Answered step by step

Verified Expert Solution

Question

1 Approved Answer

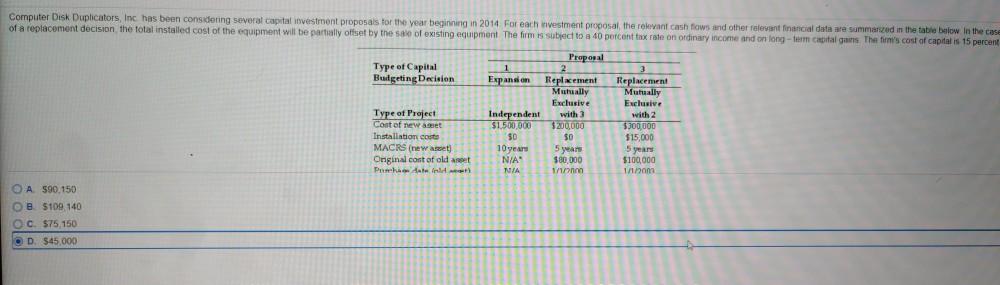

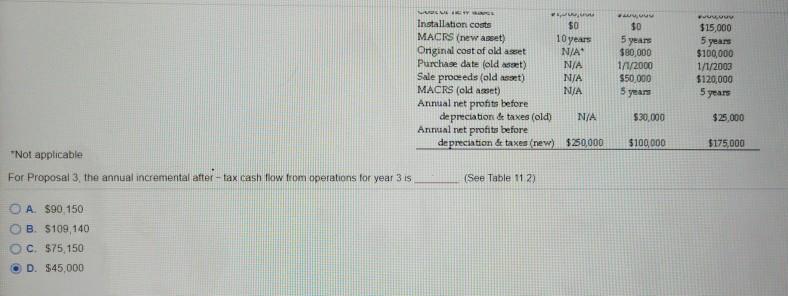

SAME QUESTION, JUST 2 pictures 15 percent Computer Disk Duplicators, Inc has been considering several capital investment proposals for the year beginning in 2014 For

SAME QUESTION, JUST 2 pictures

15 percent Computer Disk Duplicators, Inc has been considering several capital investment proposals for the year beginning in 2014 For each investment proposal the relevant cash flows and other relevant financial data are summarized in the table below in the case of a replacement decision the total installed cost of the equipment will be partially offset by the sale of existing equipment The firm is subject to a 40 percentax rate on ordinary income and on long-term capital gains. The firm's cost of capital is Proposal Type of Capital 1 2 Budgeting Decision Expansion Replacement Replacement Mutually Mutually Exclusive Exclusive Type of Project Independent with 3 3 with 2 2 Coat of new amet $1.500.000 $200,000 $300,000 Installation costo $0 $0 $ $15,000 MACRS (new) 10 year 5 years 5 years Onginal cost of old at N/A $80,000 $100,000 Perhat NIA 1/10 1/12 A 590,150 OB $109, 140 O $75,150 OD $45.000 FUVUV VIEWS www Installation costs $0 MACRS (new asset) 10 years Onginal cost of old asset N/A Purchase date (old asset) N/A Sale proceeds (old asset) N/A MACRS (old asset) N/A Annual net profits before depreciation de taxes (old) N/A. Annual net profits before depreciation & taxes (new) $250,000 $0 5 years $80,000 1/1/2000 $50,000 5 year $15,000 5 years $100,000 1/1/2003 $120,000 5 years $30,000 $25,000 $100,000 $175,000 "Not applicable For Proposal 3, the annual incremental after-tax cash flow from operations for year 3 is (See Table 112) O A $90 150 B. $109,140 c. $75,150 D. $45,000 15 percent Computer Disk Duplicators, Inc has been considering several capital investment proposals for the year beginning in 2014 For each investment proposal the relevant cash flows and other relevant financial data are summarized in the table below in the case of a replacement decision the total installed cost of the equipment will be partially offset by the sale of existing equipment The firm is subject to a 40 percentax rate on ordinary income and on long-term capital gains. The firm's cost of capital is Proposal Type of Capital 1 2 Budgeting Decision Expansion Replacement Replacement Mutually Mutually Exclusive Exclusive Type of Project Independent with 3 3 with 2 2 Coat of new amet $1.500.000 $200,000 $300,000 Installation costo $0 $0 $ $15,000 MACRS (new) 10 year 5 years 5 years Onginal cost of old at N/A $80,000 $100,000 Perhat NIA 1/10 1/12 A 590,150 OB $109, 140 O $75,150 OD $45.000 FUVUV VIEWS www Installation costs $0 MACRS (new asset) 10 years Onginal cost of old asset N/A Purchase date (old asset) N/A Sale proceeds (old asset) N/A MACRS (old asset) N/A Annual net profits before depreciation de taxes (old) N/A. Annual net profits before depreciation & taxes (new) $250,000 $0 5 years $80,000 1/1/2000 $50,000 5 year $15,000 5 years $100,000 1/1/2003 $120,000 5 years $30,000 $25,000 $100,000 $175,000 "Not applicable For Proposal 3, the annual incremental after-tax cash flow from operations for year 3 is (See Table 112) O A $90 150 B. $109,140 c. $75,150 D. $45,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started