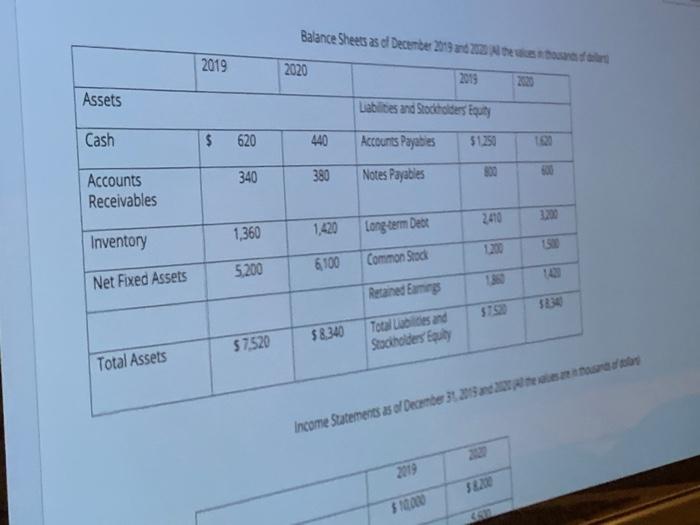

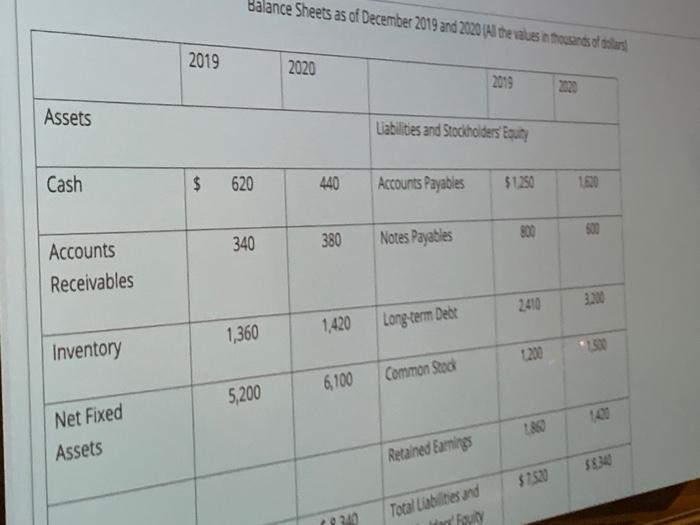

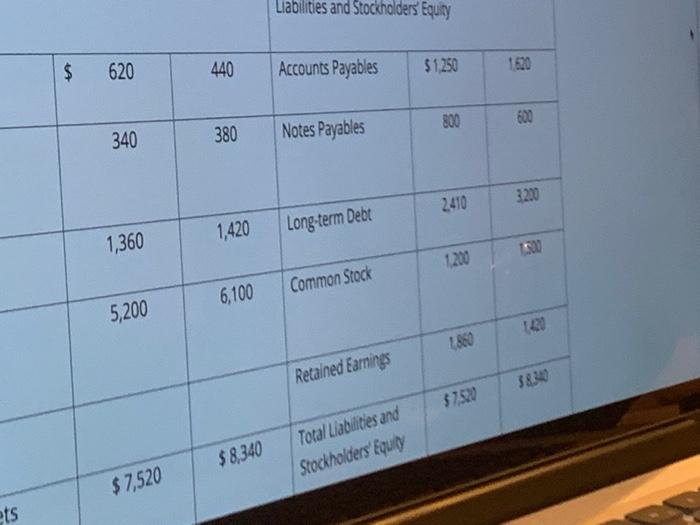

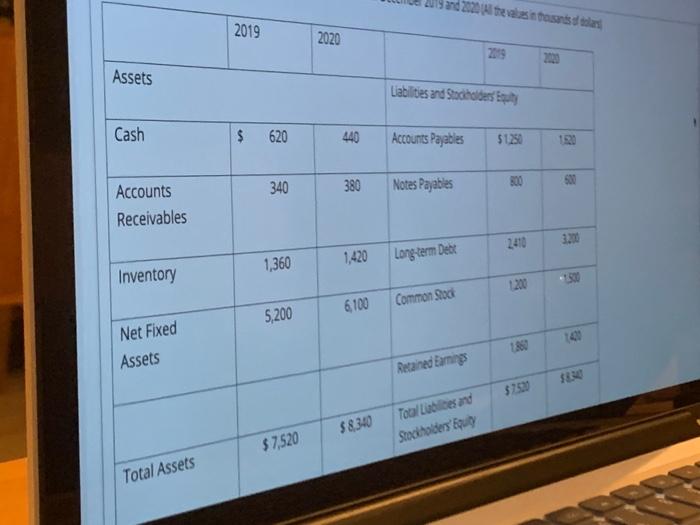

Sales 2019 Cost of Goods Sold 59000 6.000 Depreciation Earnings before interest and Tax 550 300 2200 Interest 320 Taxes 250 813 Net Income 2.067 1228 1. Briefly explain the difference between the concepts of liquidity and long term where the local 2. By using two (2) ratios from your choice, assess the iquidity of the company in 2015 and 20 3. By using two (2) ratios from your choice, assess the solvency of the compary 2015 Maret 4 Briefly explain the advantages of the DuPont analys NB: Kindly note that you have to enter all your calculations and now there (12pe TT TAW bestod 2019 Sales 2013 $10.000 58200 Cost of Goods Sold 6,000 5500 Depreciation 800 20 Earnings before interest and Tax 3.200 1980 Interest 320 Taxes 313 2067 123 Net income 1. Briefly explain the difference between the concepts of liquidity and become a seanca S 2. By using two (2) ratios from your choice, assess the liquidity of the company in 2015 a morte 3. By using two (2) ratios from your choice assess the soleny of the company in 1920 4. Briefly explain the advantages of the Dufort arus N.8: Kindly note that you have to enter all your callers and are T. T Arial Balance Sheets as de December 2013 No 2019 2020 2013 Assets Labies and Stories Equity Cash $ 620 440 Accounts Payables 51250 340 380 Notes Payables 300 500 Accounts Receivables 1,360 1,420 Inventory Long-term Dede 5200 6100 Common Stock Net Fixed Assets Retained ang 5192 $8.340 $7.520 Total des and Stacholders foly Total Assets Income Statements as of December 2015 2019 Show CS Balance Sheets as of December 2019 and 2020 (Alteus in trousers of cars 2019 2020 2019 Assets Liabilities and Stockholders Buy Cash $ $ 620 440 Accounts Payables $1250 & 300 500 340 380 Notes Payables Accounts Receivables 2,200 2410 1,420 Long-term Debt 1,360 1500 Inventory 1200 6,100 Common Stod 5,200 Net Fixed Assets Retained Earnings $752 9240 Total Labites and Thule Liabilities and Stockholders Equity $ 620 440 Accounts Payables $1,250 1620 800 600 340 380 Notes Payables 3200 2410 1,420 Long-term Debt 1,360 1200 Common Stock 6,100 5,200 Retained Earnings $7.52 $ 8,340 Total Liabilities and Stockholders' Equity $ 7,520 ets 2020 vastossa 2019 2020 Assets Liabilities and Sociales y Cash $ 620 440 Accounts Payables $1250 340 380 500 200 Notes Payables Accounts Receivables 2410 1,360 1,420 Long-term Debt Inventory 150 1.200 6100 Common god 5,200 Net Fixed Assets