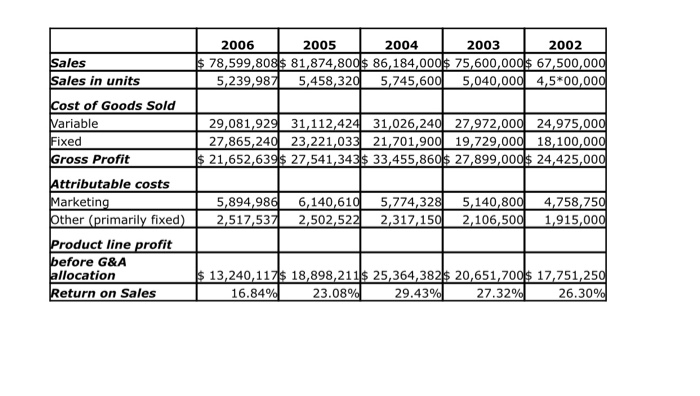

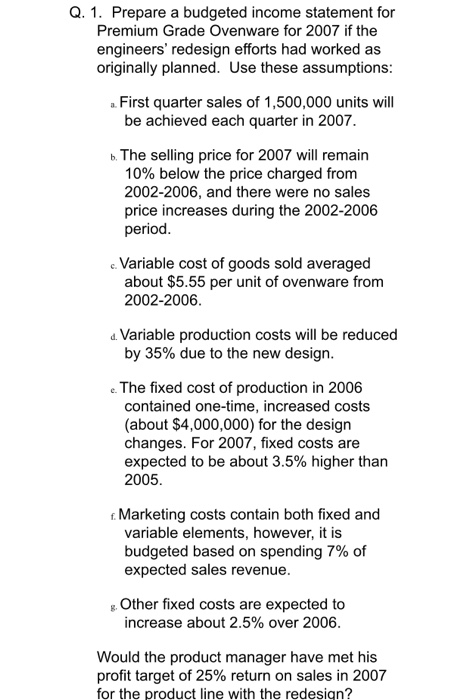

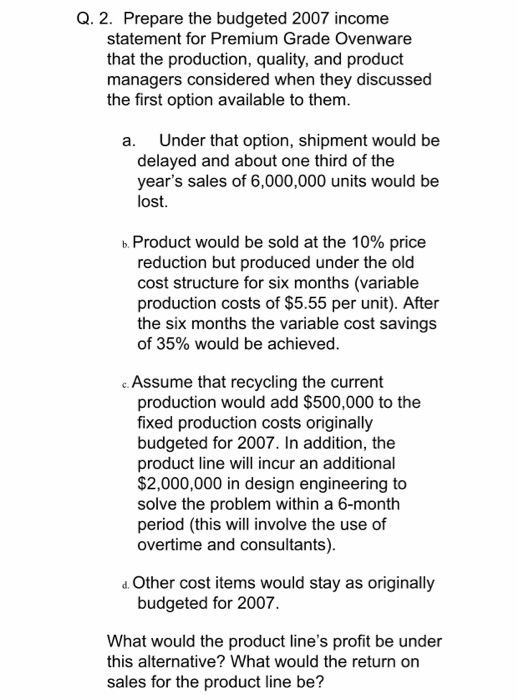

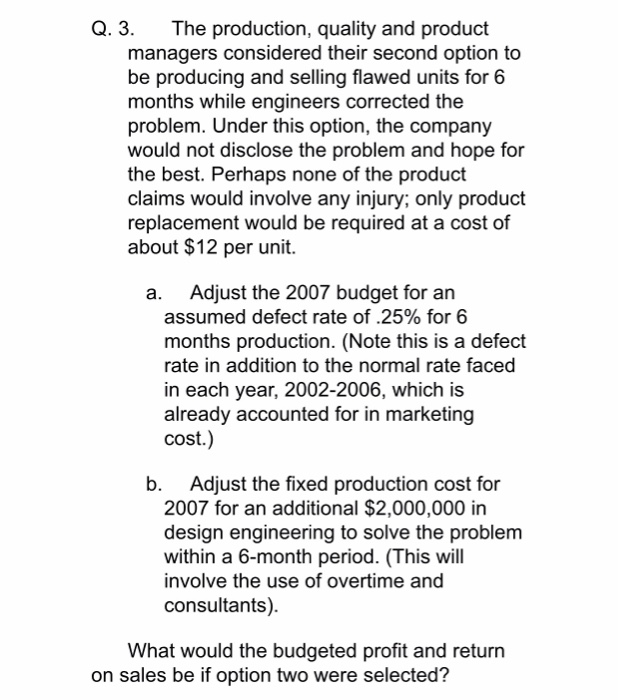

Sales Sales in units 2006 2005 | 2004 2003 2002 $78,599,808$ 81,874,800$ 86,184,000$ 75,600,000$ 67,500,000 5,239,9875,458,320 5,745,600 5,040,000 4,5*00,000 29,081,929 31,112,424 31,026,240 27,972,000 24,975,000 27,865,240 23,221,033 21,701,900 19,729,000 18,100,000 $ 21,652,639 $ 27,541,343$ 33,455,860$ 27,899,000$ 24,425,000 Cost of Goods Sold Variable Fixed Gross Profit Attributable costs Marketing Other (primarily fixed) Product line profit before G&A allocation Return on Sales 5,894,986 2,517,537 6,140,610 2,502,522 5,774,328 2,317,150 5,140,800 2,106,500 4,758,750 1,915,000 $ 13,240,117$ 18,898,211$ 25,364,382$ 20,651,700 $ 17,751,250 16.84% 23.08% 29.43% 27.32% 26.30% Q. 1. Prepare a budgeted income statement for Premium Grade Ovenware for 2007 if the engineers' redesign efforts had worked as originally planned. Use these assumptions: .. First quarter sales of 1,500,000 units will be achieved each quarter in 2007. b. The selling price for 2007 will remain 10% below the price charged from 2002-2006, and there were no sales price increases during the 2002-2006 period. Variable cost of goods sold averaged about $5.55 per unit of ovenware from 2002-2006. d. Variable production costs will be reduced by 35% due to the new design. c. The fixed cost of production in 2006 contained one-time, increased costs (about $4,000,000) for the design changes. For 2007, fixed costs are expected to be about 3.5% higher than 2005. f. Marketing costs contain both fixed and variable elements, however, it is budgeted based on spending 7% of expected sales revenue. Other fixed costs are expected to increase about 2.5% over 2006. Would the product manager have met his profit target of 25% return on sales in 2007 for the product line with the redesign? Q. 2. Prepare