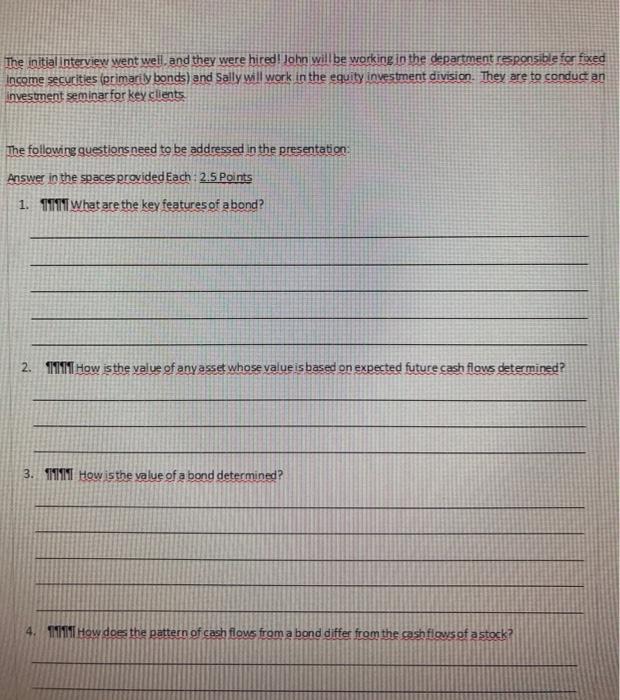

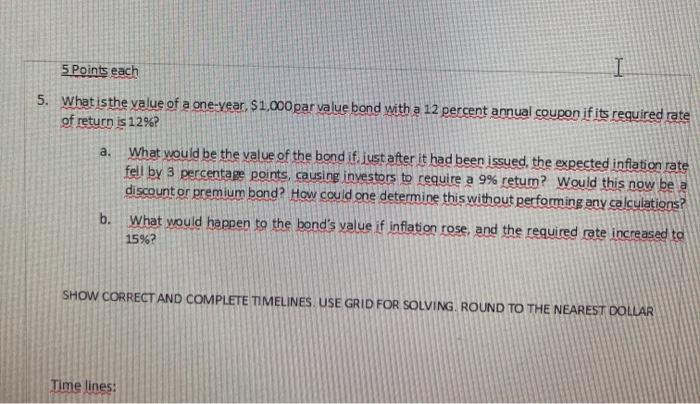

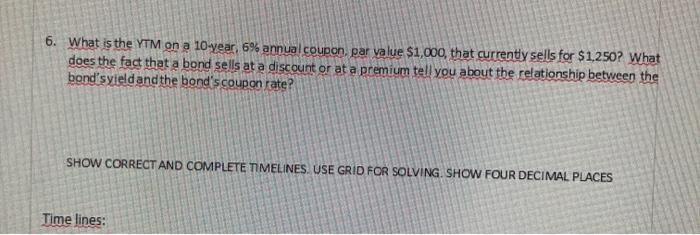

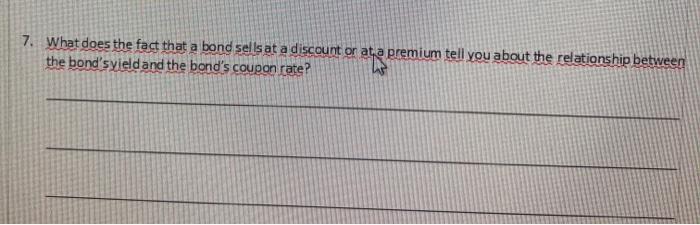

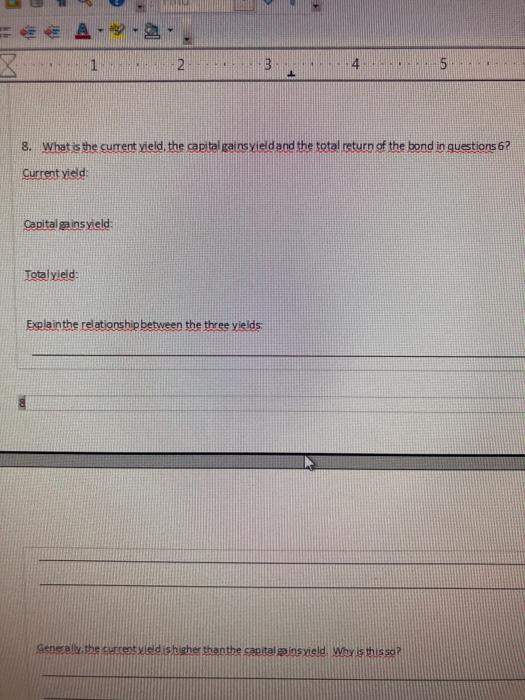

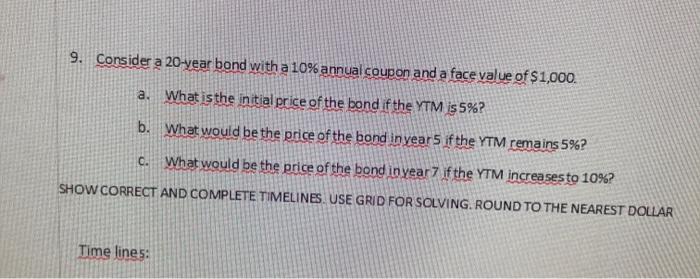

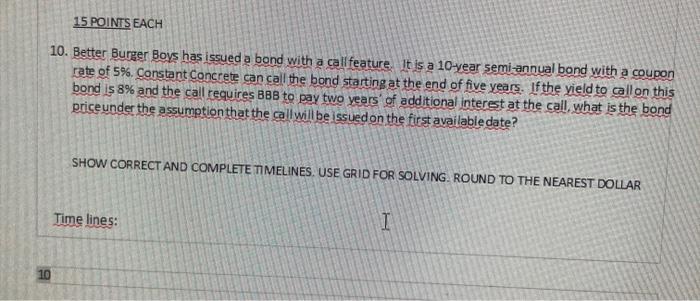

Sally Porter and John Johnson have internships at a wealth management firm in Columbia SC. If they do well during the internship, they will be hired for full-time positions in the company's pension fund management division. A good part of their job will be explaining time value of money concepts, bonds, and stocks to the company's clients. Part 1 . They have been given the following tasks to perform and present to the division managers as part of their job interview. They must show the following for each of the tasks: Show a correctly labeled timeline that corresponds to the thought process for the problem. Follow directions precisely! Use a question mark to show the variable for which is being solved. Have the correct inflow and outflow signs (negative signs must be shown for an outflow). Work neatly! . . . . 1. 1910 Points One of your favorite clients, Mr. and Mrs. Kohla, (an elderly couple that always bring cookies when they visit) has been very interested in hearing about your experiences at CSU. They would like to send their grandson to CSU in 10 years' time. You estimate that tuition will be $50,000 the first year, and that tuition will grow at 2.00% annually. They estimate it will take him 7 years to complete his undergraduate and Physician's Assistant degrees, provided he attends summer school. They would also like to bestow a gift of $20,000 to him upon his graduation from the PA program. How much must your clients deposit today, assuming an interest rate of 6%, in order to send their grandson to CSU and provide him with the graduation present? SHOW CORRECT AND COMPLETE TIMELINES, ROUND TO THE NEAREST DOLLAR Time lines: 2. 5 Points The Kohlas also have another grandson of whom they are very proud. They are considering offering him the following: a. $45,000 today or b. $55,000 towards a house down payment when he finishes medical school. Assuming an interest rate of 5%, which offer should the grandson accept? SHOW CORRECT AND COMPLETE TIMELINES. USE GRID FOR SOLVING, ROUND TO THE NEAREST DOLLAR Time lines: 3. 5 Points The Kohlas would also like to know how many years it would take for an investment to quadruple if invested at 10%, compounded quarterly. SHOW CORRECT AND COMPLETE TIMELINES. USE GRID FOR SOLVING, ROUND TO TWO DECIMAL PLACES I Timelines: The initial interview went well, and they were hired! John will be working in the department responsible for fixed Income securities primarily bonds) and Sally will work in the equity investment division. They are to conduct an investment seminar for key clients The following questions need to be addressed in the presentation Answer in the spaces provided Each :2.5 Points 1. 