Answered step by step

Verified Expert Solution

Question

1 Approved Answer

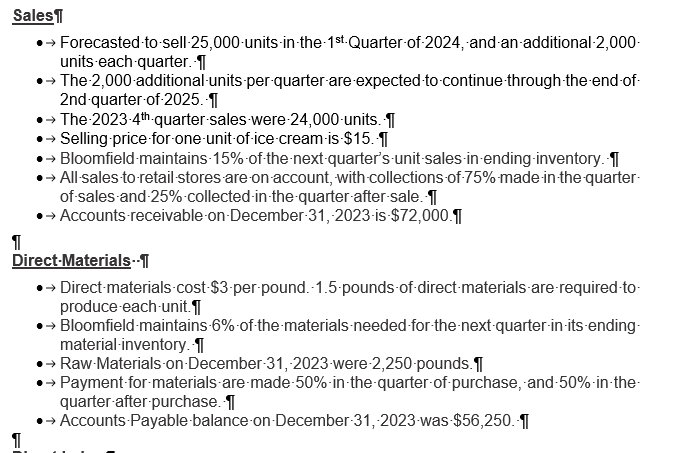

Sales Forecasted-to-sell-25,000-units-in-the-1st Quarter-of-2024, and an additional-2,000- units each quarter. The 2,000-additional units per-quarter are expected to continue through the end-of- 2nd-quarter-of-2025.- The 2023-4th-quarter-sales-were-24,000-units. Selling

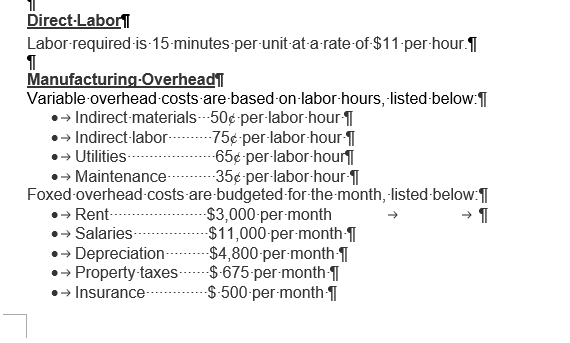

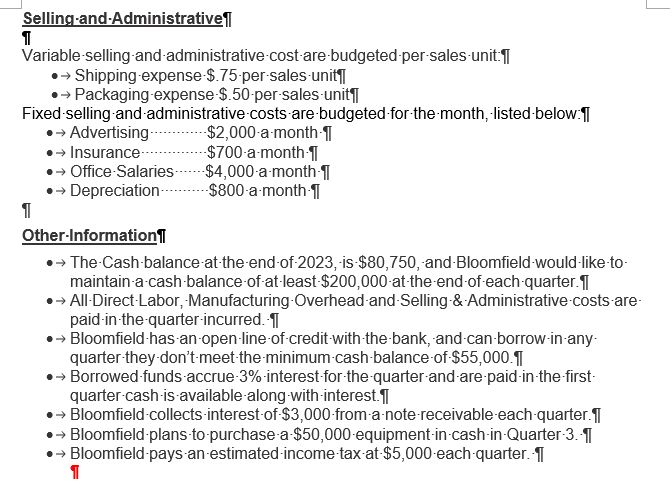

Sales Forecasted-to-sell-25,000-units-in-the-1st Quarter-of-2024, and an additional-2,000- units each quarter. The 2,000-additional units per-quarter are expected to continue through the end-of- 2nd-quarter-of-2025.- The 2023-4th-quarter-sales-were-24,000-units. Selling price for one unit of ice-cream-is $15.-1 Bloomfield-maintains 15% of the next quarter's unit-sales-in-ending-inventory. All-sales to retail stores are on account, with collections of 75% made in the quarter- of-sales-and-25%-collected in the quarter-after-sale. 1 Accounts receivable on December 31, 2023-is $72,000.1 1 Direct-Materials--1 Direct-materials cost-$3-per-pound.-1.5-pounds-of-direct-materials are required-to- produce-each-unit. Bloomfield-maintains -6% of the materials needed for the next quarter-in-its-ending- material-inventory. -1 Raw Materials on December 31, 2023-were-2,250-pounds. Payment-for-materials are made-50%-in-the-quarter of purchase, and 50%-in-the- quarter-after purchase. Accounts Payable balance on December 31, 2023-was-$56,250.- FI Direct-Labor Labor-required-is-15-minutes-per-unit-at-a-rate-of-$11-per-hour. 1 Manufacturing-Overhead Variable-overhead costs are based on-labor-hours, listed below: Indirect-materials 50-per-labor-hour- Indirect labor.... -75-per-labor-hour-1 > Utilities.. -65-per-labor-hour --35-per-labor-hour- Maintenance- Foxed-overhead-costs-are-budgeted for the month, listed below: 1 Rent... Salaries.. Depreciation- Property taxes Insurance. --$3,000-per-month $11,000-per-month- $4,800-per-month-1 -$-675-per-month-1 --$-500-per-month- Selling and Administrative 1 Variable-selling and administrative-cost-are-budgeted-per-sales-unit: Shipping expense-$.75-per-sales-unit Packaging-expense $.50-per-sales-unit Fixed-selling and administrative costs are budgeted for the month, listed below: Advertising.. > Insurance- Office Salaries. Depreciation- --$2,000-a-month- --$700-a-month-1 $4,000-a-month- --$800-a-month-1 1 Other-Information The Cash-balance at the end of 2023, is $80,750, and Bloomfield-would-like-to- maintain-a-cash-balance of at least-$200,000 at the end of each quarter. All-Direct-Labor, Manufacturing Overhead and Selling & Administrative costs are paid in the quarter-incurred. Bloomfield has an open-line of credit with the bank, and-can-borrow-in-any- quarter-they-don't-meet the minimum-cash-balance-of-$55,000. Borrowed-funds accrue-3%-interest for the quarter-and-are-paid-in-the-first- quarter-cash-is-available along with interest. Bloomfield-collects-interest of $3,000-from-a-note-receivable-each-quarter. Bloomfield-plans to purchase a $50,000-equipment-in-cash-in-Quarter-3.-1 Bloomfield-pays an estimated-income tax at $5,000-each-quarter. 1 Budgeted Income Statement For the Year Ending

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Variable Selling and Administrative Costs per Sales Unit Shipping Expense 075 per unit Packaging Exp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started