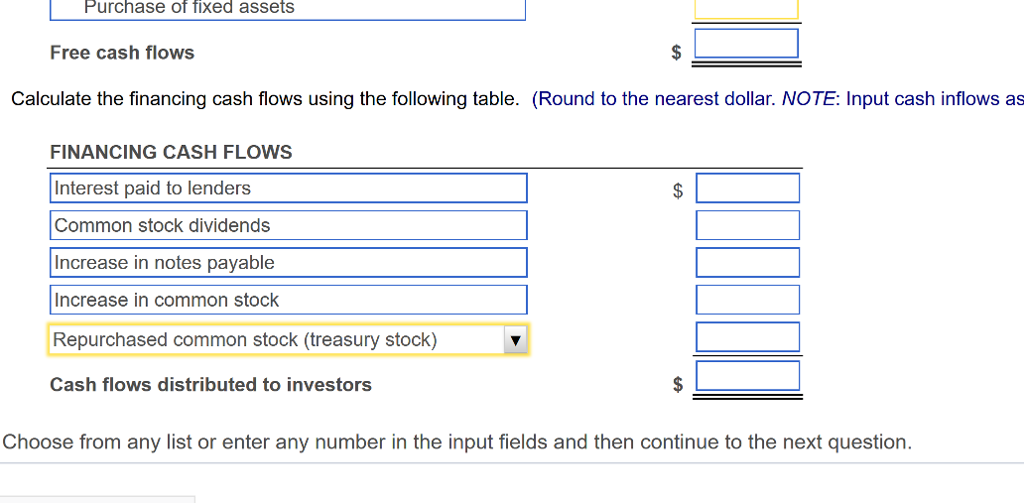

| Accounts payable | $200 | $159 | ||

| Notes payable-current (9%) | 0 | 140 | ||

| Current liabilities | $200 | $299 | ||

| Bonds | $600 | $600 | ||

| Owners' equity |

| |||

| Common stock | $900 | $900 | ||

| Retained earnings | 700 | 806 | ||

| Total owners' equity | $1,600 | $1,706 | ||

| Total liabilities and owners' equity | $2,400 |

| $2,605 |

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started