Question

Samsia is a keen landscape photographer and artist. Recently, Samsia receives a job offer to work in an art gallery in Los Angeles, which she

Samsia is a keen landscape photographer and artist. Recently, Samsia receives a job offer to work in an art gallery in Los Angeles, which she happily accepts. She is very excited about relocating to Los Angeles as she has been having trouble maintaining the profitability of her online business in selling landscape photography.

Prior to relocating, Samsia disposes the following assets:

1. An investment property. She purchased the property on 2 May 2013 for $200,000 and incurred stamp duty costs of $5,000 at the time of purchase. She sold the investment property on 1 June 2023 for $400,000.

2. Bank shares, which she purchased on 1 December 2022 for $4,000. She sold them on 5 June 2023 for $4,500.

3. An artwork set, which was gifted to her on 27 September 2000. At the time of the gift, the market value of the artwork set was $80,000. She sold it for $67,000 on 23 May 2023.

Samsia is having difficulty working out her net capital gain or net capital loss calculation and how to complete a small part of her income tax return.

She is also not sure of whether she needs to include other amounts in her calculations. One such amount is a compensation receipt of $20,000 for a cancellation of a contract by one of her film suppliers. She claims that the reduction in films may have caused the loss of profitability in her online business. She is also not sure of whether the sale proceeds, being $50,000, in selling landscape photographs as part of her online business needs to be included.

As her taxation lawyer, she seeks your advice.

Required: Calculate the net capital gain or net capital loss made for the income year ending 30 June 2023, showing and explaining all your calculations with relevant case law and legislation.

Your advice to Samsia must include:

• An explanation of what is to be included (or excluded) in the net capital gain or net capital loss calculation, showing full support with any relevant legislation and case law;

• A net capital gain or net capital loss made for the income year ending 30 June 2023, showing and explaining all your calculations with relevant case law and legislation;

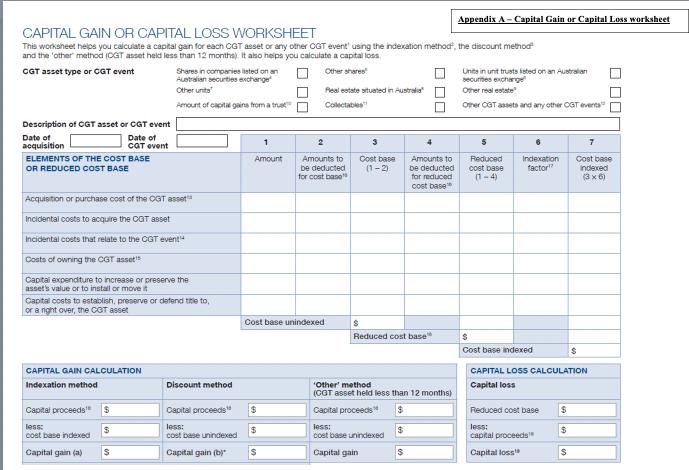

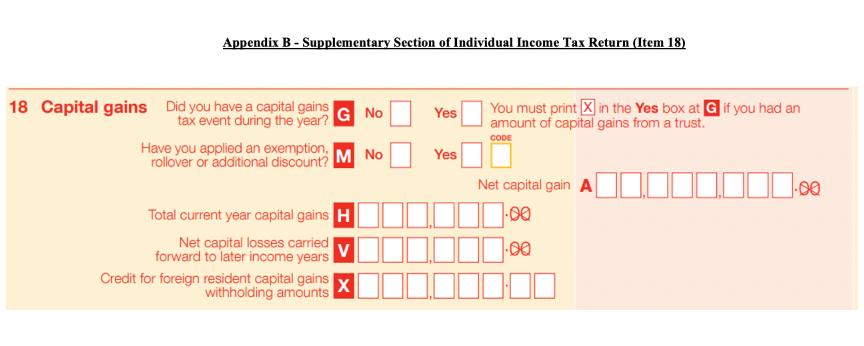

• Completion of the Capital gains or Capital loss worksheet for each CGT event (Appendix A); and

• Completion of Item 18 (this is the supplementary section of an Individual Tax Return) (Appendix B).

Further instructions for submitting into the Assignment drop box activity on Moodle:

Your final submission should consist of:

Both PDF FILES need to be uploaded into the Assignment drop box activity

Appendix A consists of multiple copies of the Capital gains or Capital loss worksheet. One worksheet is required for each CGT event. You must determine how many CGT events have occurred in this problem question, and therefore how many worksheets are required. The worksheet is similar to the table you used in your CGT tutorial, and only requires filling in your calculations. Appendix B also just requires filling in your calculations.

complete the relevant tables.

CAPITAL GAIN OR CAPITAL LOSS WORKSHEET This worksheet helps you calculate a capital gain for each CGT asset or any other CGT event using the indexation method, the discount method and the other method (CGT asset held less than 12 months). It also helps you calculate a capital loss CGT asset type or CGT event Other shares Description of CGT asset or CGT event Date of acquisition ELEMENTS OF THE COST BASE OR REDUCED COST BASE Date of CGT event Acquisition or purchase cost of the OGT asset Incidental costs to acquire the CGT asset Incidental costs that relate to the CGT event" Costs of owning the CGT asset Capital expenditure to increase or preserve the asset's value or to install or move it Shares in companies listed on an Australian securties exchange Other units Amount of capital gains from a tru Capital costs to establish, preserve or defend title to, or a right over, the CGT asset CAPITAL GAIN CALCULATION Indexation method Capital proceeds $ less: cost base indexed Capital gain (a) $ Discount method 1 Amount Real estate situated in Australia Collectables Capital proceeds" $ less: cost base unindexed Capital gain (b) 2 Amounts to be deducted for cost base" Cost base unindexed Cost base (1-2) Amounts to be deducted for reduced cost base $ Reduced cost base 'Other' method (CGT asset held less than 12 months) Capital proceeds less: cost base unindexed Capital gain $ Appendix A - Capital Gain or Capital Loss worksheet Units in unit trusts listed on an Australian securites exchange Other real estate Other CGT assets and any other CGT events" 5 Reduced cost base (1-4) Indexation factor $ Cost base indexed Reduced cost base CAPITAL LOSS CALCULATION Capital loss capital proceeds Capital loss 7 Cost base indexed (3x6) $ $

Step by Step Solution

3.53 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Capital Gains Tax CGT Calculation for Samsia Income Year Ending 30 June 2023 What is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started