Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sam wants to start a small commercial bakery to supply gourmet deserts to local restaurants. He believes that with his product line and his

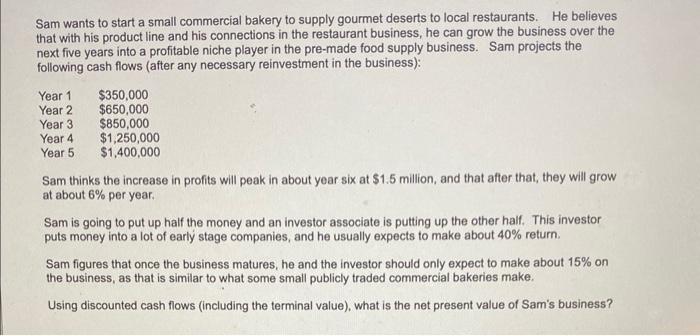

Sam wants to start a small commercial bakery to supply gourmet deserts to local restaurants. He believes that with his product line and his connections in the restaurant business, he can grow the business over the next five years into a profitable niche player in the pre-made food supply business. Sam projects the following cash flows (after any necessary reinvestment in the business): Year 1 Year 2 Year 3 Year 4 Year 5 $350,000 $650,000 $850,000 $1,250,000 $1,400,000 Sam thinks the increase in profits will peak in about year six at $1.5 million, and that after that, they will grow at about 6% per year. Sam is going to put up half the money and an investor associate is putting up the other half. This investor puts money into a lot of early stage companies, and he usually expects to make about 40% return. Sam figures that once the business matures, he and the investor should only expect to make about 15% on the business, as that is similar to what some small publicly traded commercial bakeries make. Using discounted cash flows (including the terminal value), what is the net present value of Sam's business?

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the net present value NPV of Sams business we need to discount the projected cash flows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started