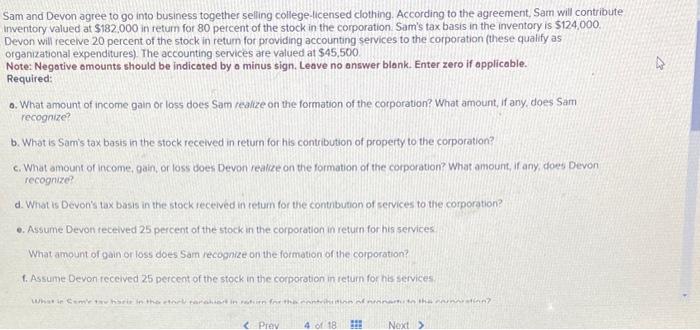

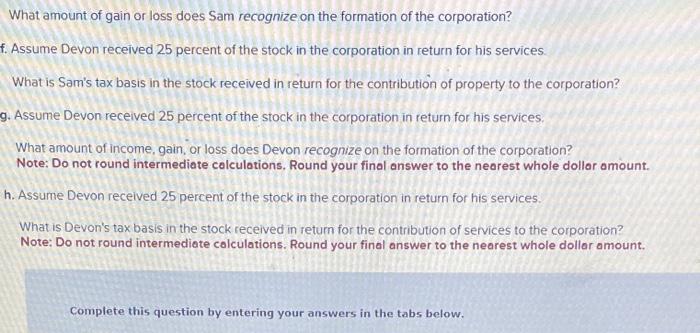

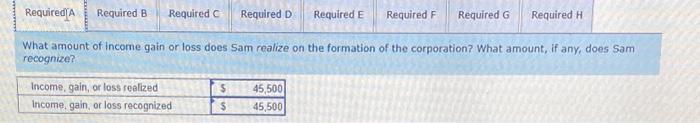

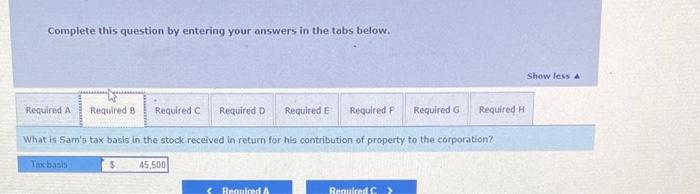

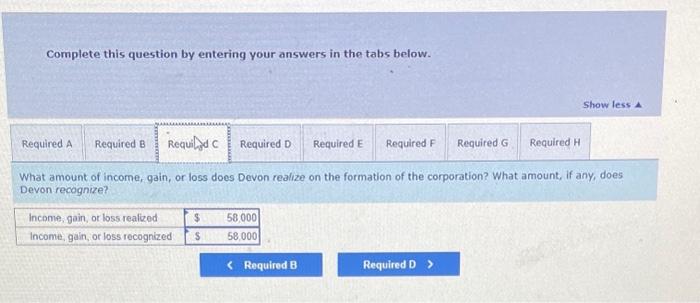

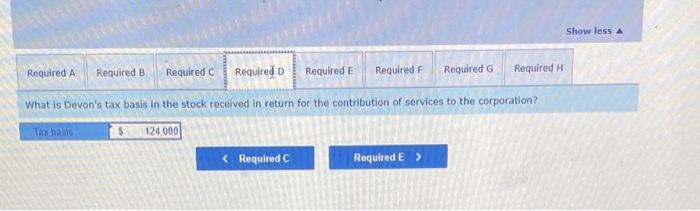

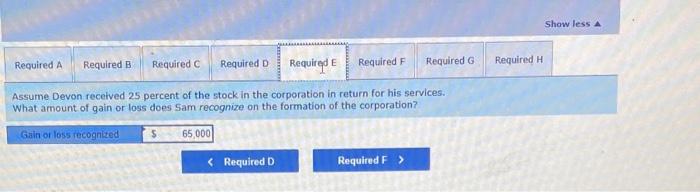

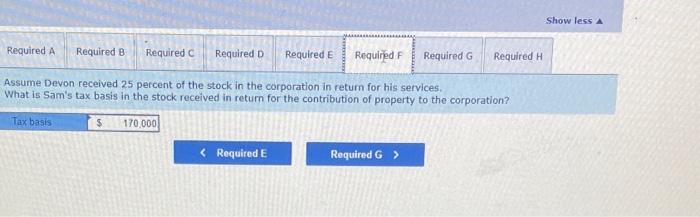

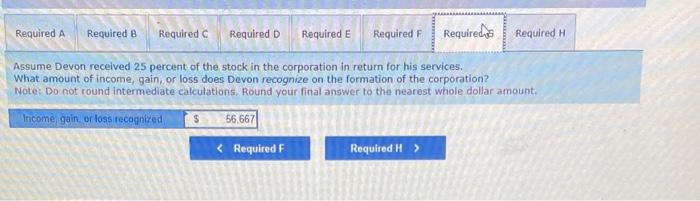

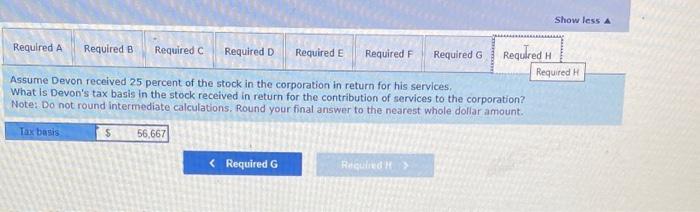

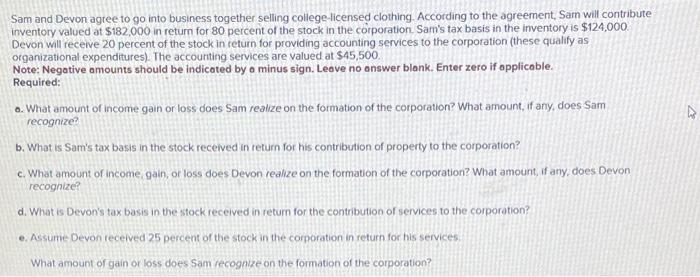

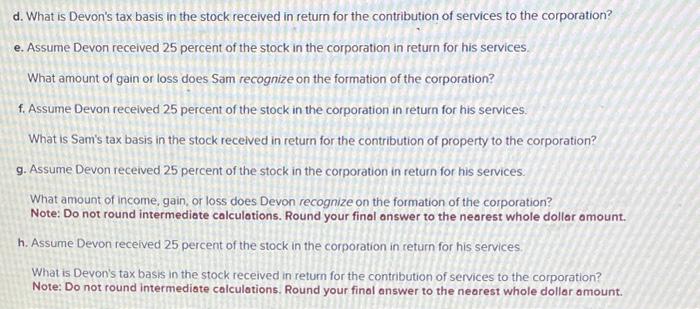

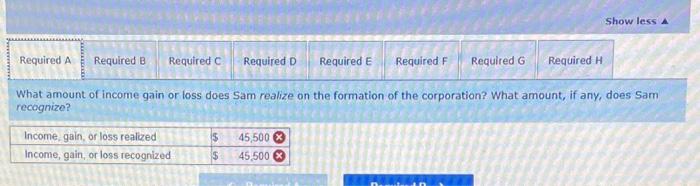

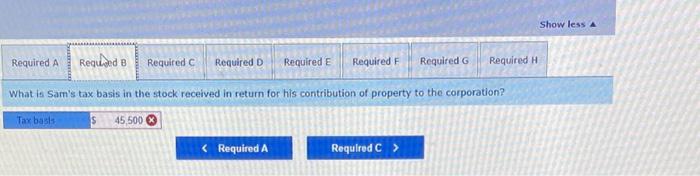

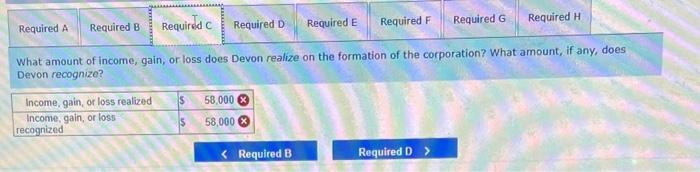

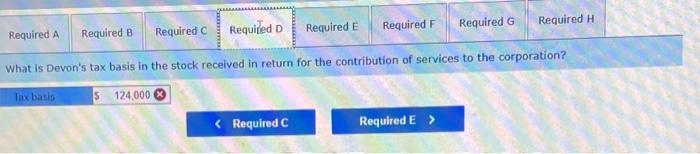

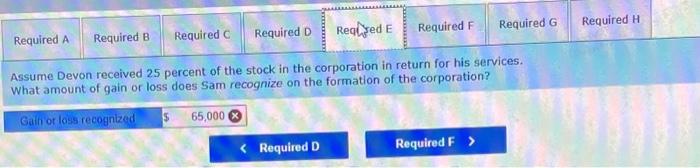

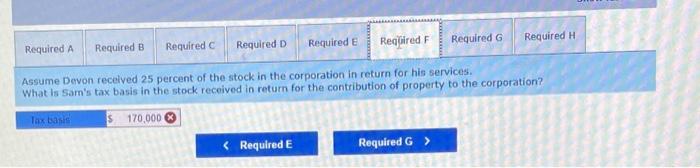

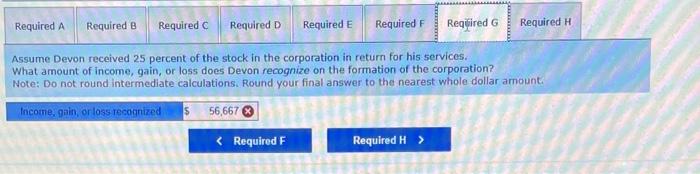

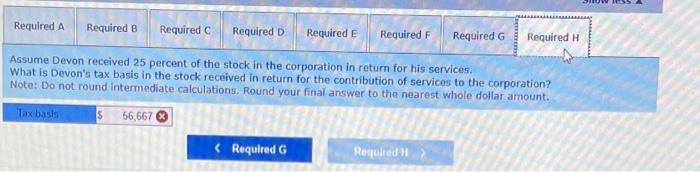

Sam and Devon agree to go into business together selling college-licensed clothing. According to the agreement, Sam will contribute inventory valued at $182.000 in retum for 80 percent of the stock in the corporation. Sam's tax basis in the inventory is $124,000. Devon will recelve 20 percent of the stock in return for providing accounting services to the corporation (these qualify as organizational expenditures). The accounting services are valued at $45,500 Note: Negative amounts should be indicated by o minus sign. Leave no onswer blank. Enter zero if applicable. Required: 0. What amount of income gain or loss does Sam realize on the formation of the corporation? What amount, if any. does Sam recognize? b. What is Sam's tax basis in the stock received in return for his contribution of property to the corporation? c. What amount of income, gain, of loss does Devon realize on the formation of the corporation? What amount, if any, does Devon recognize? d. What is Devon's tax basis in the stock recelved in ielum for the contribution of services to the corporation? e. Assume Devon received 25 percent of the stock in the corporation in return for his services: What amount of gain or loss does Sam recognize on the