Samir Sarkov incorporated Carla Vista Security Services and began operations on January 1, 2024. After a busy year, Samir thinks his business has done

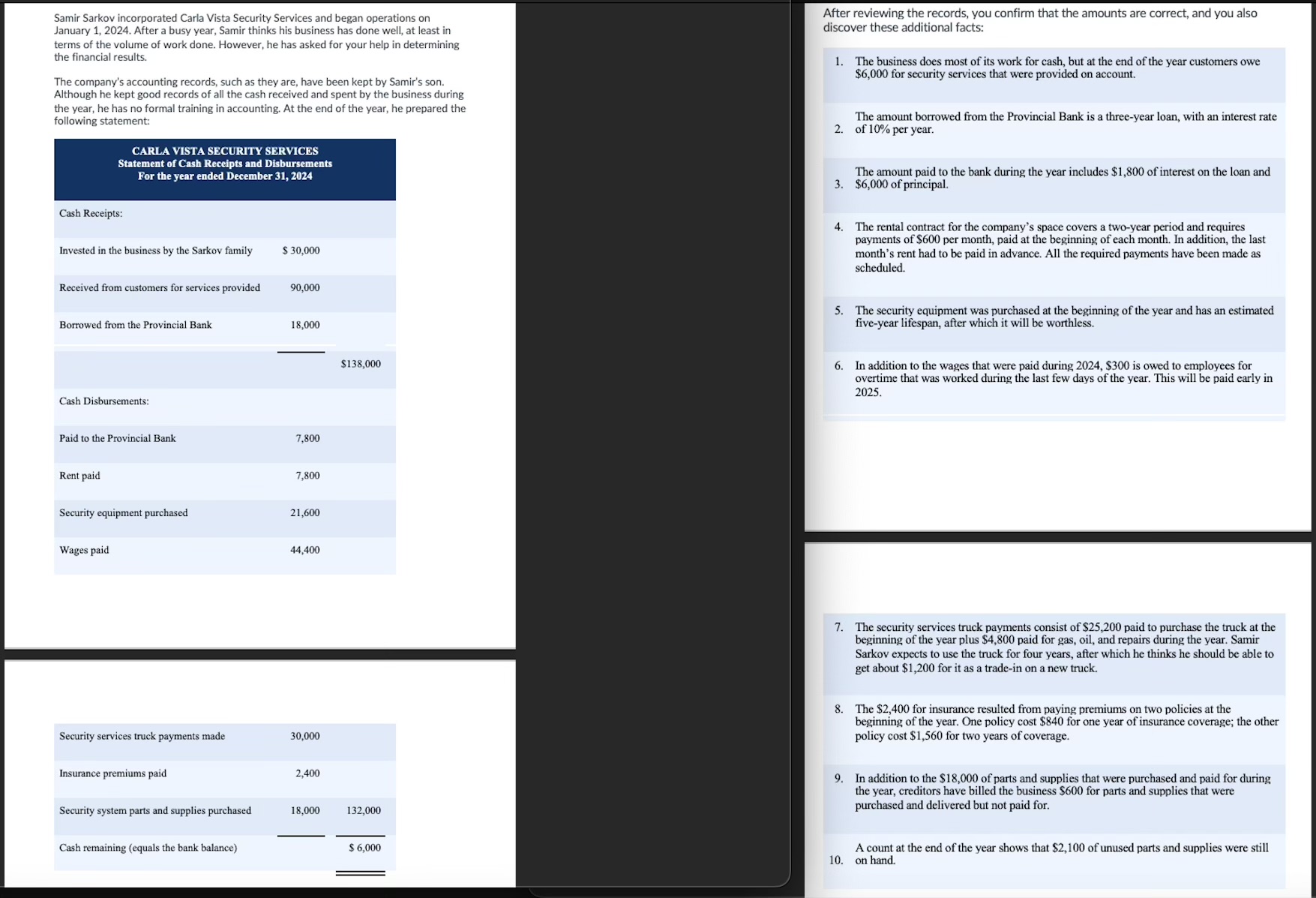

Samir Sarkov incorporated Carla Vista Security Services and began operations on January 1, 2024. After a busy year, Samir thinks his business has done well, at least in terms of the volume of work done. However, he has asked for your help in determining the financial results. The company's accounting records, such as they are, have been kept by Samir's son. Although he kept good records of all the cash received and spent by the business during the year, he has no formal training in accounting. At the end of the year, he prepared the following statement: CARLA VISTA SECURITY SERVICES Statement of Cash Receipts and Disbursements For the year ended December 31, 2024 Cash Receipts: Invested in the business by the Sarkov family $ 30,000 Received from customers for services provided 90,000 After reviewing the records, you confirm that the amounts are correct, and you also discover these additional facts: 1. The business does most of its work for cash, but at the end of the year customers owe $6,000 for security services that were provided on account. The amount borrowed from the Provincial Bank is a three-year loan, with an interest rate 2. of 10% per year. The amount paid to the bank during the year includes $1,800 of interest on the loan and 3. $6,000 of principal. 4. The rental contract for the company's space covers a two-year period and requires payments of $600 per month, paid at the beginning of each month. In addition, the last month's rent had to be paid in advance. All the required payments have been made as scheduled. Borrowed from the Provincial Bank Cash Disbursements: 18,000 Paid to the Provincial Bank 7,800 Rent paid 7,800 Security equipment purchased 21,600 Wages paid 44,400 $138,000 5. The security equipment was purchased at the beginning of the year and has an estimated five-year lifespan, after which it will be worthless. 6. In addition to the wages that were paid during 2024, $300 is owed to employees for overtime that was worked during the last few days of the year. This will be paid early in 2025. Security services truck payments made 30,000 Insurance premiums paid 2,400 Security system parts and supplies purchased 18,000 132,000 Cash remaining (equals the bank balance) $6,000 7. The security services truck payments consist of $25,200 paid to purchase the truck at the beginning of the year plus $4,800 paid for gas, oil, and repairs during the year. Samir Sarkov expects to use the truck for four years, after which he thinks he should be able to get about $1,200 for it as a trade-in on a new truck. 8. The $2,400 for insurance resulted from paying premiums on two policies at the beginning of the year. One policy cost $840 for one year of insurance coverage; the other policy cost $1,560 for two years of coverage. 9. In addition to the $18,000 of parts and supplies that were purchased and paid for during the year, creditors have billed the business $600 for parts and supplies that were purchased and delivered but not paid for. A count at the end of the year shows that $2,100 of unused parts and supplies were still 10. on hand.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To assist with the financial assessment lets analyze the information provided in the statement of cash receipts and disbursements along with the addit...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started