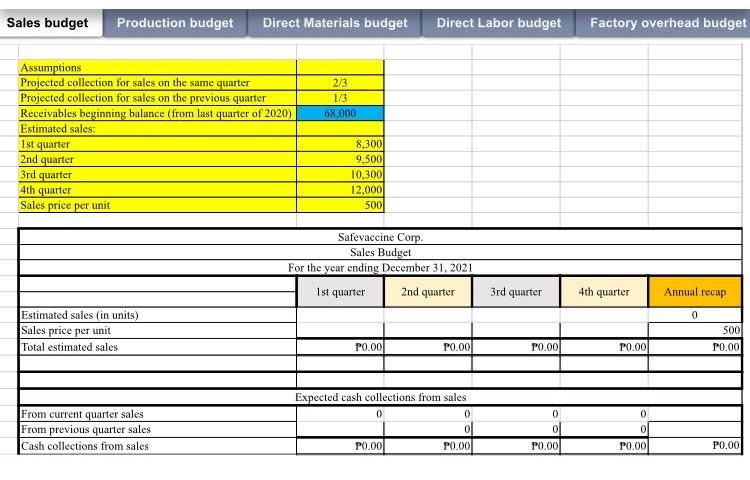

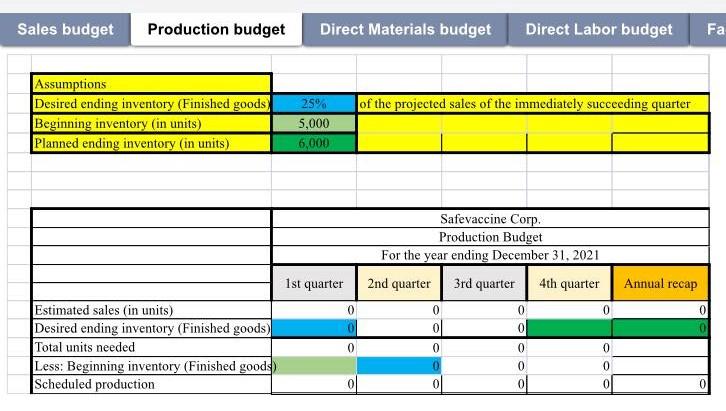

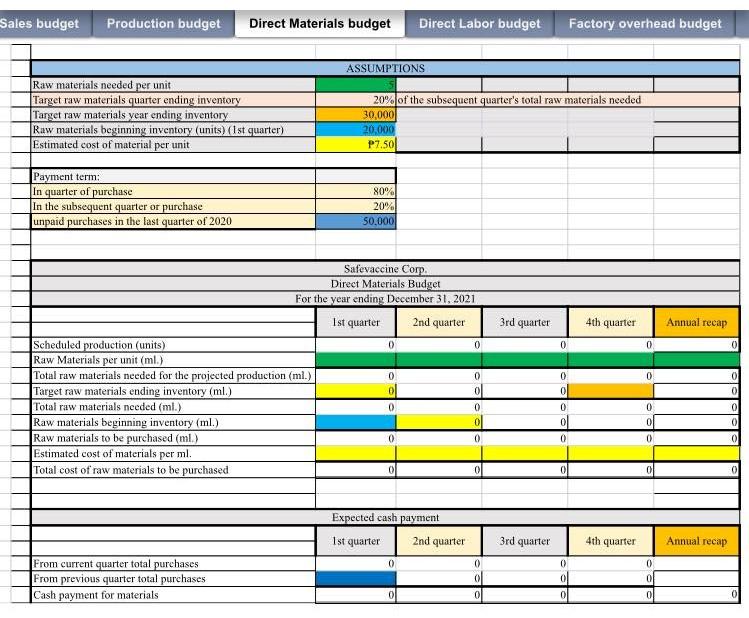

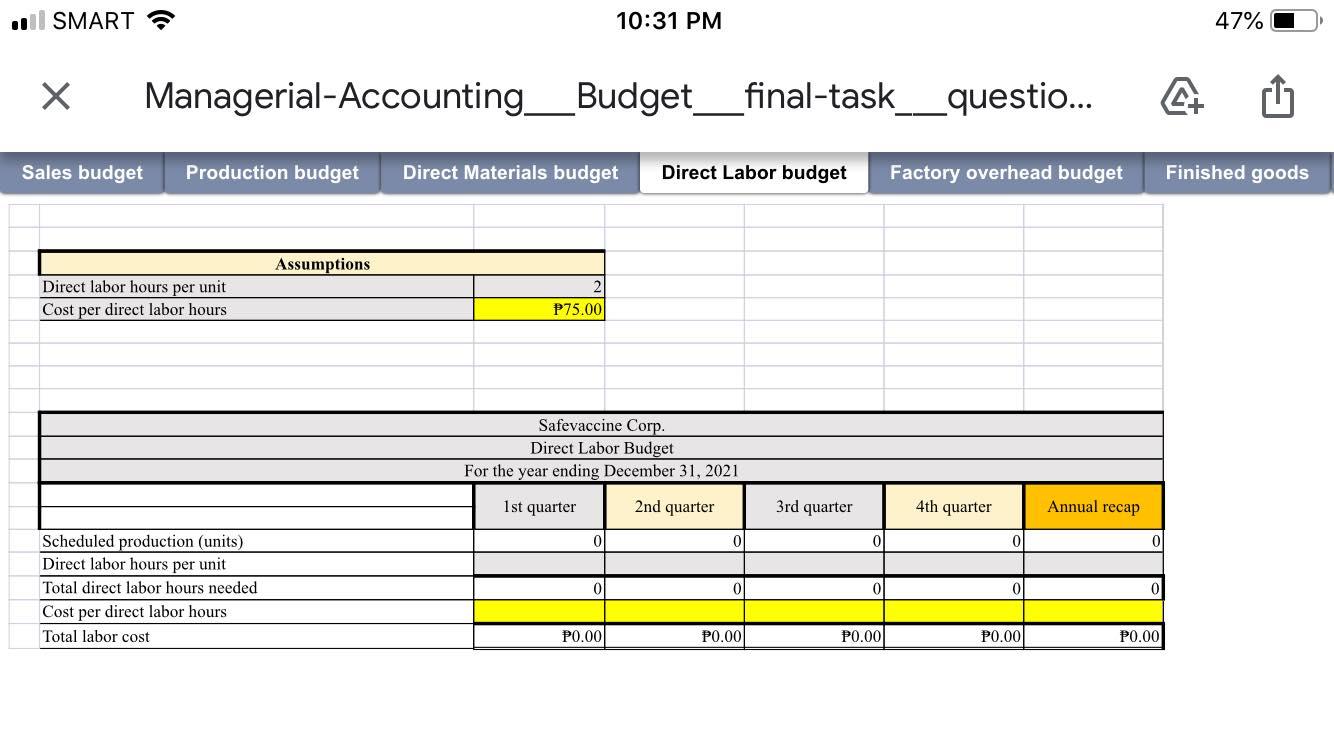

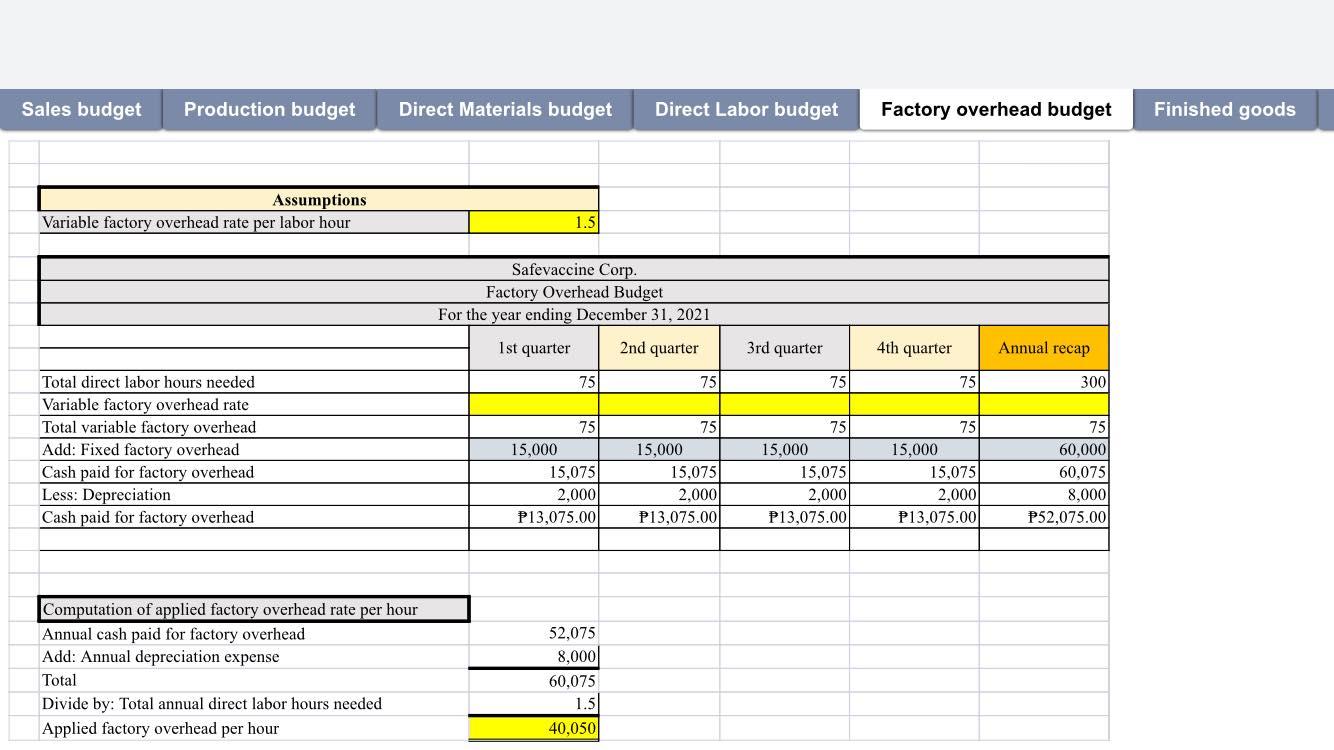

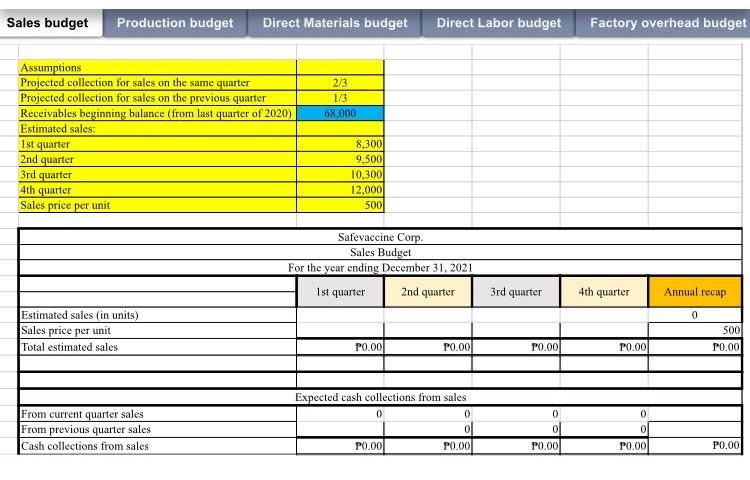

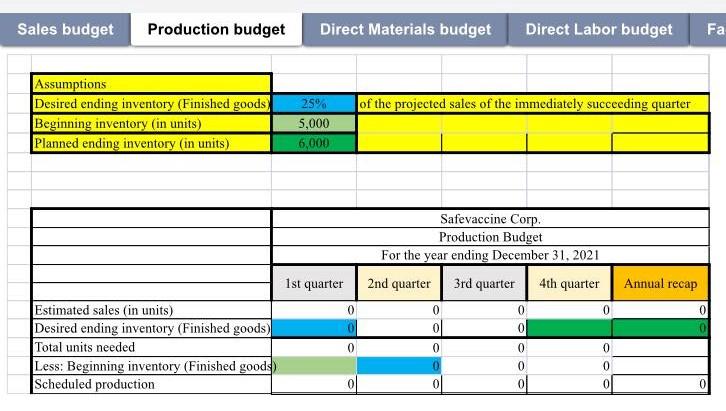

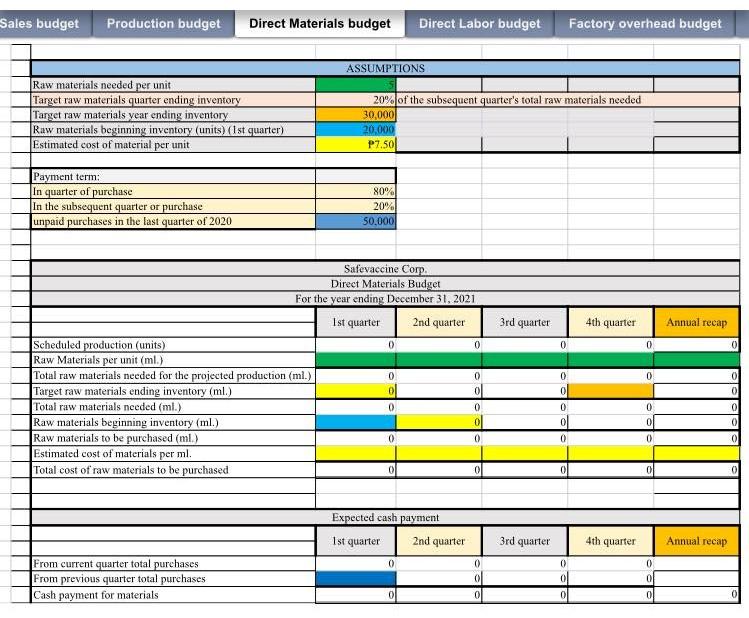

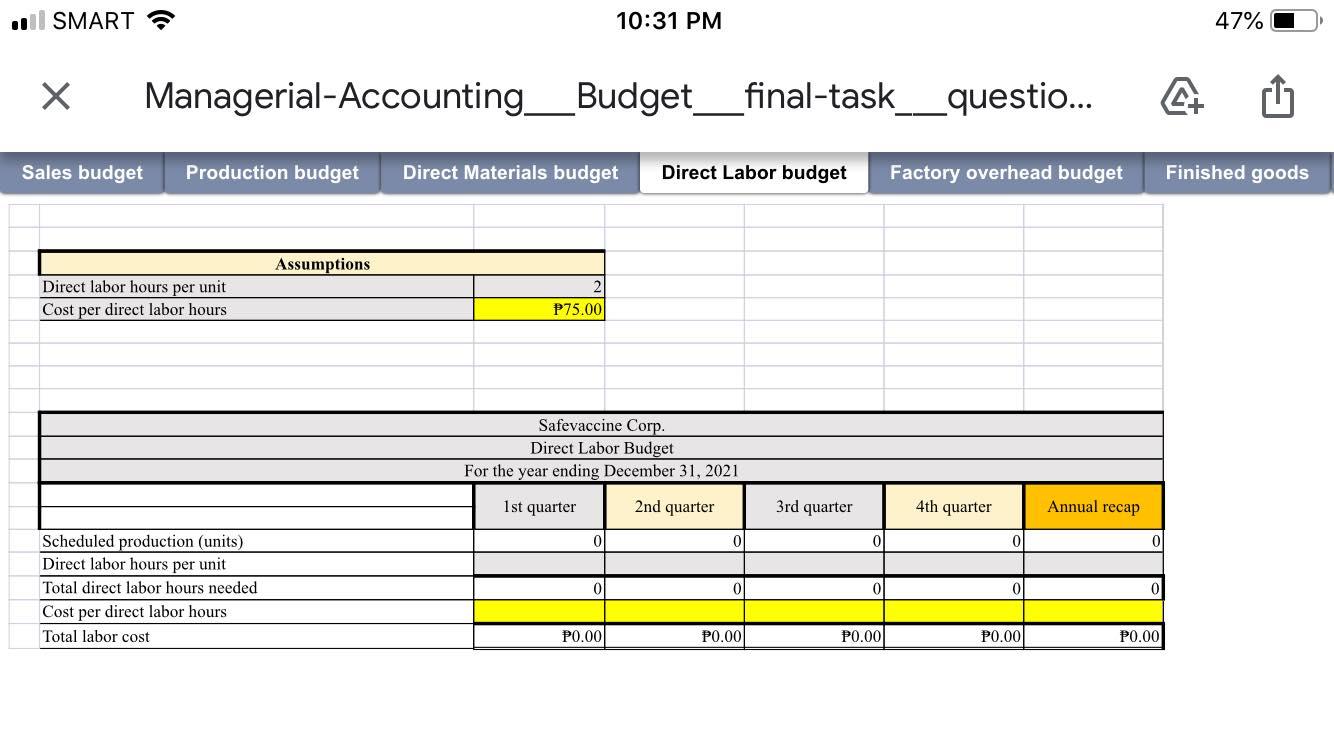

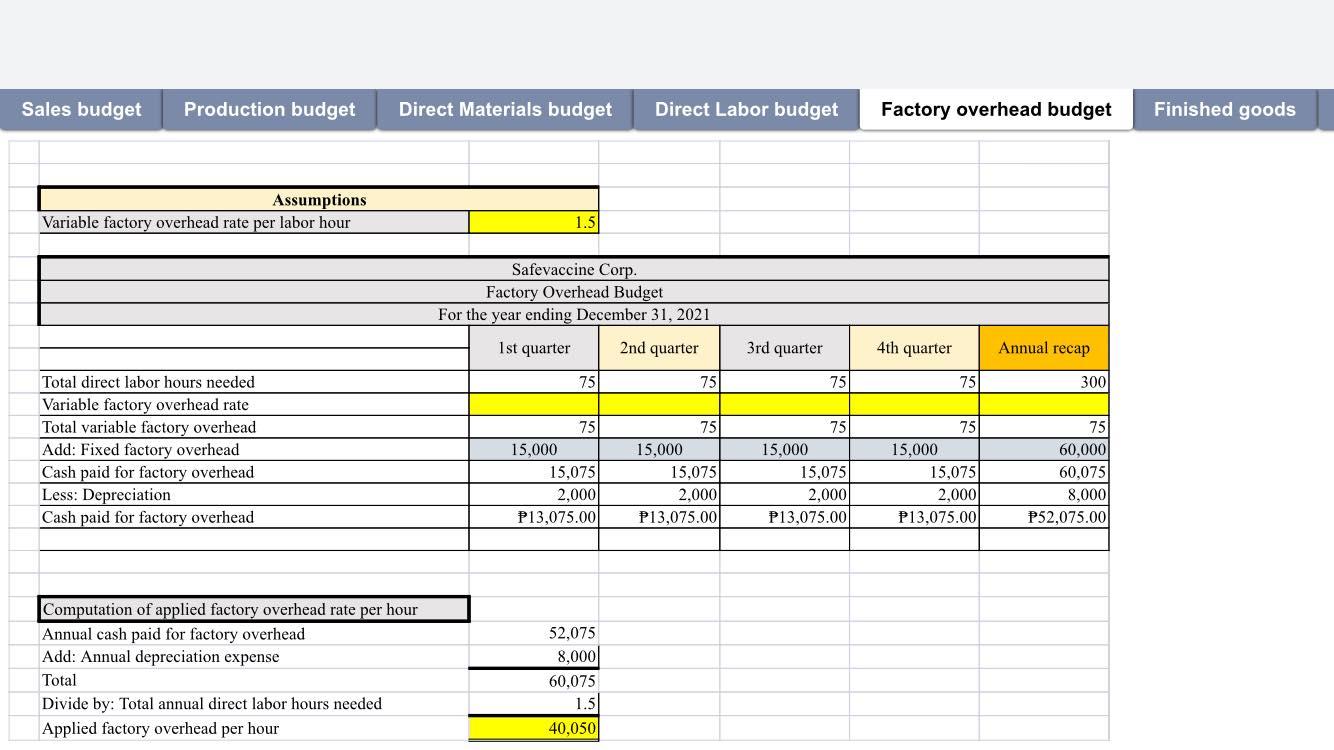

Sales budget Production budget Direct Materials budget Direct Labor budget Factory overhead budget Assumptions Projected collection for sales on the same quarter Projected collection for sales on the previous quarter Receivables beginning balance (from last quarter of 2020) Estimated sales: 2/3 1/3 68,000 Ist quarter 2nd quarter 3rd quarter 4th quarter 