Answered step by step

Verified Expert Solution

Question

1 Approved Answer

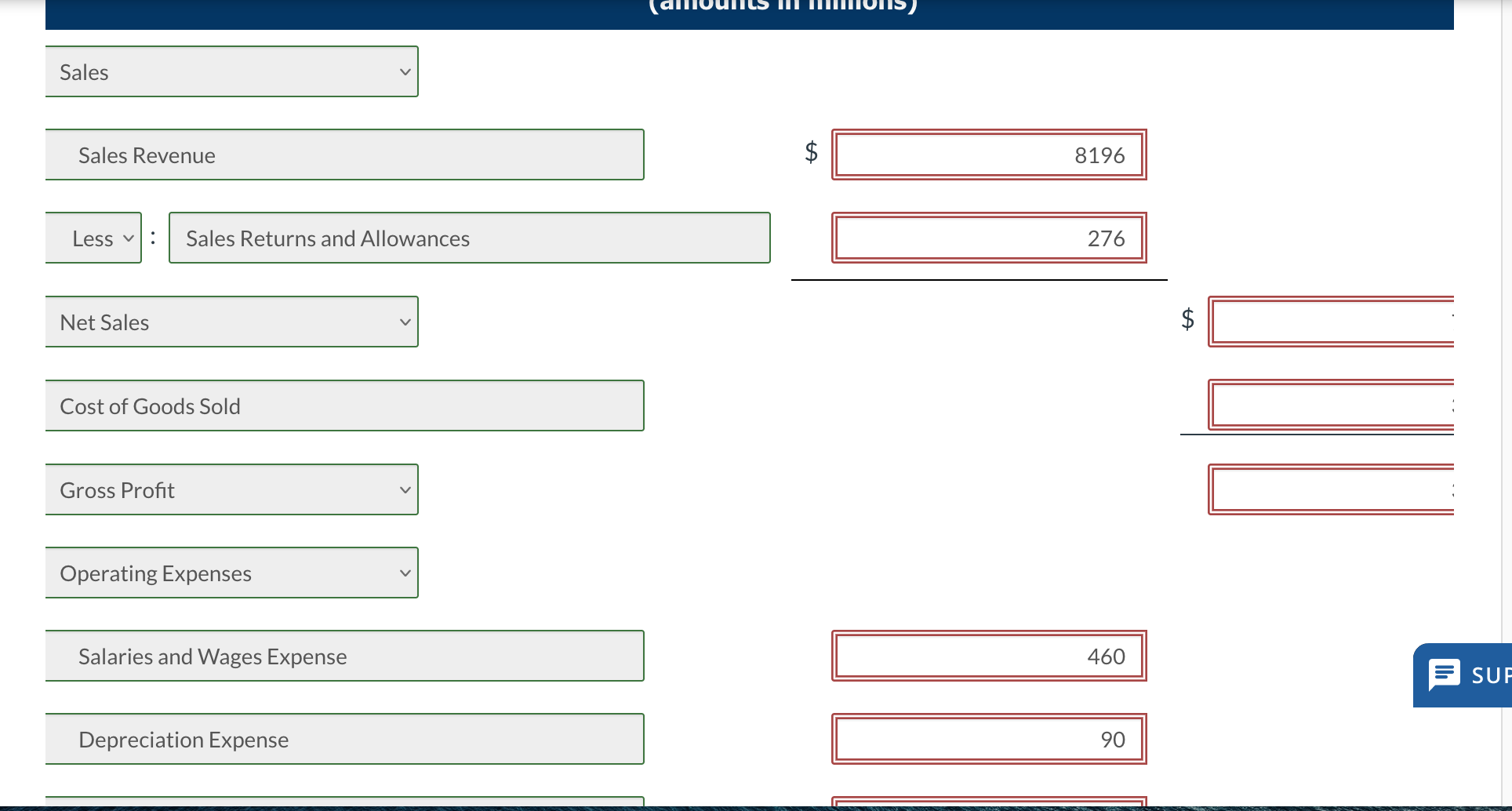

Sales Sales Revenue Less : Sales Returns and Allowances Net Sales Cost of Goods Sold Gross Profit Operating Expenses Salaries and Wages Expense Depreciation

