Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Harry's Seafood is considering the addition of a fish hatchery. Construction of the facility is estimated to cost $1,100,000 and will be depreciated over

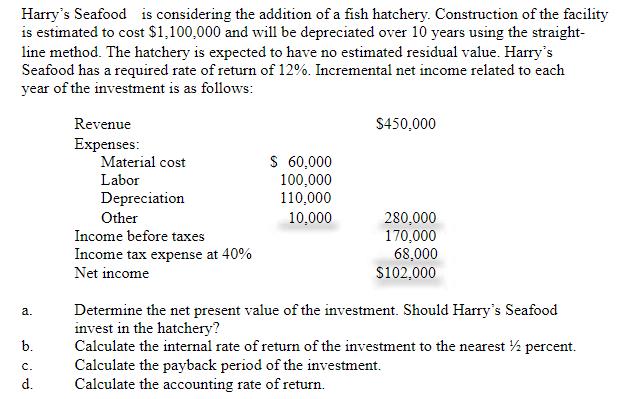

Harry's Seafood is considering the addition of a fish hatchery. Construction of the facility is estimated to cost $1,100,000 and will be depreciated over 10 years using the straight- line method. The hatchery is expected to have no estimated residual value. Harry's Seafood has a required rate of return of 12%. Incremental net income related to each year of the investment is as follows: a. b. C. d. Revenue Expenses: Material cost Labor Depreciation Other Income before taxes Income tax expense at 40% Net income $ 60,000 100,000 110,000 10,000 $450,000 280,000 170,000 68,000 $102,000 Determine the net present value of the investment. Should Harry's Seafood invest in the hatchery? Calculate the internal rate of return of the investment to the nearest percent. Calculate the payback period of the investment. Calculate the accounting rate of return.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a b C d The company should invest in the hatchery because the investment will generate a r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started