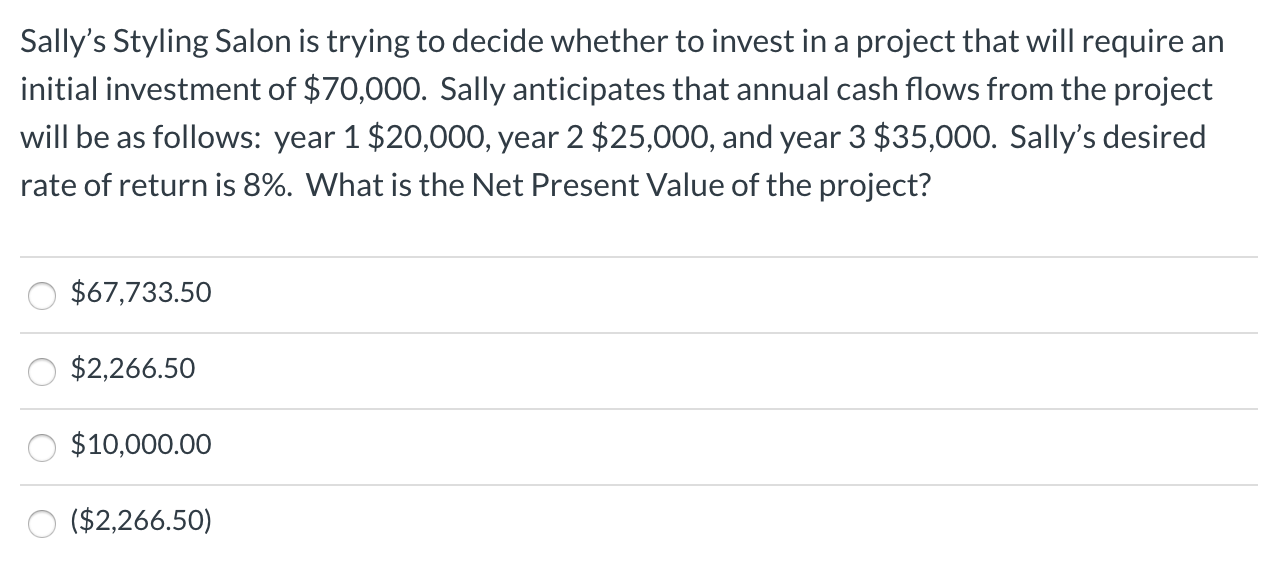

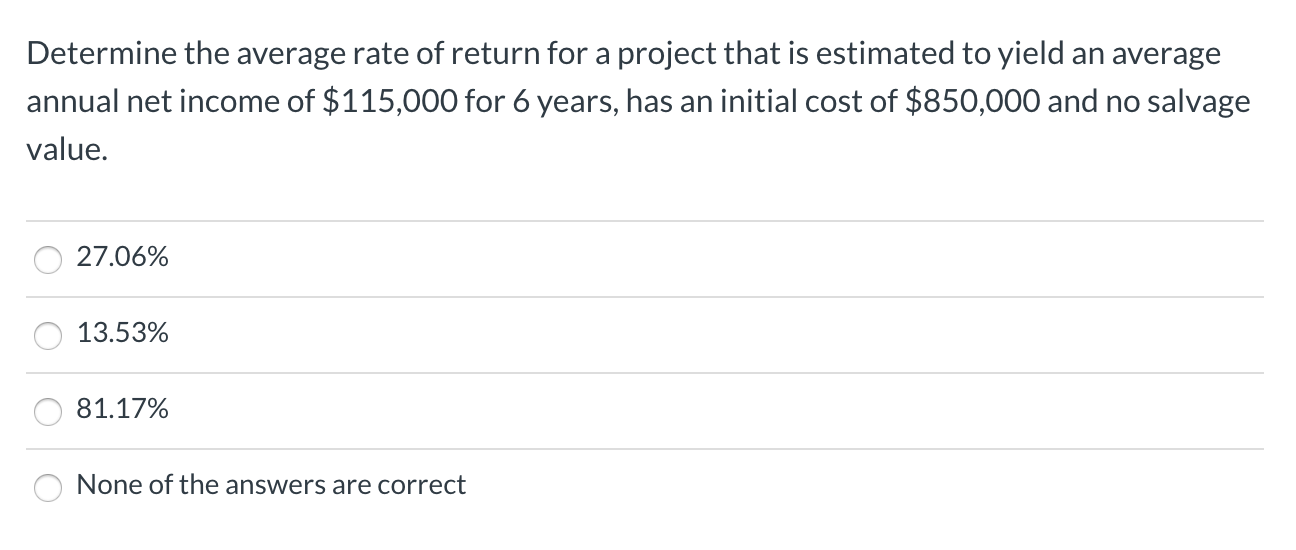

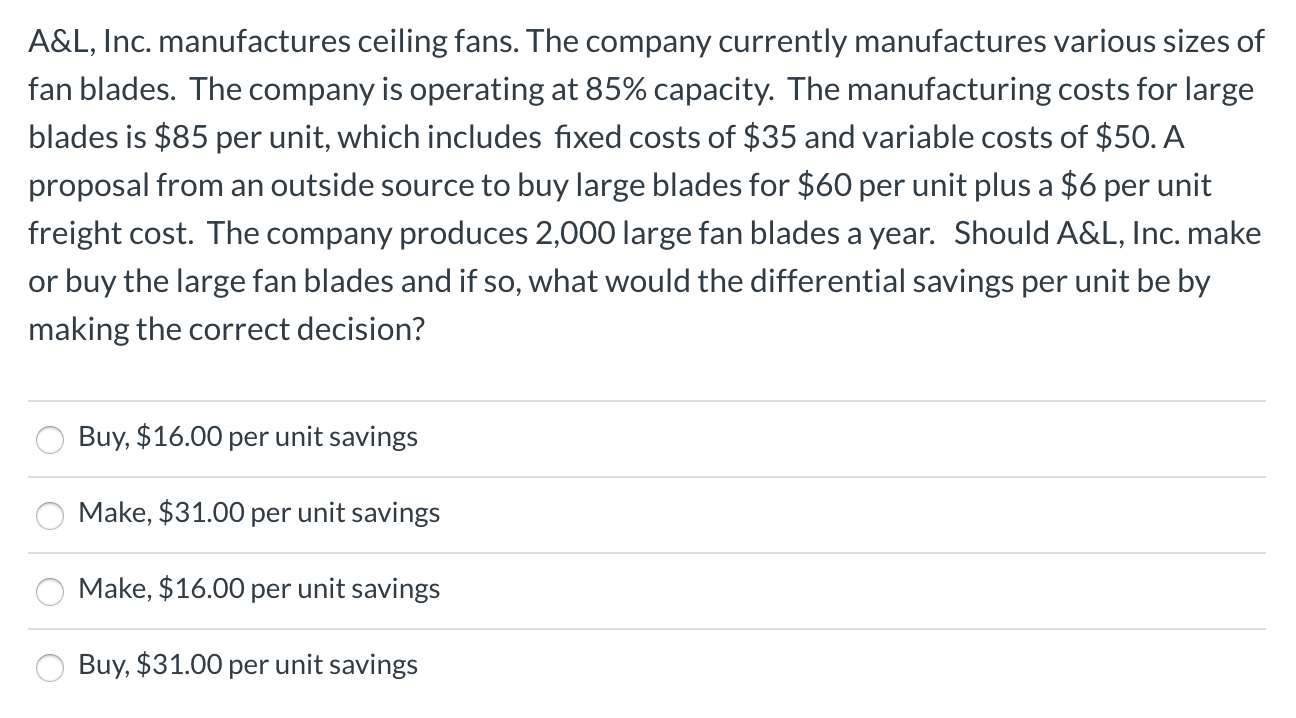

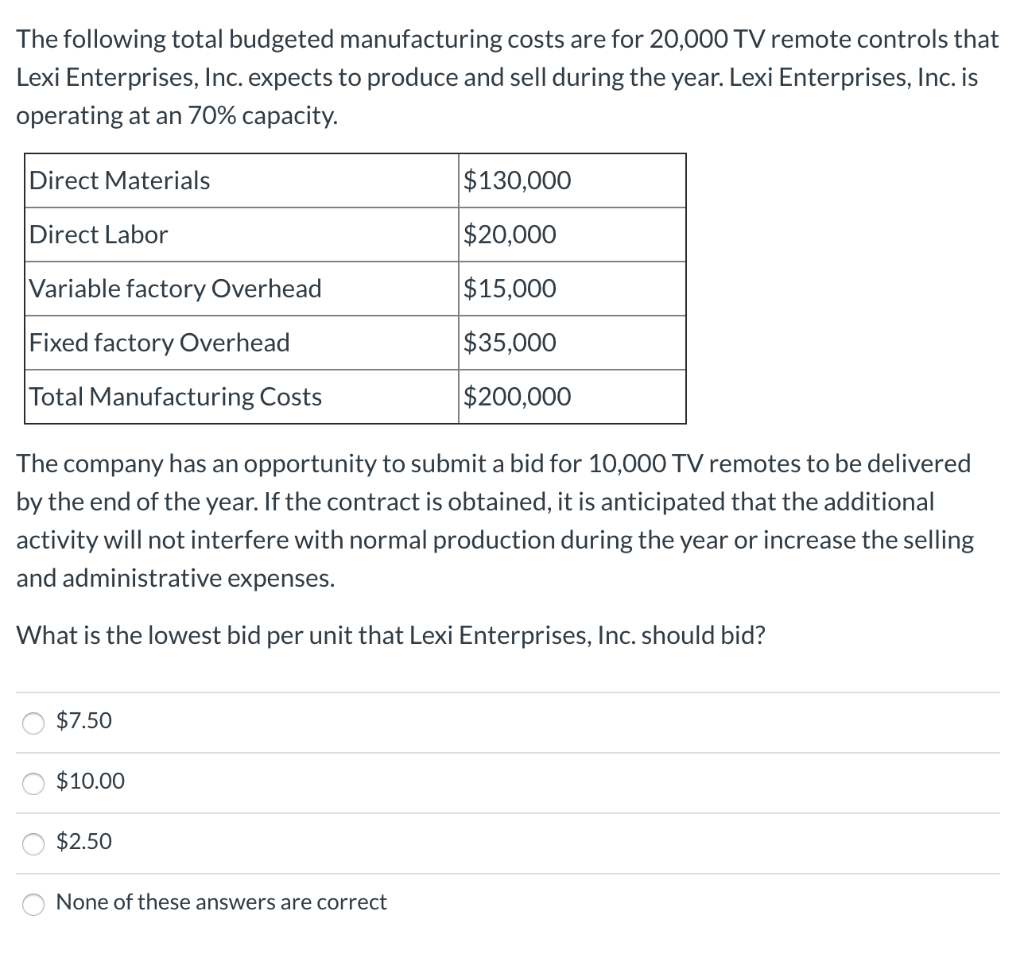

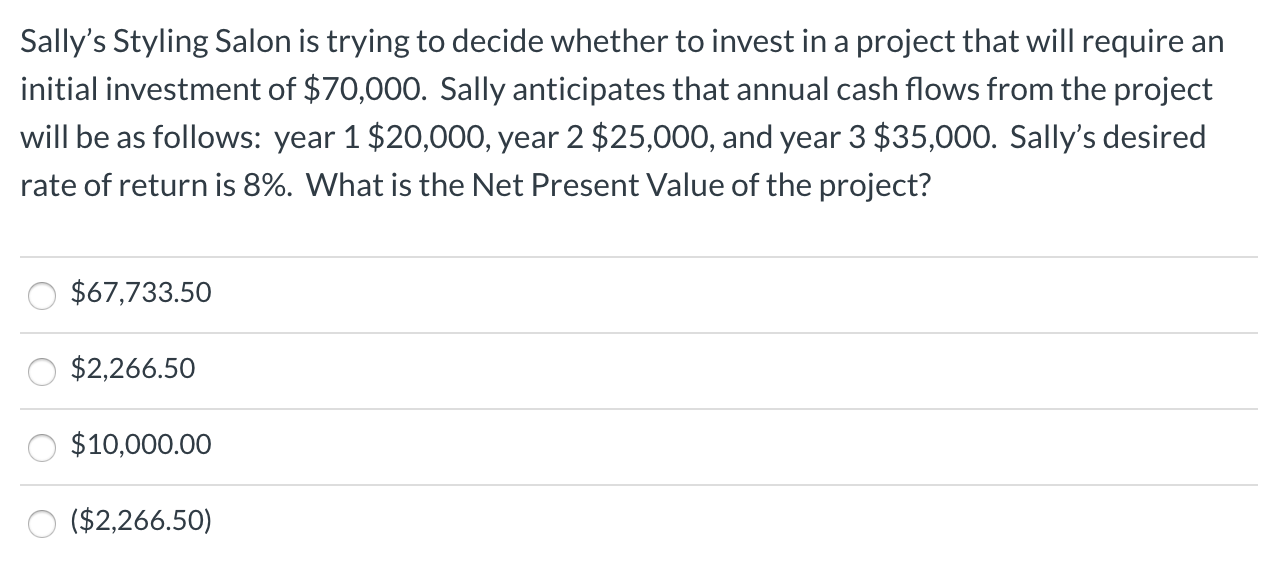

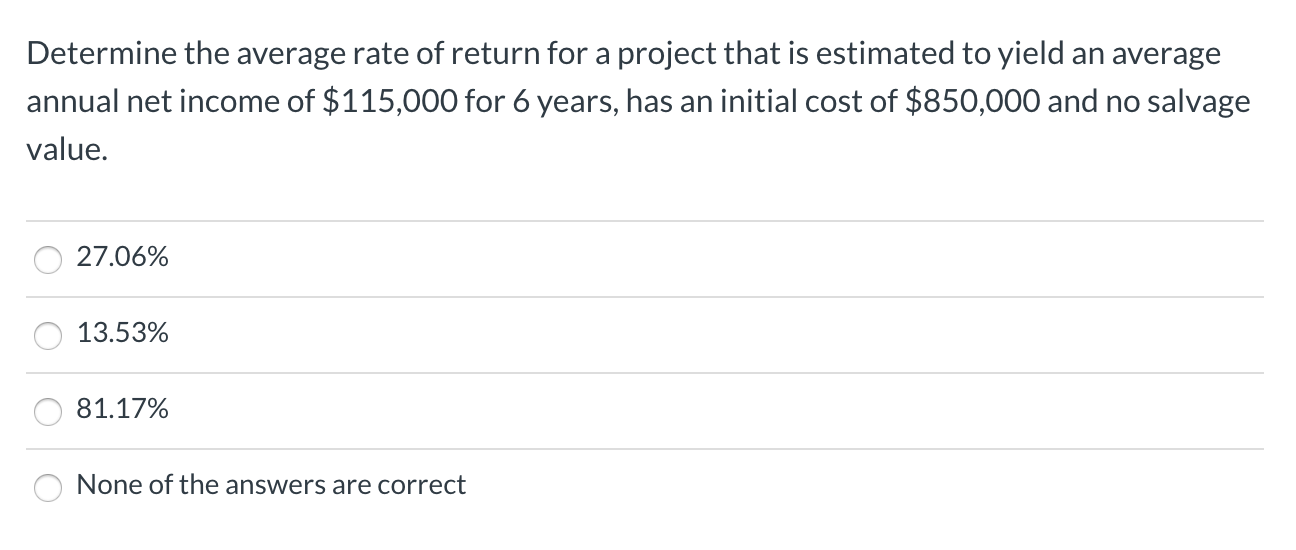

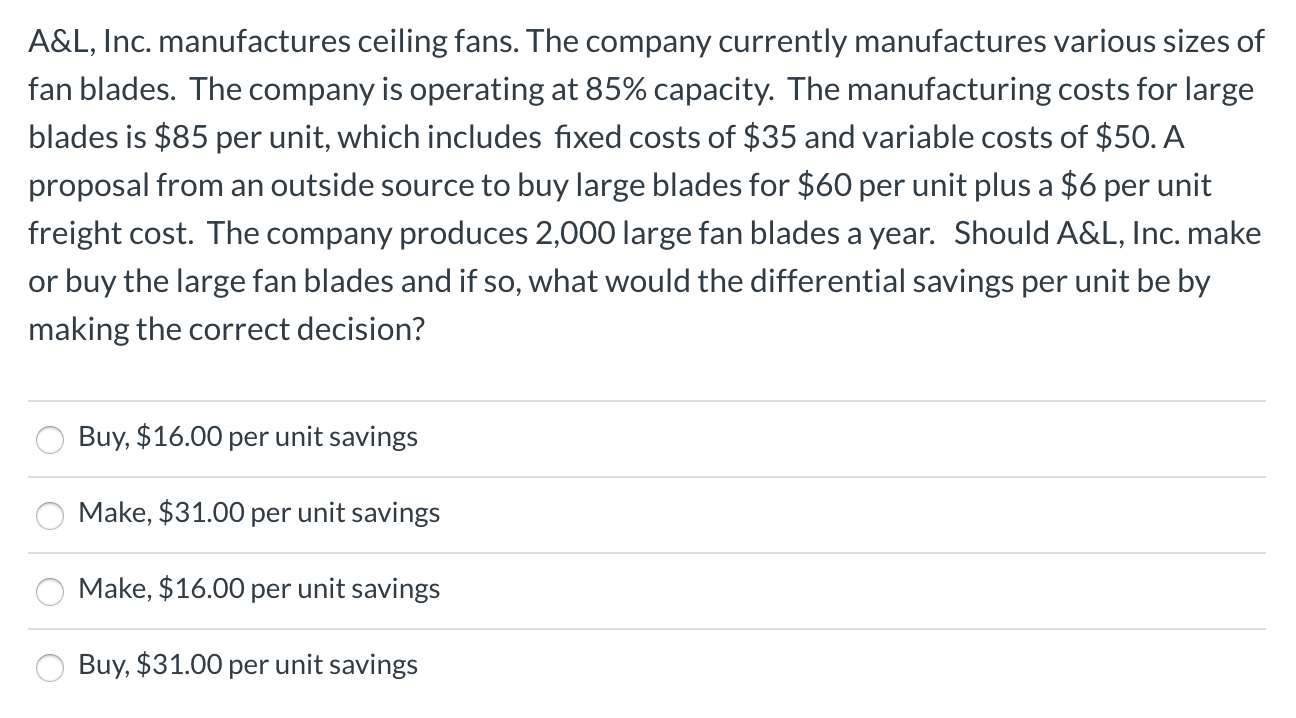

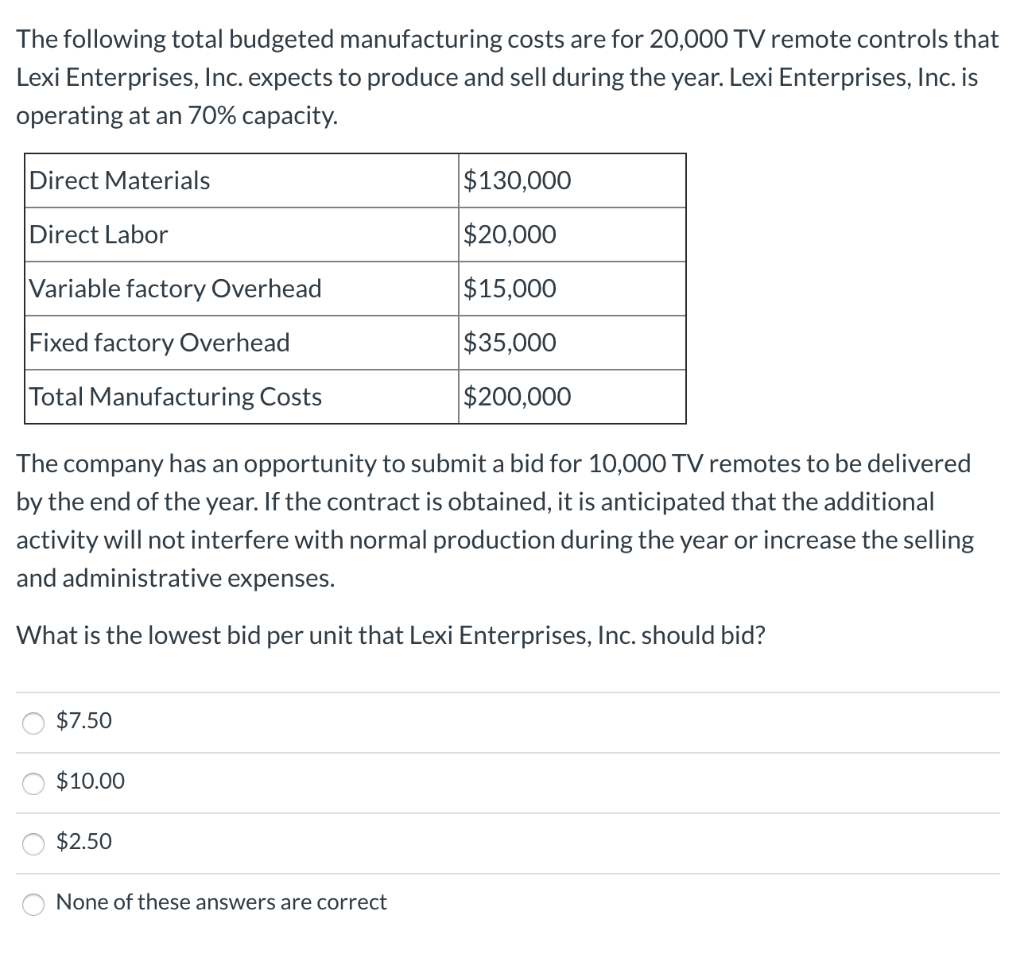

Sally's Styling Salon is trying to decide whether to invest in a project