the budgeted 2007 income statement for Premium Grade Ovenware that the production, quality, and product managers considered when they discussed the first option available to them. a. Under that option, shipment would be delayed and about one third of the year's sales of 6,000,000 units would be lost. b. Product would be sold at the 10% price reduction but produced under the old cost structure for six months (variable production costs of $5.55 per unit). After the six months the variable cost savings of 35% would be achieved. c. Assume that recycling the current production would add $500,000 to the fixed production costs originally budgeted for 2007. In addition, the product line will incur an additional $2,000,000 in design engineering to solve the problem within a 6-month period (this will involve the use of overtime and consultants). d. Other cost items would stay as originally budgeted for 2007. What would the product line's profit be under this alternative? What would the return on sales for the product line be? Q. 3. The production, quality and product managers considered their second option to be producing and selling flawed units for 6 months while engineers corrected the problem. Under this option, the company would not disclose the problem and hope for the best. Perhaps none of the product claims would involve any injury; only product replacement would be required at a cost of about $12 per unit. a. Adjust the 2007 budget for an assumed defect rate of .25% for 6 months production. (Note this is a defect rate in addition to the normal rate faced in each year, 2002-2006, which is already accounted for in marketing cost.) b. Adjust the fixed production cost for 2007 for an additional $2,000,000 in design engineering to solve the problem within a 6-month period. (This will involve the use of overtime and consultants). What would the budgeted profit and return on sales be if option two were selected