Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sales information Requirement 1 . Calculate the sales - quantity variances for each product for June. Begin by determining the basic formula for Sato Corporation's

Sales information Requirement Calculate the salesquantity variances for each product for June.

Begin by determining the basic formula for Sato Corporation's staticbudget total contribution margin CM

Rearrange the formula to determine the sales mix for each product.

The salesmix percentage of Plain wine glasses is

The salesmix percentage of Chic wine glasses is

Next, determine the formula and compute the budgeted CM based on actual units sold of all products at the budgeted mix.

The actual number of all glasses sold is units. Requirement Calculate the individualproduct and total salesmix variances for June. Calculate the individualproduct and total salesvolume variances for June.

Begin with the individualproduct salesmix variances for June. Determine the formula, and then calculate the variance for each product. Label each variance as favourable F or unfavourable UEnter

percentages, if any, as decimals rounded to two places, XXX

Now, calculate the individualproduct salesvolume variances for June. Determine the formula, and then calculate the variance for each product. Label each variance as favourable F or

unfavourable U

The total salesvolume variance isRequirement Briefly describe the conclusions you can draw from the variances.

Sato Corporation shows an

salesquantity variance because it sold

wine glasses in total than was budgeted. This is partially offset by

salesmix variance because the actual mix of wine glasses sold has shifted in favour of the highercontributionmargin

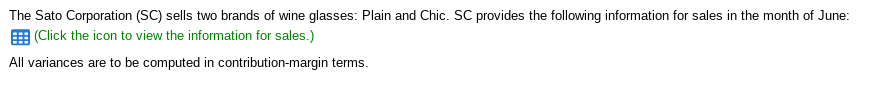

wine glasses.The Sato Corporation SC sells two brands of wine glasses: Plain and Chic. SC provides the following information for sales in the month of June:

Click the icon to view the information for sales.

All variances are to be computed in contributionmargin terms.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started