8,300 9,500 10,300 12,000 500 Sales price per unit Safevaccine Corp. Sales Budget For the year ending December 31, 2021 1st quarter 2nd quarter 3rd quarter 4th quarter Annual recap 0 Estimated sales (in units) Sales price per unit Total estimated sales 500 10.00 P0.00 P0.00 P0.00 20.00 Expected cash collections from sales 0 0 0 From current quarter sales From previous quarter sales Cash collections from sales 0 0 10.00 10.00 10.00 10.00 P0.00 Sales budget Production budget Direct Materials budget Direct Labor budget Fa Assumptions Desired ending inventory (Finished goods Beginning inventory (in units) Planned ending inventory (in units) of the projected sales of the immediately succeeding quarter 25% 5,000 6,000 Safevaccine Corp. Production Budget For the year ending December 31, 2021 2nd quarter 3rd quarter 4th quarter 1st quarter Annual recap 0 0 0 0 0 0 Estimated sales (in units) Desired ending inventory (Finished goods) Total units needed Less: Beginning inventory (Finished goods Scheduled production 0 0 0 0 0 0 0 0 0 0 Sales budget Production budget Direct Materials budget Direct Labor budget Factory overhead budget ASSUMPTIONS Raw materials needed per unit Target raw materials quarter ending inventory Target raw materials year ending inventory Raw materials beginning inventory (units) (Ist quarter) Estimated cost of material per unit 20% of the subsequent quarter's total raw materials needed 30,0001 20,000 P7.50 Payment term: In quarter of purchase In the subsequent quarter or purchase unpaid purchases in the last quarter of 