111T What are the key features of abond? 2. 1991 How is the value of any asset whose value is based on expected future cash flows determined? 3. 1111 How is the value of a bond determined? 4. 1711 How does the pattern of cash flows from a bond differ from the cashflows of a stock? 5 Points each I 5. What isthe value of a one-year. $1,000 par value bond with a 12 percent annual coupon if its required rate of return is 12%? a. What would be the value of the bond if just after it had been issued, the expected inflation rate fell by 3 percentage points, causing investors to require a 9% return? Would this now be a discount or premium bond? How could one determine this without performing any calculations? b. What would happen to the bond's value if inflation rose, and the required rate increased to 15%? SHOW CORRECT AND COMPLETE TIMELINES. USE GRID FOR SOLVING, ROUND TO THE NEAREST DOLLAR Time lines: 6. What is the YTM on a 10-year, 6% annual coupon par value $1,000, that currently sells for $1.250? What does the fact that a bond sells at a discount or at a premium tell you about the relationship between the bond'syield and the bond's coupon rate? SHOW CORRECT AND COMPLETE TIMELINES. USE GRID FOR SOLVING. SHOW FOUR DECIMAL PLACES Time lines: 7. What does the fact that a bond sells at a discount or at a premium tell you about the relationship between the bond'syield and the bond's coupon rate? FEE & A 1-2- 1 BI 2 3 4 5 BH . 8. What is the current yield, the capital gains yieldand the total return of the bond in questions 6? Current yield Capital gainsyield Totalyield: Explainthe relationship between the three yields Generally, the current yield is higher thanthe capital gains vield. Why is this? 9. Corsider a 20-year bond with a 10% annual coupon and a face value of $1,000. a. What is the initial price of the bond if the YTM is 5%? b. What would be the price of the bond in year 5 if the YTM remains 5%? C. What would be the price of the bond in year 7 if the YTM increases to 10%? SHOW CORRECT AND COMPLETE TIMELINES USE GRID FOR SOLVING. ROUND TO THE NEAREST DOLLAR Time lines: 15 POINTS EACH 10. Better Burger Boys has issued a bond with a call feature. It is a 10-year semiannual bond with a coupon rate of 5%. Constant Concrete can call the bond starting at the end of five years. If the yield to call on this bond is 8% and the call requires BBB to pay two years of additional interest at the call, what is the bond priceunder the assumption that the call will be issued on the first available date? SHOW CORRECT AND COMPLETE TIMELINES. USE GRID FOR SOLVING, ROUND TO THE NEAREST DOLLAR Time lines: I 10