Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Salvador Pimenta, a teacher at Cambode High School (CHS) in Saskatchewan, provided the following financial information for 2020: Salvador had employment income of $65,000

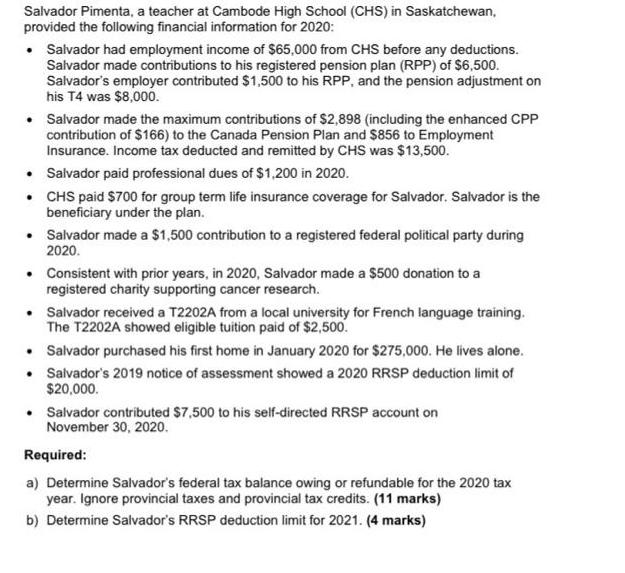

Salvador Pimenta, a teacher at Cambode High School (CHS) in Saskatchewan, provided the following financial information for 2020: Salvador had employment income of $65,000 from CHS before any deductions. Salvador made contributions to his registered pension plan (RPP) of $6,500. Salvador's employer contributed $1,500 to his RPP, and the pension adjustment on his T4 was $8,000. Salvador made the maximum contributions of $2,898 (including the enhanced CPP contribution of $166) to the Canada Pension Plan and $856 to Employment Insurance. Income tax deducted and remitted by CHS was $13,500. Salvador paid professional dues of $1,200 in 2020. . CHS paid $700 for group term life insurance coverage for Salvador. Salvador is the beneficiary under the plan. Salvador made a $1,500 contribution to a registered federal political party during 2020. Consistent with prior years, in 2020, Salvador made a $500 donation to a registered charity supporting cancer research. Salvador received a T2202A from a local university for French language training. The T2202A showed eligible tuition paid of $2,500. Salvador purchased his first home in January 2020 for $275,000. He lives alone. Salvador's 2019 notice of assessment showed a 2020 RRSP deduction limit of $20,000. Salvador contributed $7,500 to his self-directed RRSP account on November 30, 2020. Required: a) Determine Salvador's federal tax balance owing or refundable for the 2020 tax year. Ignore provincial taxes and provincial tax credits. (11 marks) b) Determine Salvador's RRSP deduction limit for 2021. (4 marks)

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a Salvadors federal tax balance owing for the 2020 tax year is 29...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started