Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Saline Waitrose Ltd. produces 2 products, Product X and Product Y. till now, it. The company has adopted the traditional absorption costing methods in

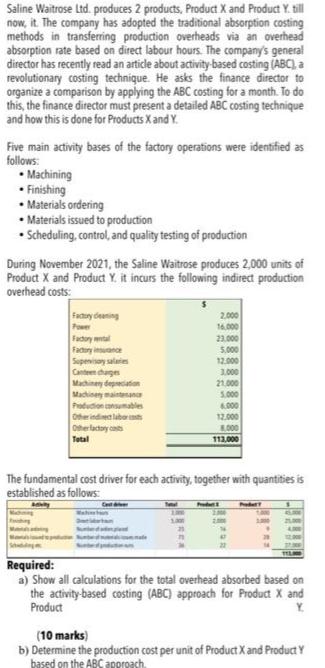

Saline Waitrose Ltd. produces 2 products, Product X and Product Y. till now, it. The company has adopted the traditional absorption costing methods in transferring production overheads via an overhead absorption rate based on direct labour hours. The company's general director has recently read an article about activity based costing (ABC) a revolutionary costing technique. He asks the finance director to organize a comparison by applying the ABC costing for a month. To do this, the finance director must present a detailed ABC costing technique and how this is done for Products X and Y. Five main activity bases of the factory operations were identified as follows: Machining Finishing Materials ordering Materials issued to production Scheduling, control, and quality testing of production During November 2021, the Saline Waitrose produces 2,000 units of Product X and Product Y. it incurs the following indirect production overhead costs: 2,000 14.000 23.000 Fadury deaning Power Fadory wtal Fatury inuance Supenisay salate Canteen chage Machineny depeciation Machineny maintenana Pedudion ansumable Oher indiea laberin 5.000 12.000 1.000 21.000 5.000 4.000 12.000 Oherlactoy cat 000 Tetal 113,000 The fundamental cost driver for each activity, together with quantities is established as follows: Sh Required: a) Show all calculations for the total overhead absorbed based on the activity-based costing (ABC) approach for Product X and Product Y. (10 marks) b) Determine the production cost per unit of Product Xand Product Y based on the ABC approach.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

RegularSupreme Total a Direct Labor Hours per unit 3 b Monthly Sales Units c Total Direct Labor hour...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started