Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Discuss how taxes may affect firm value. Can changes in tax rates affect capital budgeting? How does a change in tax rate affect

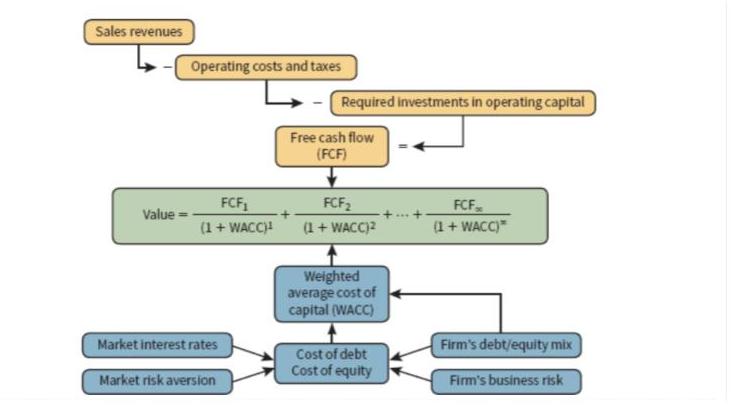

1. Discuss how taxes may affect firm value. Can changes in tax rates affect capital budgeting? How does a change in tax rate affect municipal bonds? 2. Discuss the difference between accounting profit measures (EBIT, EBITDA, and Net Income) and FCF. 3. Discuss how recent interest rate increases may affect a firm's value. Sales revenues Value = Operating costs and taxes FCF (1 + WACC) Market interest rates Market risk aversion Required investments in operating capital Free cash flow (FCF) FCF (1 + WACC) Weighted average cost of capital (WACC) Cost of debt Cost of equity FCF (1 + WACC)* Firm's debt/equity mix Firm's business risk

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Taxes can have an impact on business equity in numerous ways Corporation tax ratio A rise in the company tax rate can lower a companys aftertax income causing its equity to fall Conversely lowering th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started