Question

Sales are $100 million in the first year. Sales are expected to grow by 20% in the second year, 15% in year three, and 10%

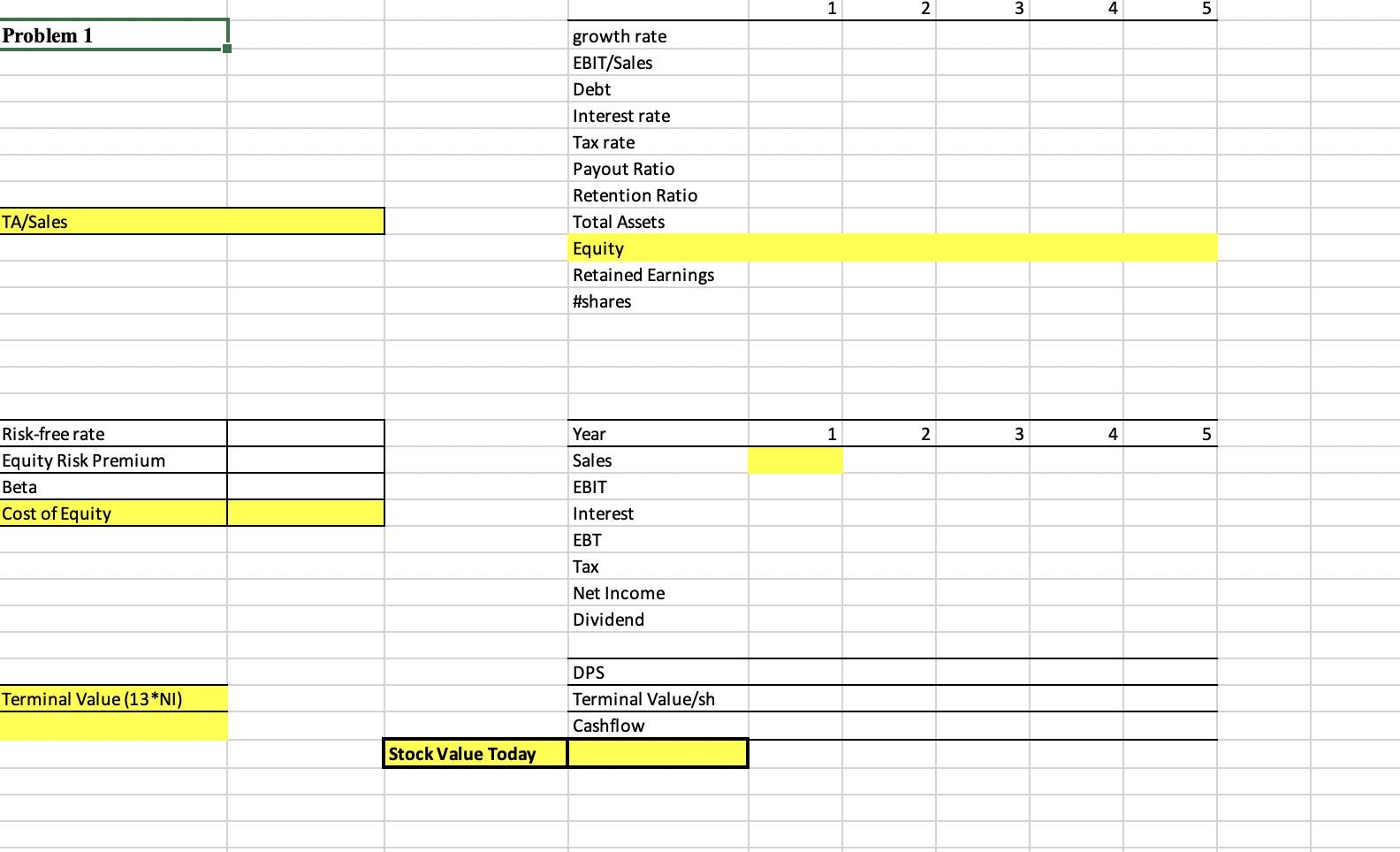

Sales are $100 million in the first year. Sales are expected to grow by 20% in the second year, 15% in year three, and 10% in years 4 and 5. Earnings before interest and taxes (EBIT) are 20% of sales in the first and second years, respectively. EBIT is 18% of sales in the third year, and 16% of sales in Years4 and 5. Interest charges are 10% of total debt for the current year. The income tax rate is 40%.Yokohama pays out 20% of earnings in dividends in the first and second years, 30% in the third year,40% in Year 4, and 50% in the fifth year. Retained earnings are added to equity in the following year. Total assets are 80% of the current year’s sales in all years. In the first year, debt is 40 million and shareholder’s equity is $40 million. Debt equals total assets less shareholders’ equity. Shareholders’ equity will equal prior year’s shareholders’ equity plus the addition to retained earnings from the prior year. Yokohama has 4 million shares outstanding. The risk-free rate is 2.3%. The shares of Yokohama have an estimated beta of 1.23, and the equity risk premium is estimated at 4.45%. The value of the company at the end of the fifth year is expected to be 15 times earnings. Your task is to help Julio dela Renta estimate Yokohama’s current value per share. Use excel format given

Problem 1 TA/Sales Risk-free rate Equity Risk Premium Beta Cost of Equity Terminal Value (13*NI) Stock Value Today growth rate EBIT/Sales Debt Interest rate Tax rate Payout Ratio Retention Ratio Total Assets Equity Retained Earnings #shares Year Sales EBIT Interest EBT Tax Net Income Dividend DPS Terminal Value/sh Cashflow 1 1 2 2 3 3 4 4 5

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Yokohamas current value per share we need to follow the steps of a discounted cash flow DCF analysis This involves projecting future cash flows and discounting them to their present value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started