sales related and purchase related transactions using perpetual inventory system

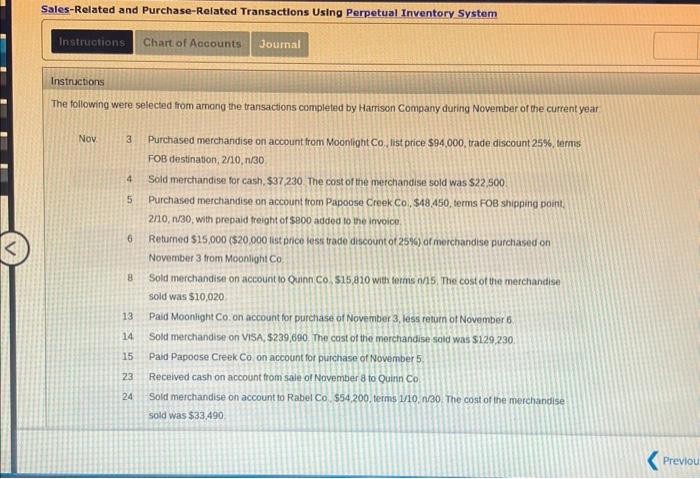

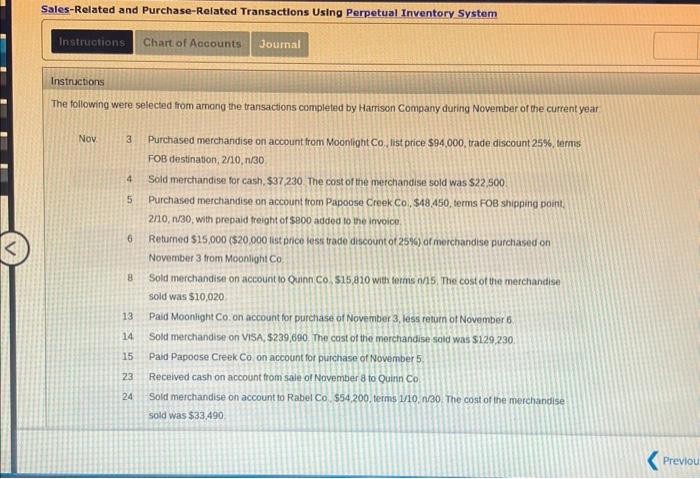

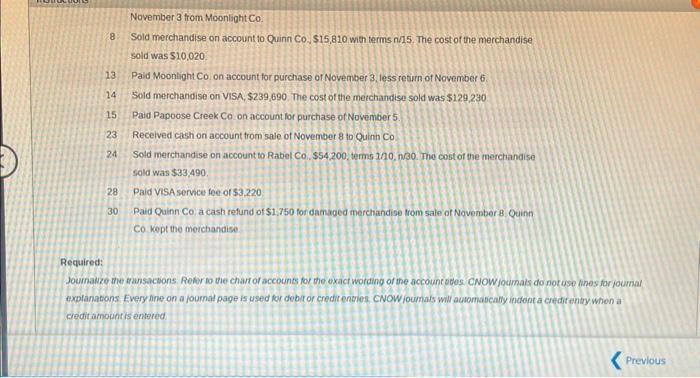

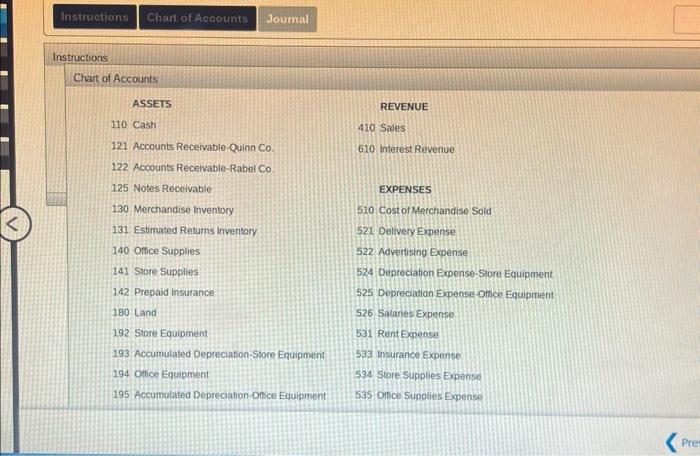

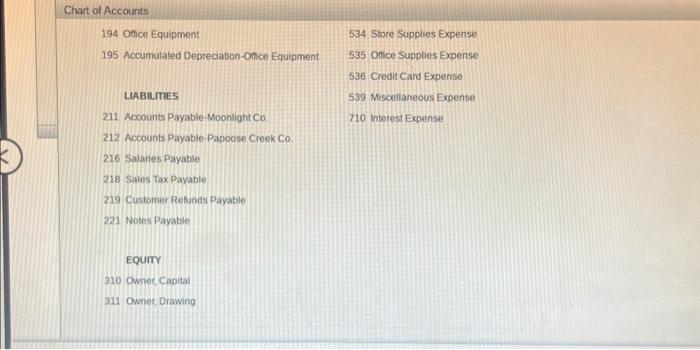

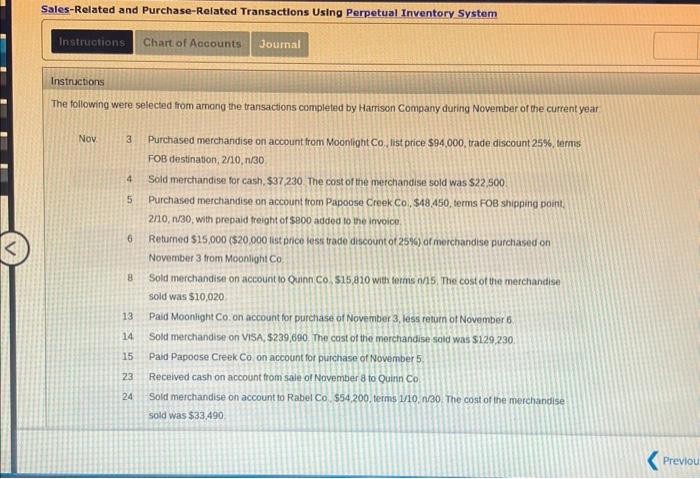

Chart of Accounts: 194 Otlce Equipment 195 Accumulated Depreciation-Oflice Equipment LABILIIES 211 Accounts Payable-Moonlight Co. 212 Accounts Payable Papoose Creek Co. 216 Salaries Payatile 218 Sales Tox Payable 219 Customer Retunds Payable 221 Notes Payable Equm 310 Ownet, Capital 311 Ownet Orawino 534 Store Supplies Expense 535 Otice Supplies Expense 536 Credit Card Expense 539 Miscellaneous Expense 710 interest Expense 8. Sold merchandise on account to Quinn Co, $15,810 with termis n/15. The cost of the merchandise sold was $10,020 13. Pald Moonlight Co. on account for purchase or November 3, less return of November 6. 14 Sold merchandise on VISA, $239,690. The cost of the merchandise sold was $129,230 15 Pad Papoose Creek Co on account for purchase of November 5. 23 Received cash on account from sale of November 8 to Quinh Co. 24 Sold merchandise on account to Rabel Co. $54,200, terms 130,n/30. The cost of the merctiandise sold was $33,490. 28 Paid VisA service foe or $3,220 30 Pad Quinn Co a cash refund of $1.750 for damaged merchandise trom sale of November 8 Quinn Co kept the merchandise. Required: explanasons Every dine on a joumal page is used for debit or credireneres. CNOWjoumals wil automabcally indent a credirentry when a credit amountis entered Instructions Chart of Accounts: Joumal \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & BATL & ackcastion & & DOST AN5. & onart & CAEOT & Asscts & Hanuties & roumr \\ \hline 1 & & & & & & & & & \\ \hline 2. & & & & & & & & & \\ \hline 3 & & & & & & & & & \\ \hline 1 & & & & & & & & & \\ \hline 3 & & & & & & & & & \\ \hline 