Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sally is a sole proprietor. She purchased an airplane on January 2nd for she and her assistant to fly from Honolulu to New Mexic

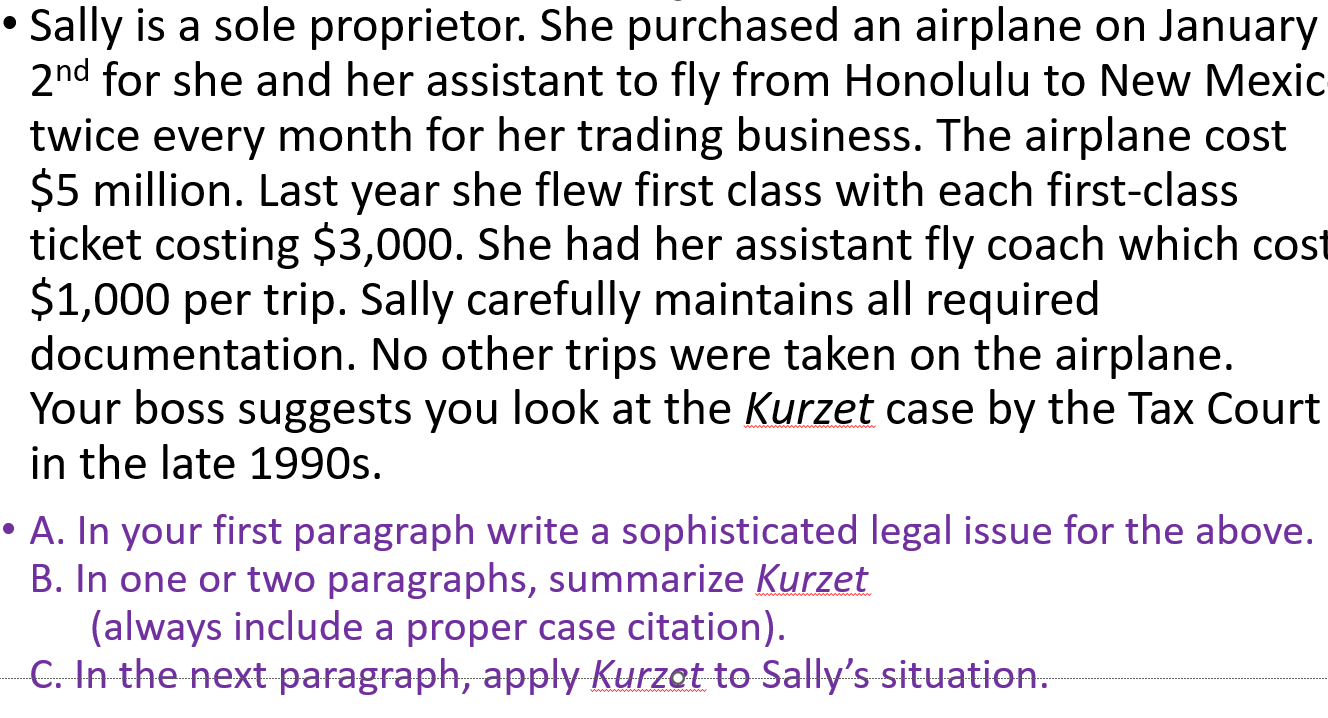

Sally is a sole proprietor. She purchased an airplane on January 2nd for she and her assistant to fly from Honolulu to New Mexic twice every month for her trading business. The airplane cost $5 million. Last year she flew first class with each first-class ticket costing $3,000. She had her assistant fly coach which cost $1,000 per trip. Sally carefully maintains all required documentation. No other trips were taken on the airplane. Your boss suggests you look at the Kurzet case by the Tax Court in the late 1990s. A. In your first paragraph write a sophisticated legal issue for the above. B. In one or two paragraphs, summarize Kurzet (always include a proper case citation). C. In the next paragraph, apply Kurzot to Sally's situation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started