formation of the corporation? f. Assume Devon received 25 percent of the stock in the corporation in return for his services What amount of gain or loss does Sam recognize on the formation of the corporation? Assume Devon received 25 percent of the stock in the corporation in return for his services. What is Sam's tax basis in the stock received in return for the contribution of property to the corporation? Assume Devon received 25 percent of the stock in the corporation in return for his services. What amount of income, gain, or loss does Devon recognize on the formation of the corporation? Note: Do not round intermediate calculations, Round your final answer to the nearest whole dollar amount. h. Assume Devon received 25 percent of the stock in the corporation in return for his services, What is Devon's tax basis in the stock received in return for the contribution of services to the corporation? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount. What amount of income gain or loss does Sam cealize on the formation of the corporation? What amount, if any, does Sam recognize? Complete this question by entering your answers in the tabs below. What is Sam's tax basis in the stock received in retum for his contribution of property to the corporation? Complete this question by entering your answers in the tabs below. What amount of income, gain, or loss does Devon realize on the formation of the corporation? What amount, if any, does Devon recognize? What is Devon's tax basis in the stock received in return for the contribution of services to the corporation? Assume Devon recetved 25 percent of the stock in the corporation in return for his services. What amount of gain or loss does Sam recognize on the formation of the corporation? ssume Devon received 25 percent of the stock in the corporation in return for his services. That is Sam's tax basis in the stock received in retum for the contribution of property to the corporation? Assume Devon received 25 percent of the stock in the corporation in return for his services. What amount