sample answer for this question to help for studies

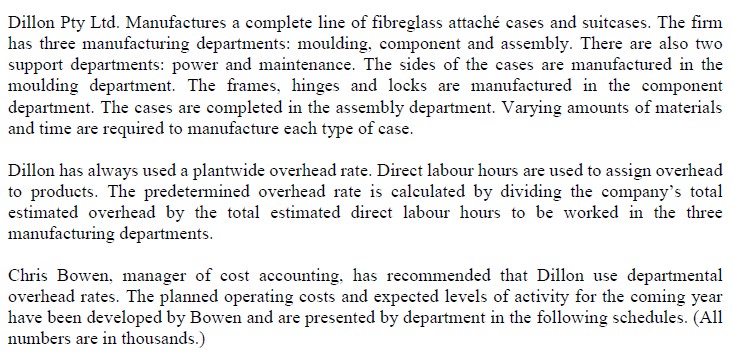

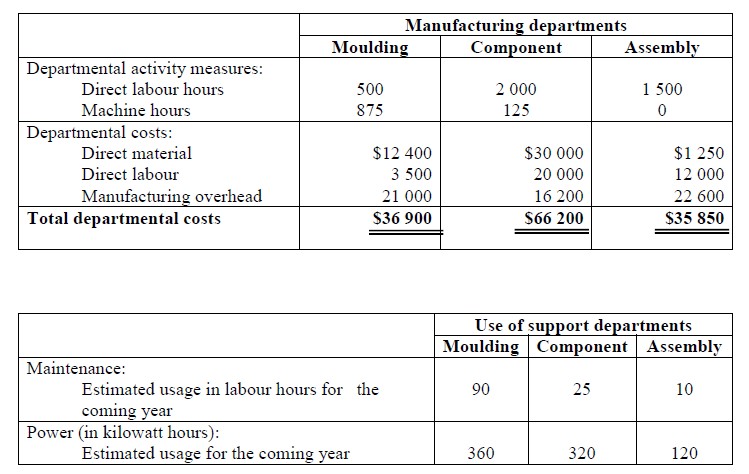

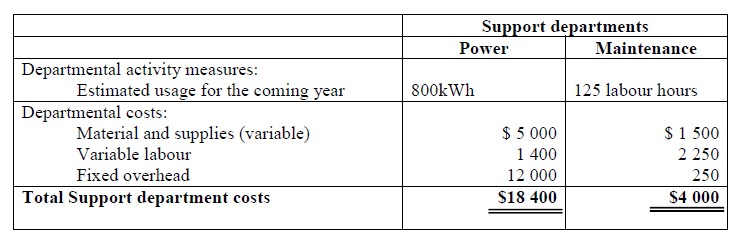

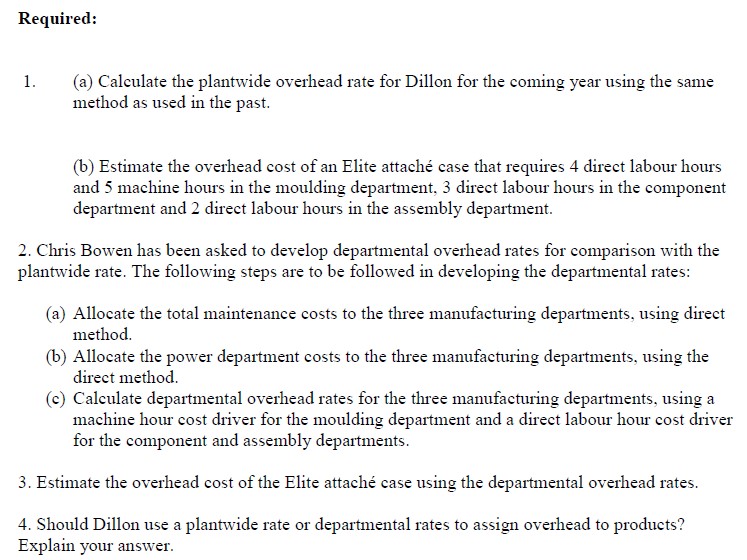

Dillon Pty Ltd. Manufactures a complete line of breglass attache cases and suitcases. The rm has three manufacturing departments: moulding= component and assembly. There are also two support departments: power and maintenance. The sides of the cases are manufactured in the moulding department. The frames. hinges and locks are manufactured in the component department. The cases are completed in the assembly department. Varying amounts of materials and time are required to manufacture each type of case. Dillon has always used a plantwide overhead rate. Direct labour hours are used to assign overhead to products. The predetermined overhead rate is calculated by dividing the company's total estimated overhead by the total estimated direct labour hours to be worked in the three manufacturing departments. Chris Bowen= manager of cost accounting, has recommended that Dillon use departmental overhead rates. The planned operating costs and expected levels of activity for the coming year have been developed by Bowen and are presented by department in the following schedules. (All ntunbers are in thousands.) Manufacturing departments Moulding Component Assembly Departmental activity measures: Direct labour hours 500 2 000 1 500 Machine hours 875 125 0 Departmental costs: Direct material $12 400 $30 000 $1 250 Direct labour 3 500 20 000 12 000 Manufacturing overhead 21 000 16 200 22 600 Total departmental costs $36 900 $66 200 $35 850 Use of support departments Moulding Component Assembly Maintenance: Estimated usage in labour hours for the 90 25 10 coming year Power (in kilowatt hours): Estimated usage for the coming year 360 320 120Support departments Power Maintenance Departmental activity measures: Estimated usage for the coming year 800kWh 125 labour hours Departmental costs: Material and supplies (variable) $ 5 000 $ 1 500 Variable labour 1 400 2 250 Fixed overhead 12 000 250 Total Support department costs $18 400 $4 000Required: 1. (a) Calculate the plantwide overhead rate for Dillon for the coming year using the same method as used in the past. (b) Estimate the overhead cost of an Elite attache case that requires 4 direct labour hours and 5 machine hours in the moulding department, 3 direct labour hours in the component department and 2 direct labour hours in the assembly department. 2. Chris Bowen has been asked to develop departmental overhead rates for comparison with the plantwide rate. The following steps are to be followed in developing the departmental rates: (a) Allocate the total maintenance costs to the three manufacturing departments, using direct method. (b) Allocate the power department costs to the three manufacturing departments, using the direct method. (c) Calculate departmental overhead rates for the three manufacturing departments, using a machine hour cost driver for the moulding department and a direct labour hour cost driver for the component and assembly departments. 3. Estimate the overhead cost of the Elite attache case using the departmental overhead rates. 4. Should Dillon use a plantwide rate or departmental rates to assign overhead to products? Explain your