Answered step by step

Verified Expert Solution

Question

1 Approved Answer

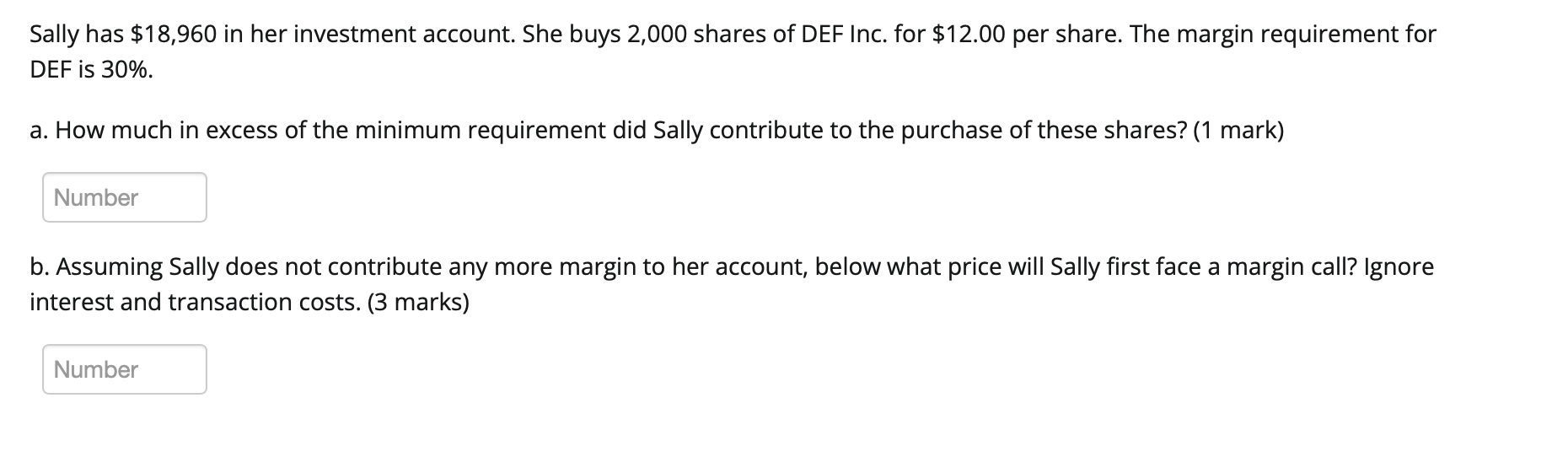

Sally has $18,960 in her investment account. She buys 2,000 shares of DEF Inc. for $12.00 per share. The margin requirement for DEF is

Sally has $18,960 in her investment account. She buys 2,000 shares of DEF Inc. for $12.00 per share. The margin requirement for DEF is 30%. a. How much in excess of the minimum requirement did Sally contribute to the purchase of these shares? (1 mark) Number b. Assuming Sally does not contribute any more margin to her account, below what price will Sally first face a margin call? Ignore interest and transaction costs. (3 marks) Number

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Sally purchased 2000 shares of DEF at 12 per share so total purchase was 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started