6 & & & & & & & & & \\ \hline r & & & & & & & & 10 & k \\ \hline \end{tabular} The following were selected from among the transactions completed by Harrison Company during November of the cutrent yeat Nov. 3 Purchased merchandise on account from Moonlight Co, list price $94,000, trade discount 25%, terms FOB destination, 2/10,n/30 4 Sold merchandise for cash, $37,230. The cost of the merchandise sold was $22,500 5 Purchased merchandise on account from Papoose CreekCo, $48,450, terms FOB shipping point. 2110,nB30, with prepaid treight of $800 added to the invoice. 6 Returned 515,000 (\$20,000 ist pnce less trade discount of 25\%) of merchandise purchased on November 3 from Moonlight Co 8. Sold merchandise on account to Quinh Co, $15,810 with ferms n/25. The cost of the merchandise soid was $10,020. 13 Paid Moonlight Co. on account for purchase of November 3 , less return of November 6 14 Sold merchandise on VISA, $239,690. The cost of the merchandise soid was $129,230. 15 Paid Papoose Creek Co on account for purchase of November 5. 23 Received cash on account from sale ot November 8 to Quin Co 24 Sold merchandise on account to Rabel C0,554,200, terms 1/0,n/0. The cost of the merchandise sold was $33.490 Joumal Instructions Chart of Accounts ASSETS 110 Cash 121 Accounts Receivable-Quinn Co. 122 Accounts Recelvable-Rabel Co. 125 Notes Receivable 130 Merchandise Inventory 131 Estimated Returns Inventory 140 Office Supplies 141 Store Supplies 142 Prepaid Insurance 180 Land 192 Store Equipment 193 Accumulated Depreciation-Store Equipment 194 Onfice Equipment 195 Accumulated Depreciation-Onice Equipment REVENUE 410 Sales 610 Interest Revenue EXPENSES 510 Cost of Merchandise Sold 521 Delivery Expense 522 Advertising Expense 524 Depreciation Expense-Store Equipment 525 Depreciation Expense-Ofice Equipment 526. Sataries Expenso 531 Rent Expense 533 Insurance Expense: 534 Store Supplies Expense 535 Orsce Supplies Expense