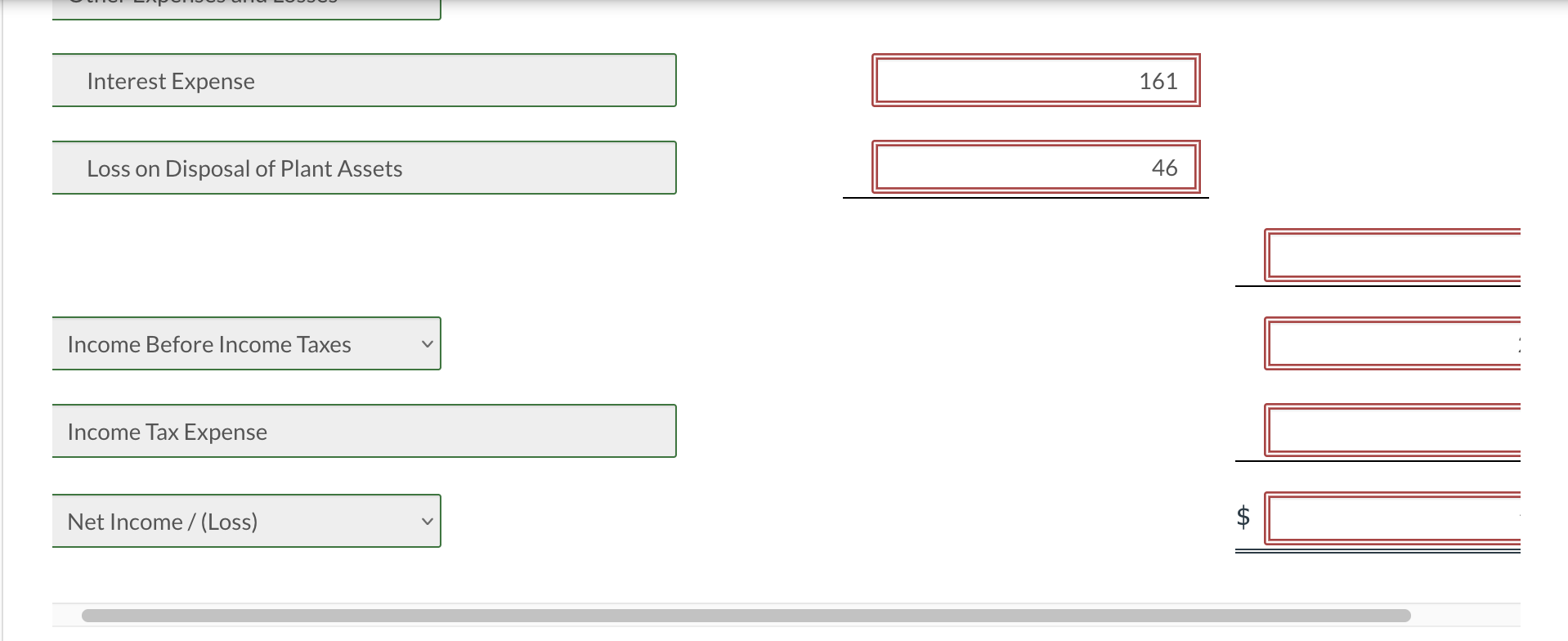

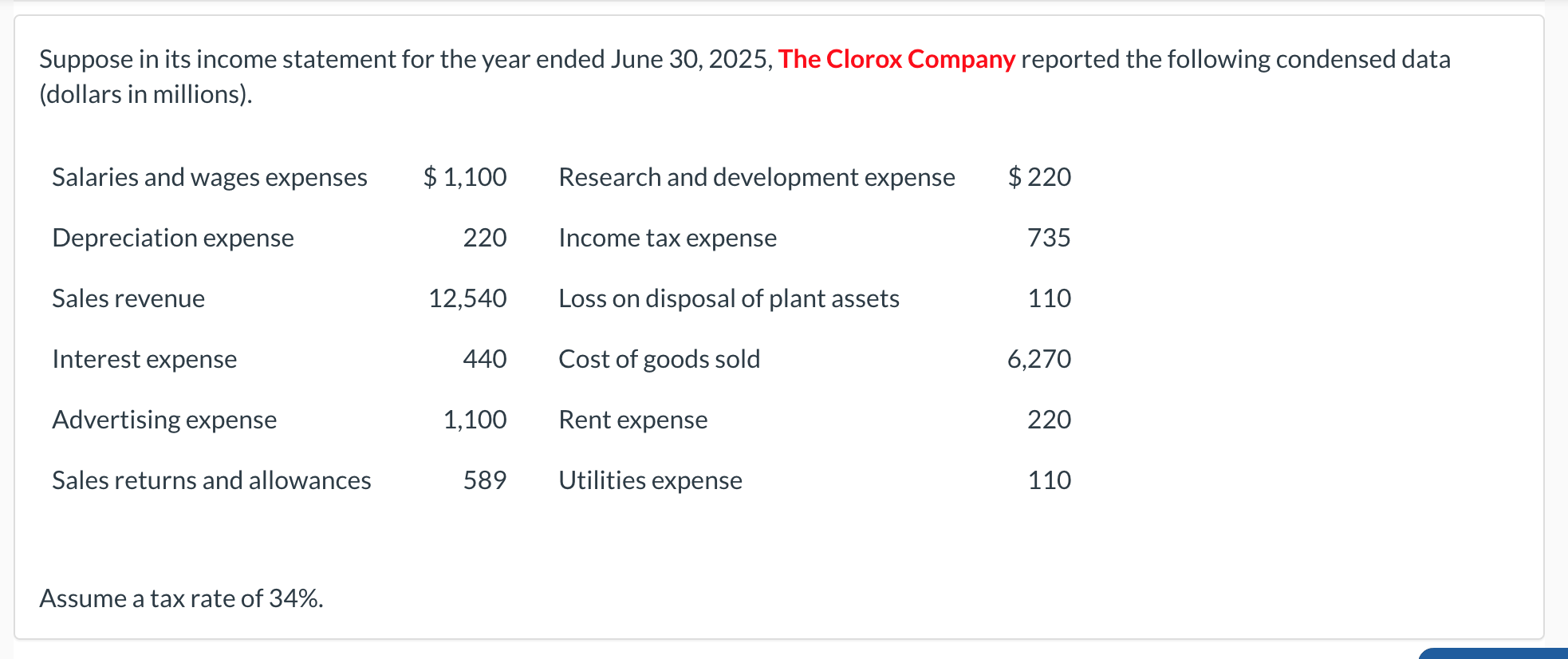

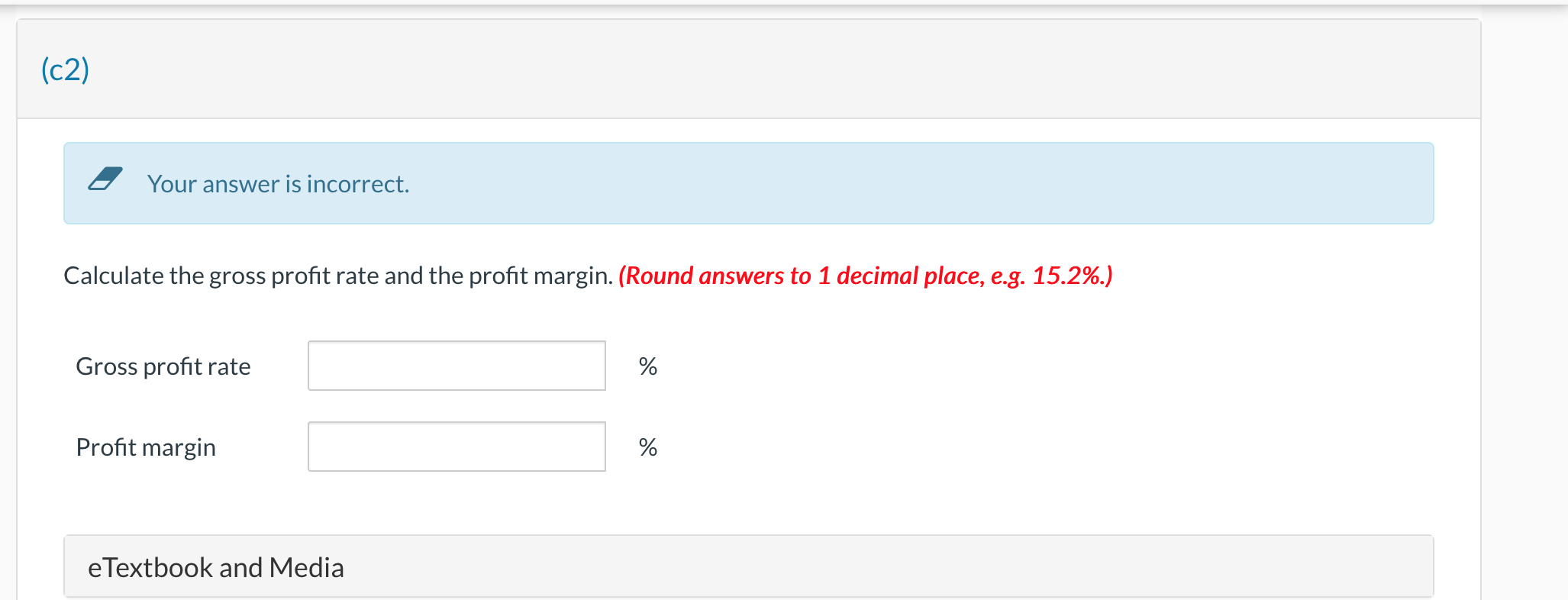

Sales Sales Revenue Less : Sales Returns and Allowances Net Sales Cost of Goods Sold Gross Profit Operating Expenses Salaries and Wages Expense Depreciation Expense A 8196 276 460 90 GA $ SUF Depreciation Expense Advertising Expense Research and Development Expense Rent Expense Utilities Expense Total Operating Expenses Income From Operations Other Expenses and Losses Interest Expense Loss on Disposal of Plant Accote 90 90 839 114 105 60 161 16 SU Interest Expense Loss on Disposal of Plant Assets Income Before Income Taxes Income Tax Expense Net Income (Loss) 161 46 A Suppose in its income statement for the year ended June 30, 2025, The Clorox Company reported the following condensed data (dollars in millions). Salaries and wages expenses $ 1,100 Research and development expense $220 Depreciation expense 220 Income tax expense 735 Sales revenue 12,540 Loss on disposal of plant assets 110 Interest expense 440 Cost of goods sold 6,270 Advertising expense 1,100 Rent expense 220 Sales returns and allowances 589 Utilities expense 110 Assume a tax rate of 34%. (c2) Your answer is incorrect. Calculate the gross profit rate and the profit margin. (Round answers to 1 decimal place, e.g. 15.2%.) Gross profit rate Profit margin eTextbook and Media % do %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started