Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sam, a 20-year-old graduate, has just found his first full-time job. An investment analyst suggests that he should try to have a substantial amount

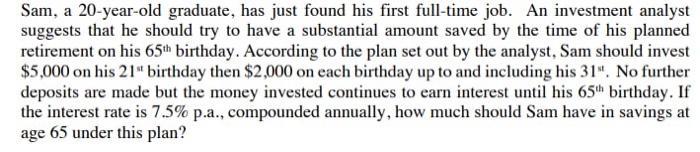

Sam, a 20-year-old graduate, has just found his first full-time job. An investment analyst suggests that he should try to have a substantial amount saved by the time of his planned retirement on his 65th birthday. According to the plan set out by the analyst, Sam should invest $5,000 on his 21st birthday then $2,000 on each birthday up to and including his 31". No further deposits are made but the money invested continues to earn interest until his 65th birthday. If the interest rate is 7.5% p.a., compounded annually, how much should Sam have in savings at age 65 under this plan?

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Heres how to calculate how much Sam will have in savings at age 65 1 Define vari...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started