Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sam's Apparels is looking to partner with a local celebrity/inflencer to launch a new line of clothing. As per the partnership agreement, Sam's Apparel

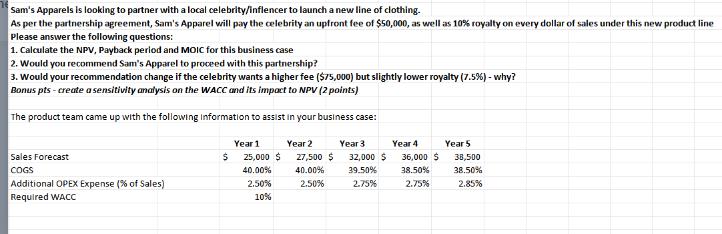

Sam's Apparels is looking to partner with a local celebrity/inflencer to launch a new line of clothing. As per the partnership agreement, Sam's Apparel will pay the celebrity an upfront fee of $50,000, as well as 10% royalty on every dollar of sales under this new product line Please answer the following questions: 1. Calculate the NPV, Payback period and MOIC for this business case 2. Would you recommend Sam's Apparel to proceed with this partnership? 3. Would your recommendation change if the celebrity wants a higher fee ($75,000) but slightly lower royalty (7.5%) - why? Bonus pts - create a sensitivity analysis on the WACC and its impact to NPV (2 points) The product team came up with the following information to assist in your business case: Year 2 25,000 $ 27,500 $ 40.00% 40.00% 2.50% 2.50% 10% Sales Forecast COGS Additional OPEX Expense (% of Sales) Required WACC $ Year 1 Year 3 Year 4 32,000 $ 39.50% 2.75% 36,000 $ 38.50% 2.75% Year 5 38,500 38.50% 2.85%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION IN DETAILS To calculate the NPV we need to discount the future cash flows using the cost of capital WACC The WACC for Sams Apparel is 10 NPV ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started