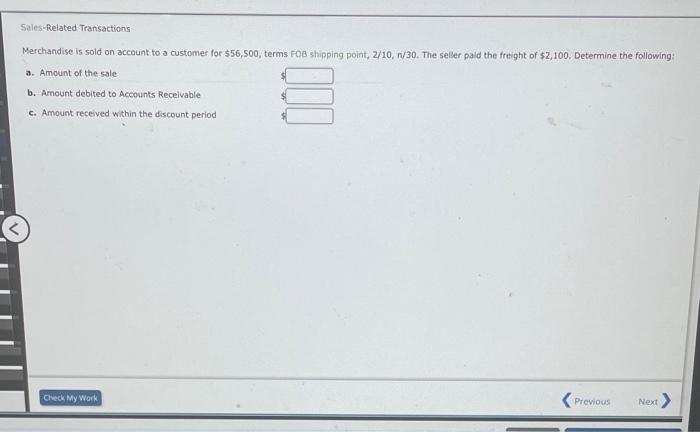

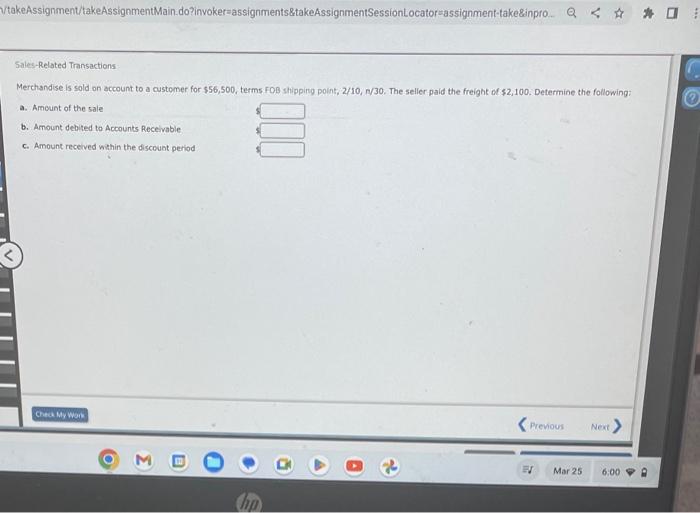

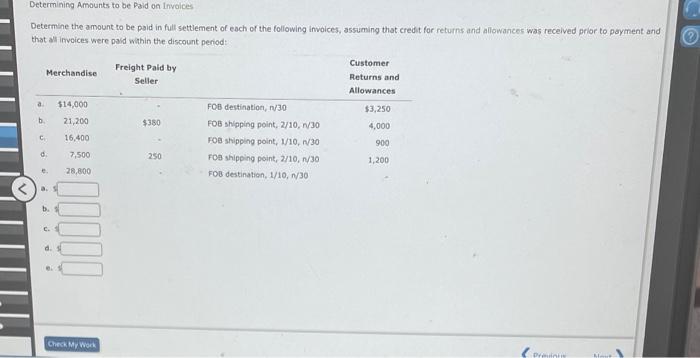

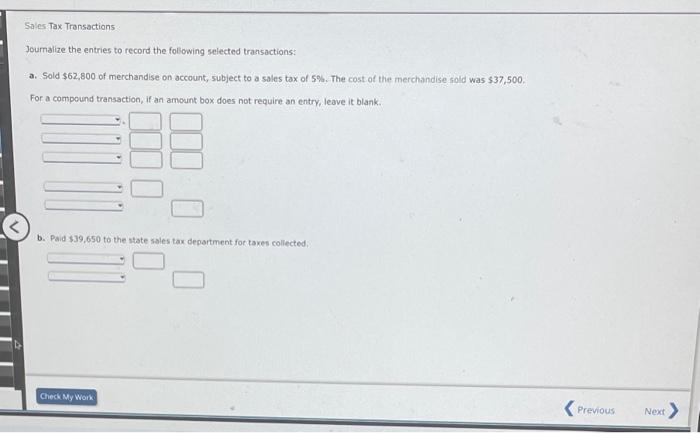

Sales-Related Transactions Merchandise is sold on account to a customer for $56,500, terms FoB shipping point, 2/10, n/30. The seller paid the freight of $2,100, Determine the following: a. Amount of the sale b. Amount debited to Accounts Receivable c. Amount received within the discount period Sales-Related Transactions Merchsndise is sold on account to a customer for $56,500, terms FOB shipping point, 2/10,n/30. The selier paid the freight of $2,100. Determine the following: Determiniling Aniaunts to be Pald on involces Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was recelved prior to payment and that al invoices were paid whin the discount periodt Sales Tax Transactions Joumalize the entries to record the following selected transactions: a. Sold $62,800 of merchandise on account, subject to a sales tax of 5%. The cost of the merchandise 501 was was $37,500. For a compound transaction, if an amount box does not require an entry, leave it blank. b. Paid $39,650 to the state sales tax department for taxes collected; Sales-Related Transactions Merchandise is sold on account to a customer for $56,500, terms FoB shipping point, 2/10, n/30. The seller paid the freight of $2,100, Determine the following: a. Amount of the sale b. Amount debited to Accounts Receivable c. Amount received within the discount period Sales-Related Transactions Merchsndise is sold on account to a customer for $56,500, terms FOB shipping point, 2/10,n/30. The selier paid the freight of $2,100. Determine the following: Determiniling Aniaunts to be Pald on involces Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was recelved prior to payment and that al invoices were paid whin the discount periodt Sales Tax Transactions Joumalize the entries to record the following selected transactions: a. Sold $62,800 of merchandise on account, subject to a sales tax of 5%. The cost of the merchandise 501 was was $37,500. For a compound transaction, if an amount box does not require an entry, leave it blank. b. Paid $39,650 to the state sales tax department for taxes collected