of income, gain, or loss does Devon recognize on the formation of the corporation? Note: Do not round intermediate calculations, Round your final answer to the nearest whole dollar amount. Assume Devon received 25 percent of the stock in the corporation in return for his services, What is Devon's tax basis in the stock received in return for the contribution of services to the corporation? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount. Sam and Devon agree to go into business together selling college-licensed clothing. According to the agreement, Sam will contribute inventory valued at $182,000 in return for 80 percent of the stock in the corporation. Sam's tax basis in the inventory is $124,000 Devon will receive 20 percent of the stock in return for providing accounting services to the corporation (these qualify as organizational expenditures). The accounting services are valued at $45,500. Note: Negative amounts should be indicated by o minus sign. Leove no answer blank. Enter zero if opplicable. Required: 0. What amount of income gain or loss does Sam realize on the formation of the corporation? What amount, if any, does Sam recognize? b. What is Sam's tax basis in the stock received in return for his contribution of property to the corporation? c. What amount of income gain, of loss does Devon realize on the formation of the corporation? What amount, if any, does Devon recognize? d. What is Devon's tax basis in the stock received in return for the contribution of services to the corporation? e. Assume Devon received 25 percent of the stock in the corporation in return for his services. What amount of gain or loss does Sam recognize on the formation of the corporation? d. What is Devon's tax basis in the stock received in return for the contribution of services to the corporation? e. Assume Devon received 25 percent of the stock in the corporation in return for his services. What amount of gain or loss does Sam recognize on the formation of the corporation? f. Assume Devon received 25 percent of the stock in the corporation