Question

Samantha owns a partnership interest in Sky Partnership. Immediately before she receives a proportionate non liquidating distribution from Sky Partnership, the basis of her

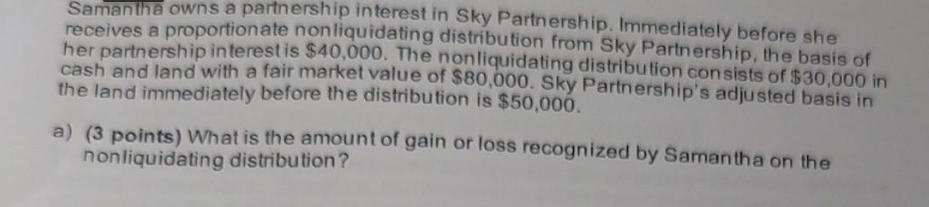

Samantha owns a partnership interest in Sky Partnership. Immediately before she receives a proportionate non liquidating distribution from Sky Partnership, the basis of her partnership interest is $40,000. The nonliquidating distribution consists of $30,000 in cash and land with a fair market value of $80,000. Sky Partnership's adjusted basis in the land immediately before the distribution is $50,000. a) (3 points) What is the amount of gain or loss recognized by Samantha on the nonliquidating distribution? b) (3 points) What is Samantha's remaining basis in her partnership interest? c) (3 points) What basis does Samantha take in the distributed assets?

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the amount of gain or loss recognized by Samantha on the nonliquidating distribution ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South Western Federal Taxation 2016 Corporations Partnerships Estates And Trusts

Authors: James Boyd, William Hoffman, Raabe, David Maloney, Young

39th Edition

978-1305399884

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App