that will require an initial investment of $70,000. Sally anticipates that annual cash flows from the project will be as follows: year 1 $20,000, year 2 $25,000, and year 3 $35,000. Sally's desired rate of return is 8%. What is the Net Present Value of the project? 0 $67,733.50 0 $2,266.50 0 $10,000.00 O ($2,266.50) Determine the average rate of return for a project that is estimated to yield an average annual net income of $115,000 for 6 years, has an initial cost of $850,000 and no salvage value. 0 27.06% 0 13.53% 0 81.17% O None of the answers are correct A&L, Inc. manufactures ceiling fans. The company currently manufactures various sizes of fan blades. The company is operating at 85% capacity. The manufacturing costs for large blades is $85 per unit, which includes fixed costs of $35 and variable costs of $50. A proposal from an outside source to buy large blades for $60 per unit plus a $6 per unit freight cost. The company produces 2,000 large fan blades a year. Should A&L, Inc. make or buy the large fan blades and if so, what would the differential savings per unit be by making the correct decision? O Buy, $16.00 per unit savings 0 Make, $31.00 per unit savings O Make, $16.00 per unit savings O Buy, $31.00 per unit savings The following total budgeted manufacturing costs are for 20,000 TV remote controls that Lexi Enterprises, Inc. expects to produce and sell during the year. Lexi Enterprises, Inc. is operating at an 70% capacity. Direct Materials $130,000 Direct Labor $20,000 $15,000 Variable factory Overhead Fixed factory Overhead Total Manufacturing Costs $35,000 $200,000 The company has an opportunity to submit a bid for 10,000 TV remotes to be delivered by the end of the year. If the contract is obtained, it is anticipated that the additional activity will not interfere with normal production during the year or increase the selling and administrative expenses. What is the lowest bid per unit that Lexi Enterprises, Inc. should bid? $7.50 $10.00 O $2.50 None of these answers are correct