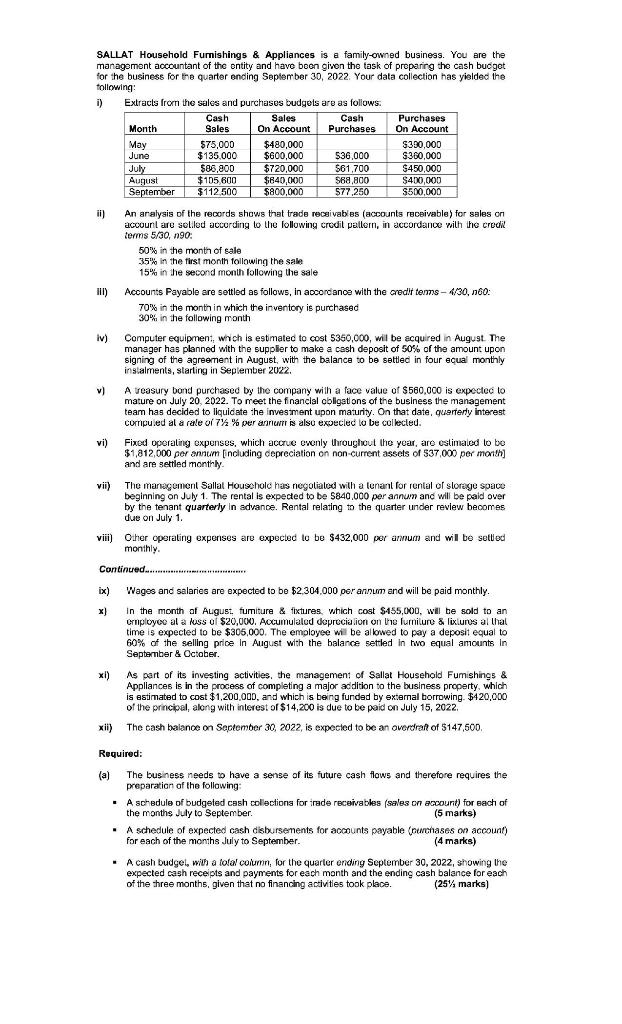

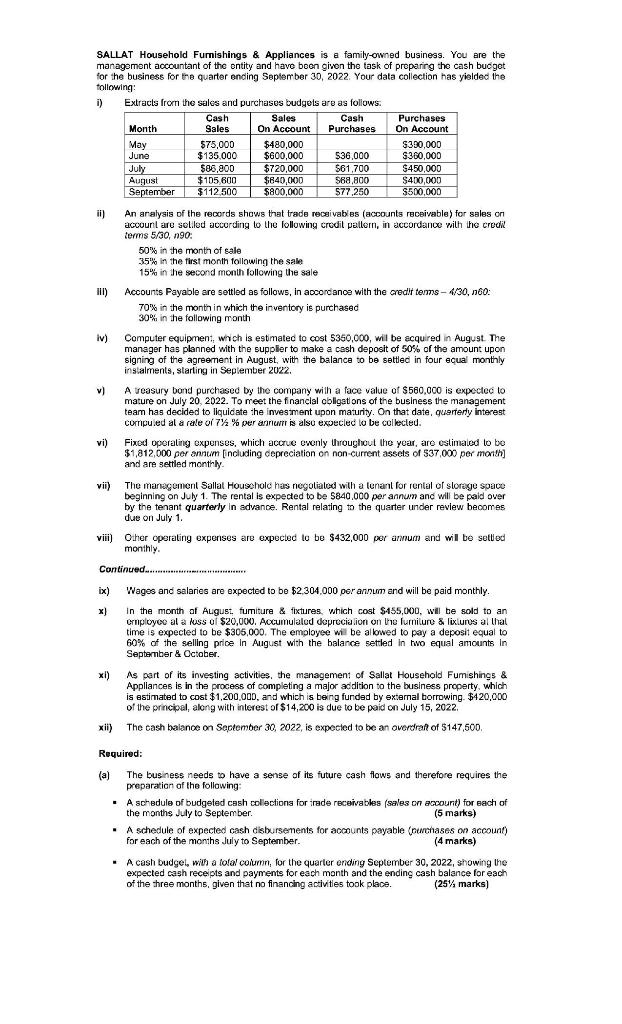

SALLAT Household Furnishings & Appliances is a family-owned business. You are the management accountant of the entity and have been given the task of preparing the cash budget for the business for the quarter ending September 30, 2022. Your data collection has yielded the following: i) i) Extracts from the sales and purchases budgets are as follows: Cash Sales Cash Purchases Month Sales On Account Purchases On Account May $75,000 $480,000 $390.000 June $135.000 $600,000 536,000 $360,000 July $86,800 $720,000 $61,700 $450,000 August $105 600 $640,000 $ $68,800 $400,000 September $112 500 $800,000 $77,250 $ $500,000 ii) HI) iv) An analysis of the records shows that trade receivables (accounts receivable) for sales on account are seliled according to the following credil pallom, in accordance with the credit terms 5/30, n90 50% in the month of sale 35% in the first month following the sale 15% in the second month following the sale Accounts Payable are settled as follows, in accordance with the credit temns - 4/30, 160: 70% in the month in which the inventory is purchased 30% in the following month Computer equipment, which is estimated to cost $350,000, will be acquired in August. The manager has planned with the supplier to make a cash deposit of 50% of the amount upon signing of the agreement in August, with the balance to be settled in four equal monthly instalments, starting in Seplember 2022. A reasury bond purchased by the company with a face value of $560,000 is expected to mature on July 20, 2022. To meet the financial obligations of the business the management team has decided to liquidate the investment upon maturity. On that date, querterly interest compued al a rale oi 74 % per annut is also expecled to be collected. Fixed operating expenses, which accrue evenly throughout the year, are estimaled to be $1,812,000 per annum including cepreciation on non-current assets of 537,000 per month) and are settled monthly v] vi) DER vii) The management Sallal Household has negotialed with a tenant for rental of storage space beginning on July 1. The rental is expected to be 5840.000 per annum and will be paid over by the tenant quarterly in advance. Rental relating to the quarter under review becomes due on July 1. vii) Other operating experises are expected to be $432,000 per annum and will be settled monthly Continued............. ix) Wages and salaries are expected to be $2.304,000 per annum and will be paid monthly. x) In the month of August. fumiture & fixtures, which cost $455,000, will be sold to an crnployce al a luss of $20,00X. Accumulalod deprecia.ion on the furniture & lixcuros al thal time is expected to be $305,000. The employee will be allowed to pay a deposit equal to 60% of the selling price in August with the balance settled in two equal amounts In September & October xi) As part of its investing activities, the management of Sallat Household Fumishings & Appliances is in the process of completing a major addition to the business property, which is estimated to cost $1,200.000, and which is being funded by external borrowing. $420,000 of the principal, along with interest of $14,200 is due to be paid on July 15, 2022 xii) The cash balance on September 30, 2022, is expected to be an overdraft of $147,500. (5 marks) Required: (a) The business needs to have a sense of its future cash flows and therefore requires the a preparation of the following: A schedule of budgeted cash collections for trade receivables (sales on account) for each of ) the months July to September. . A schedule of expected cash disbursements for accounts payable (purchases on account) for each of the months July to September. (4 marks) . A cash budget, with a total column, for the quarter ending September 30, 2022, showing the expected cash receipts and payments for each month and the ending cash balance for each of the three months, given that no financing activities took place. (25% marks)