Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sally will earn $30,000 this year and $40,500 next year. The real interest rate is 10% between this year and next year; she can borrow

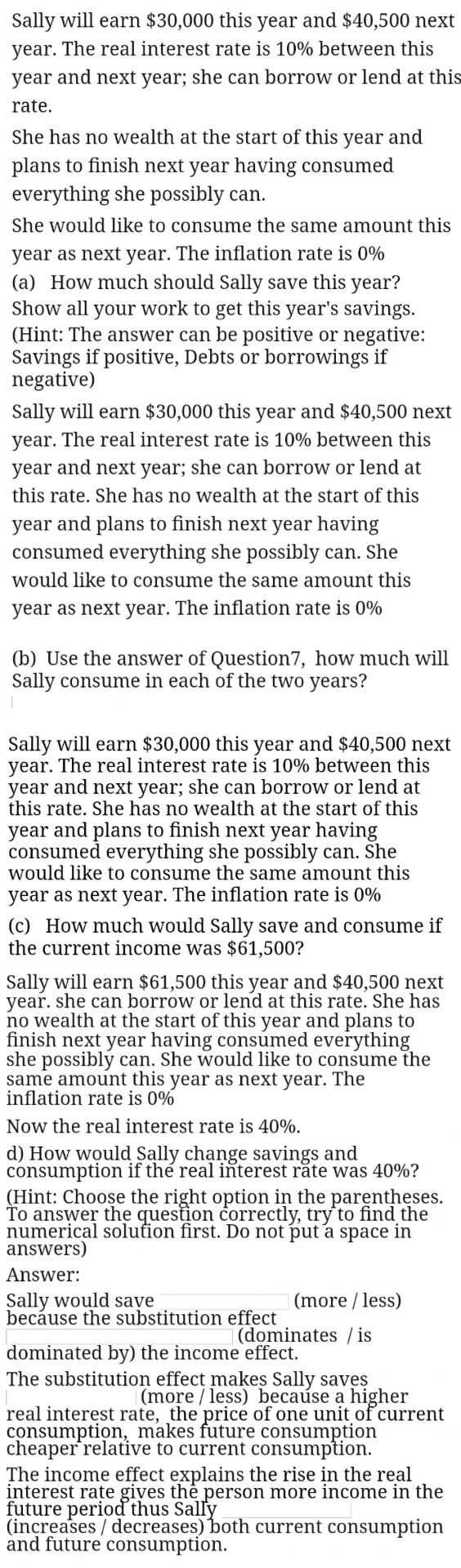

Sally will earn $30,000 this year and $40,500 next year. The real interest rate is 10% between this year and next year; she can borrow or lend at this rate. She has no wealth at the start of this year and plans to finish next year having consumed everything she possibly can. She would like to consume the same amount this year as next year. The inflation rate is 0% (a) How much should Sally save this year? Show all your work to get this year's savings. (Hint: The answer can be positive or negative: Savings if positive, Debts or borrowings if negative) Sally will earn $30,000 this year and $40,500 next year. The real interest rate is 10% between this year and next year; she can borrow or lend at this rate. She has no wealth at the start of this year and plans to finish next year having consumed everything she possibly can. She would like to consume the same amount this year as next year. The inflation rate is 0% (b) Use the answer of Question7, how much will Sally consume in each of the two years? Sally will earn $30,000 this year and $40,500 next year. The real interest rate is 10% between this year and next year; she can borrow or lend at this rate. She has no wealth at the start of this year and plans to finish next year having consumed everything she possibly can. She would like to consume the same amount this year as next year. The inflation rate is 0% (c) How much would Sally save and consume if the current income was $61,500? Sally will earn $61,500 this year and $40,500 next year. she can borrow or lend at this rate. She has no wealth at the start of this year and plans to finish next year having consumed everything, she possibly can. She would like to consume the same amount this year as next year. The inflation rate is 0% Now the real interest rate is 40%. d) How would Sally change savings and consumption if the real interest rate was 40%? (Hint: Choose the right option in the parentheses. To answer the question correctly, try to find the numerical solution first. Do not put a space in answers) Answer: Sally would save (more/less) because the substitution effect (dominates / is dominated by) the income effect. The substitution effect makes Sally saves (more / less) because a higher real interest rate, the price of one unit of current consumption, makes future consumption cheaper relative to current consumption. The income effect explains the rise in the real interest rate gives the person more income in the future period thus Sally (increases / decreases) both current consumption and future consumption

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started