Answered step by step

Verified Expert Solution

Question

1 Approved Answer

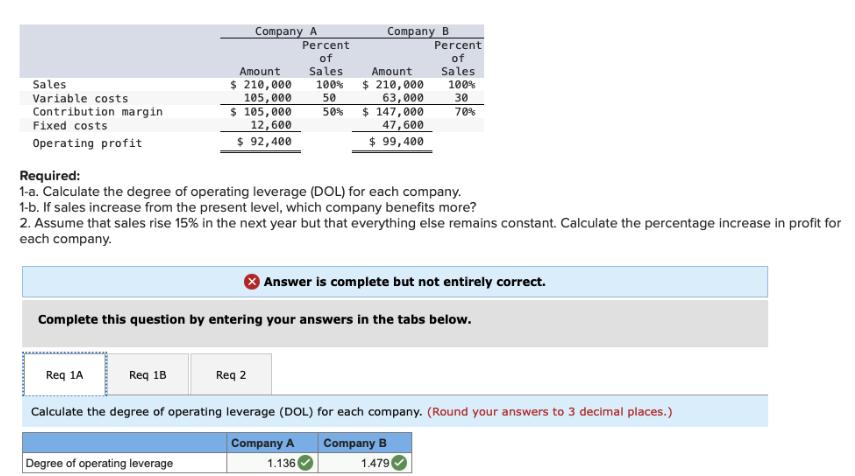

Sales Company B Company A Percent Percent of of Amount Sales Amount Sales $210,000 105,000 100% 50 $ 210,000 100% 63,000 Contribution margin $

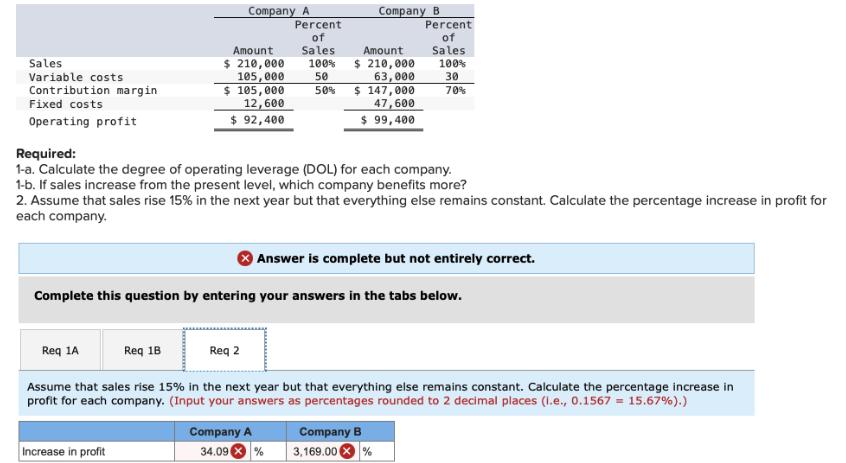

Sales Company B Company A Percent Percent of of Amount Sales Amount Sales $210,000 105,000 100% 50 $ 210,000 100% 63,000 Contribution margin $ 105,000 12,600 50% $ 147,000 30 70% 47,600 $ 92,400 $ 99,400 Variable costs Fixed costs Operating profit Required: 1-a. Calculate the degree of operating leverage (DOL) for each company. 1-b. If sales increase from the present level, which company benefits more? 2. Assume that sales rise 15% in the next year but that everything else remains constant. Calculate the percentage increase in profit for each company. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 2 Calculate the degree of operating leverage (DOL) for each company. (Round your answers to 3 decimal places.) Degree of operating leverage Company A 1.136 ( Company B 1.4790 Sales Variable costs Contribution margin Fixed costs Operating profit Required: Company A Amount $ 210,000 105,000 $ 105,000 12,600 $ 92,400 Percent Company B Percent of Sales 100% 50 Amount $ 210,000 of Sales 100% 63,000 30 50% $ 147,000 70% 47,600 $ 99,400 1-a. Calculate the degree of operating leverage (DOL) for each company. 1-b. If sales increase from the present level, which company benefits more? 2. Assume that sales rise 15% in the next year but that everything else remains constant. Calculate the percentage increase in profit for each company. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 2 Assume that sales rise 15% in the next year but that everything else remains constant. Calculate the percentage increase in profit for each company. (Input your answers as percentages rounded to 2 decimal places (1.e., 0.1567 = 15.67%).) Increase in profit Company A 34.09% Company B 3,169.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started