Retained Earnings $750 $8.340 Tool Libes Stockholders' Equity $ 7,520 Total Assets Sales 2019 Cost of Goods Sold 59000 6.000 Depreciation Earnings before interest and Tax 550 300 2200 Interest 320 Taxes 250 813 Net Income 2.067 1228 1. Briefly explain the difference between the concepts of liquidity and long term where the local 2. By using two (2) ratios from your choice, assess the iquidity of the company in 2015 and 20 3. By using two (2) ratios from your choice, assess the solvency of the compary 2015 Maret 4 Briefly explain the advantages of the DuPont analys NB: Kindly note that you have to enter all your calculations and now there (12pe TT TAW bestod 2019 Sales 2013 $10.000 58200 Cost of Goods Sold 6,000 5500 Depreciation 800 20 Earnings before interest and Tax 3.200 1980 Interest 320 Taxes 313 2067 123 Net income 1. Briefly explain the difference between the concepts of liquidity and become a seanca S 2. By using two (2) ratios from your choice, assess the liquidity of the company in 2015 a morte 3. By using two (2) ratios from your choice assess the soleny of the company in 1920 4. Briefly explain the advantages of the Dufort arus N.8: Kindly note that you have to enter all your callers and are T. T Arial Balance Sheets as de December 2013 No 2019 2020 2013 Assets Labies and Stories Equity Cash $ 620 440 Accounts Payables 51250 340 380 Notes Payables 300 500 Accounts Receivables 1,360 1,420 Inventory Long-term Dede 5200 6100 Common Stock Net Fixed Assets Retained ang 5192 $8.340 $7.520 Total des and Stacholders foly Total Assets Income Statements as of December 2015 2019 Show CS Balance Sheets as of December 2019 and 2020 (Alteus in trousers of cars 2019 2020 2019 Assets Liabilities and Stockholders Buy Cash $ $ 620 440 Accounts Payables $1250 & 300 500 340 380 Notes Payables Accounts Receivables 2,200 2410 1,420 Long-term Debt 1,360 1500 Inventory 1200 6,100 Common Stod 5,200 Net Fixed Assets Retained Earnings $752 9240 Total Labites and Thule Liabilities and Stockholders Equity $ 620 440 Accounts Payables $1,250 1620 800 600 340 380 Notes Payables 3200 2410 1,420 Long-term Debt 1,360 1200 Common Stock 6,100 5,200 Retained Earnings $7.52 $ 8,340 Total Liabilities and Stockholders' Equity $ 7,520 ets 2020 vastossa 2019 2020 Assets Liabilities and Sociales y Cash $ 620 440 Accounts Payables $1250 340 380 500 200 Notes Payables Accounts Receivables 2410 1,360 1,420 Long-term Debt Inventory 150 1.200 6100 Common god 5,200 Net Fixed Assets Retained Earnings $750 $8.340 Tool Libes Stockholders' Equity $ 7,520 Total Assets