Answered step by step

Verified Expert Solution

Question

1 Approved Answer

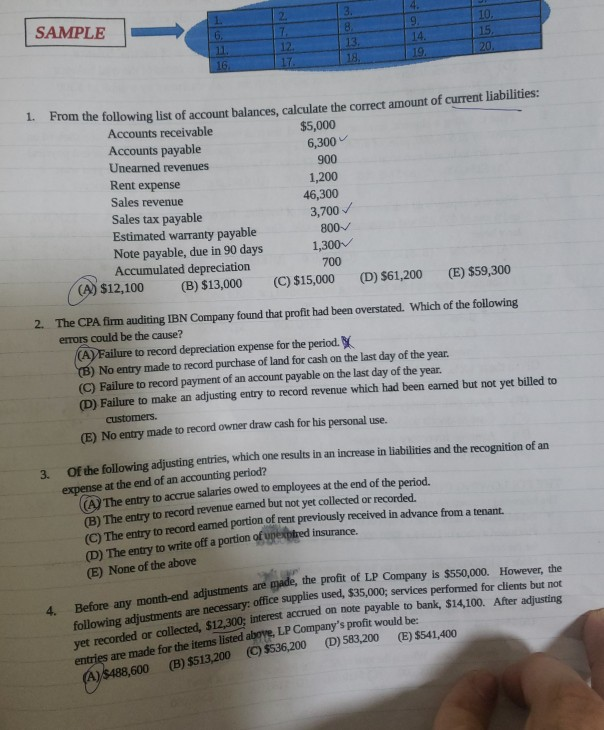

SAMPLE 20. From the following list of account balances calculate the correct amount of current liabilities: Accounts receivable $5,000 Accounts payable 6,300 Unearned revenues 900

SAMPLE 20. From the following list of account balances calculate the correct amount of current liabilities: Accounts receivable $5,000 Accounts payable 6,300 Unearned revenues 900 Rent expense 1,200 Sales revenue 46,300 Sales tax payable 3,700 Estimated warranty payable 8007 Note payable, due in 90 days 1,300 Accumulated depreciation 700 (A) $12,100 (B) $13,000 (C) $15,000 (D) $61,200 (E) $59,300 2. The CPA firm auditing IBN Company found that profit had been overstated. Which of the following errors could be the cause? (A) Failure to record depreciation expense for the period. (B) No entry made to record purchase of land for cash on the last day of the year. (C) Failure to record payment of an account payable on the last day of the year. (D) Failure to make an adjusting entry to record revenue which had been earned but not yet billed to customers. (E) No entry made to record owner draw cash for his personal use. following adjusting entries, which one results in an increase in liabilities and the recognition of an expense at the end of an accounting period? A The entry to accrue salaries owed to employees at the end of the period. (B) The entry to record revenue eamed but not yet collected or recorded. record earned portion of rent previously received in advance from a tenant. (D) The entry to write off a portion of unexptred insurance. (E) None of the above ments are made, the profit of LP Company is $550,000. However, the necessary: office supplies used, $35,000, services performed for clients but not interest accrued on note payable to bank, $14,100. After adjusting Before any month-end adjustments are made, the profit of LP Cor following adjustments are necessary: office supplies used, $35,000; servic yet recorded or collected, $12,300; interest accrued on note payable to hand entries are made for the items listed above, LP Company's profit would be (A) $488,600 (B) $513,200 $536,200 (D) 583,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started