Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sam is a self-employed hairdresser in her late 30s and is investing toward retirement. She has moderate risk tolerance and is in a low

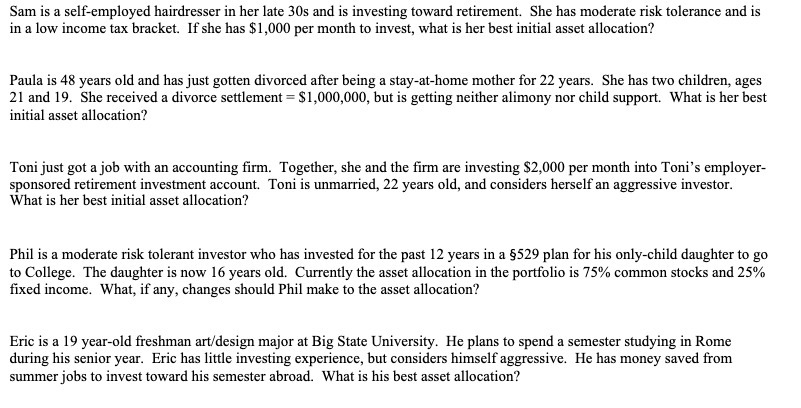

Sam is a self-employed hairdresser in her late 30s and is investing toward retirement. She has moderate risk tolerance and is in a low income tax bracket. If she has $1,000 per month to invest, what is her best initial asset allocation? Paula is 48 years old and has just gotten divorced after being a stay-at-home mother for 22 years. She has two children, ages 21 and 19. She received a divorce settlement = $1,000,000, but is getting neither alimony nor child support. What is her best initial asset allocation? Toni just got a job with an accounting firm. Together, she and the firm are investing $2,000 per month into Toni's employer- sponsored retirement investment account. Toni is unmarried, 22 years old, and considers herself an aggressive investor. What is her best initial asset allocation? Phil is a moderate risk tolerant investor who has invested for the past 12 years in a 529 plan for his only-child daughter to go to College. The daughter is now 16 years old. Currently the asset allocation in the portfolio is 75% common stocks and 25% fixed income. What, if any, changes should Phil make to the asset allocation? Eric is a 19 year-old freshman art/design major at Big State University. He plans to spend a semester studying in Rome during his senior year. Eric has little investing experience, but considers himself aggressive. He has money saved from summer jobs to invest toward his semester abroad. What is his best asset allocation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Determining the best asset allocation for each individual depends on various factors such as age risk tolerance financial goals and time horizon Howev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started