Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sally Polar is an entrepreneurial company owned by Sally Bear, which develops refrigerating apparatuses. The company plans to enter the market for the production

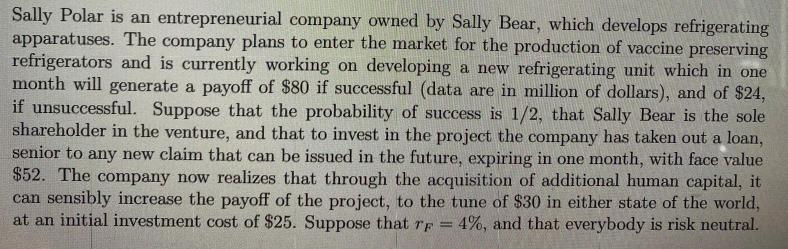

Sally Polar is an entrepreneurial company owned by Sally Bear, which develops refrigerating apparatuses. The company plans to enter the market for the production of vaccine preserving refrigerators and is currently working on developing a new refrigerating unit which in one month will generate a payoff of $80 if successful (data are in million of dollars), and of $24, if unsuccessful. Suppose that the probability of success is 1/2, that Sally Bear is the sole shareholder in the venture, and that to invest in the project the company has taken out a loan, senior to any new claim that can be issued in the future, expiring in one month, with face value $52. The company now realizes that through the acquisition of additional human capital, it can sensibly increase the payoff of the project, to the tune of $30 in either state of the world, at an initial investment cost of $25. Suppose that TF 4%, and that everybody is risk neutral. Propose an alternative deal in which Sally shoulders the entire capital expenditure, while the debtholder accepts a haircut in the face value of its debt, making sure that the debtholder is indifferent between signing the deal or not.

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To propose an alternative deal in which Sally shoulders the entire capital expenditure while the debtholder accepts a haircut in the face value of its ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started