2020 80% 20% 50,000 3rd quarter 4th quarter Annual recap 0 0 0 Safevaccine Corp Direct Materials Budget For the year ending December 31, 2021 Ist quarter 2nd quarter Scheduled production (units) 0 0 Raw Materials per unit (ml.) Total raw materials needed for the projected production (ml.) Target raw materials ending inventory (ml.) 0 Total raw materials needed (ml.) 0 Raw materials beginning inventory (ml.) 0 Raw materials to be purchased (ml.) 0 Estimated cost of materials per ml. Total cost of raw materials to be purchased 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Expected cash payment 1st quarter 2nd quarter 3rd quarter 4th quarter Annual recap 0 0 0 0 From current quarter total purchases From previous quarter total purchases Cash payment for materials () 0 0 0 0 0 0 I SMART 10:31 PM 47% Managerial-Accounting__Budget_final-task_questio... 4 Sales budget Production budget Direct Materials budget Direct Labor budget Factory overhead budget Finished goods Assumptions Direct labor hours per unit Cost per direct labor hours 2 P75.00 Safevaccine Corp. Direct Labor Budget For the year ending December 31, 2021 1st quarter 2nd quarter 3rd quarter 4th quarter Annual recap 0 0 0 0 Scheduled production (units) Direct labor hours per unit Total direct labor hours needed Cost per direct labor hours Total labor cost 0 01 ol 0 0 P0.00 P0.00 P0.00 P0.00 P0.00 Sales budget Production budget Direct Materials budget Direct Labor budget Factory overhead budget Finished goods Assumptions Variable factory overhead rate per labor hour 1.51 Safevaccine Corp. Factory Overhead Budget For the year ending December 31, 2021 1st quarter 2nd quarter 3rd quarter 4th quarter Annual recap 75 751 75 75 300 75 Total direct labor hours needed Variable factory overhead rate Total variable factory overhead Add: Fixed factory overhead Cash paid for factory overhead Less: Depreciation Cash paid for factory overhead 15,000 15,075 2,000 P13,075.00 75 15,000 15.075 2,000 P13,075.00 75 15.000 15,075 2,000 P13,075.00 75 15.000 15,075 2,000 P13,075.00 75 60,000 60.075 8.000 P52,075.00 52,075 8,000 Computation of applied factory overhead rate per hour Annual cash paid for factory overhead Add: Annual depreciation expense Total Divide by: Total annual direct labor hours needed Applied factory overhead per hour 60,075 1.51 40,050