in return for his services. What is Sam's tax basis in the stock recelved in return for the contribution of property to the corporation? g. Assume Devon received 25 percent of the stock in the corporation in return for his services: What amount of income, gain, or loss does Devon recognize on the formation of the corporation? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount. h. Assume Devon recelved 25 percent of the stock in the corporation in return for his services. What is Devon's tax basis in the stock received in return for the contribution of services to the corporation? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount. What amount of income gain or loss does Sam realize on the formation of the corporation? What amount, if any, does Sam recognize? What is Sam's tax basis in the stock received in return for his contribution of property to the corporation? What amount of income, gain, or loss does Devon realize on the formation of the corporation? What amount, if any, does Devon recognize? hat is Devon's tax basis in the stock received in retum for the contribution of services to the corporation? Assume Devon received 25 percent of the stock in the corporation in return for his services. What amount of gain or loss does Sam recognize on the formation of the corporation? issume Devon recelved 25 percent of the stock in the corporation in return for his services. What Is Sam's tax basis in the stock received in return for the contribution of property to the corporation? Nssume Devon received 25 percent of the stock in the corporation in return for his 5 ervicos. What amount of income, gain, or loss does Devon recognize on the formation of the corporation? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount. Assume Devon received 25 percent of the stock in the corporation in return for his services. What is Devon's tax basis in the stock received in return for the contribution of services to the corporation? Yote: Do not round intermediate calculations. Round your final answer to the nearest whole dollar amount