Answered step by step

Verified Expert Solution

Question

1 Approved Answer

sam and sue want to provide full funding for theor 5 year old daughter who will start college at 18. current annual cost of a

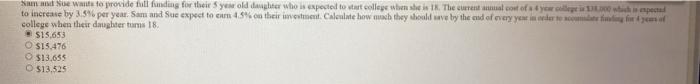

sam and sue want to provide full funding for theor 5 year old daughter who will start college at 18. current annual cost of a 4 year college js $38,000 which is expected to increase by 3.5% a year. sam and sue expect to earn 4.5% on their investment. calculate how much money they should save by the end of every year in order to have enough funding for four years of college when their daughter turns 18

am Newasto provide full funding for their Syes old who is expected to art college whes I. The cost of your schepeal to increase by 5% per year. Sam and Sue expect to em 45% their investment Calentate how much they should we by the end of every year to com college when their daughtertums 18. $15.633 O $15.476 O $13.655 O $13.525 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started