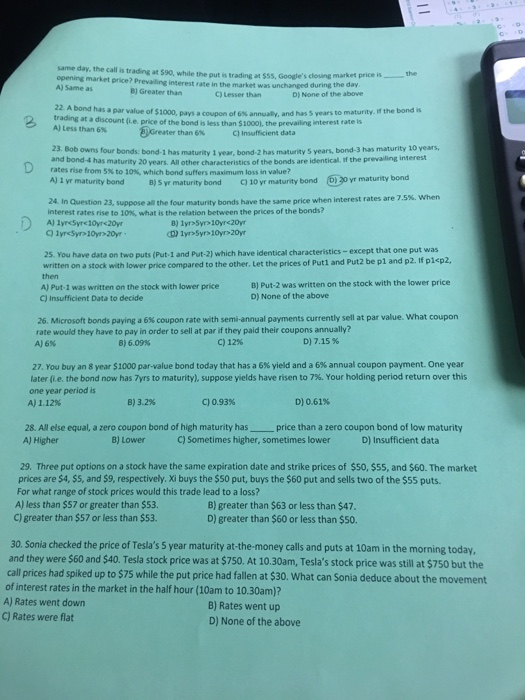

same day, the calis trading at $90, while the put is trading at sss opening market price? Prevailing interest A) Same as $55, Google's closing market price is rate in the market was unchanged during the day B) Greater than C) Lesser than D) None of the above 22 Abond has a par value of $1000, pays a coupon of 6% annually, and has 5 years to maturity." the at a discount (i.e price of bond is trading at a discount (ie price of the bond is less than $1000), the prevailing interest rate is than 6% A)Less than 6% C) Insufficient data Bob owns four bonds: bond-1 has maturity 1 year, bond-Z has maturity 5 years, bond-3 has AJ 1 yr maturity bond B)Syr maturity bond C3 10 yr maturity bond b)20 vr maturity bond 24. In Question 23, suppose all the four maturity bonds have the same price maturity 10 years, and bond-4 has maturity 20 years. All other characteristics of the bonds are identical, if the prevailing interest rates rise from 5% to 10%, which bond suffers maximum loss in value? when interest rates are 7.5%, when interest rates rise to 10% what is the relation between the prices of the bonds? 25. You have data on two puts (Put-1 and Put-2) which have identical characteristics- except that one put was written on a stock with lower price compared to the other. Let the prices of Putl and Put2 be p1 and p2. f plep2, then B] Put-2 was written on the stock with the lower price D) None of the above A) Put-1 was written on the stock with lower price C) Insufficient Data to decide 26, Microsoft bonds paying a 6% coupon rate with semi-annual payments currently sell at par value. what coupon rate would they have to pay in order to sell at par if they paid their coupons annually? A) 6% 6) 6.09% C)12% D) 7.15 % 27, You buy an 8 year S1000 par-value bond today that has a 6% yield and a 6% annual coupon payment. One year later (ie, the bond now has 7yrs to maturity), suppose yields have risen to 7%. Your holding period return over this one year period is A) 1.12% B) 3.2% C) 0.93% D) 0.61% 28. All else equal, a zero coupon bond of high maturity hasprice than a zero coupon bond of low maturity A) Higher B) Lower C) Sometimes higher, sometimes lower D) Insufficient data 29. Three put options on a stock have the same expiration date and strike prices of $50, $55, and $60. The market prices are $4, s5, and $9, respectively. Xi buys the $50 put, buys the $60 put and sells two of the $55 puts. For what range of stock prices would this trade lead to a loss? A) less than $57 or greater than $53. C) greater than $57 or less than $53. B) greater than $63 or less than $47. D) greater than $60 or less than $50. 30. Sonia checked the price of Tesla's 5 year maturity at-the-money calls and puts at 10am in the morning today, and they were $60 and $40. Tesla stock price was at $750. At 10.30am, Tesla's stock price was still at $750 but the call prices had spiked up to $75 while the put price had fallen at $30. What can Sonia deduce about the movement of interest rates in the market in the half hour (10am to 10.30am)? A) Rates went down B) Rates went up D) None of the above C) Rates were flat