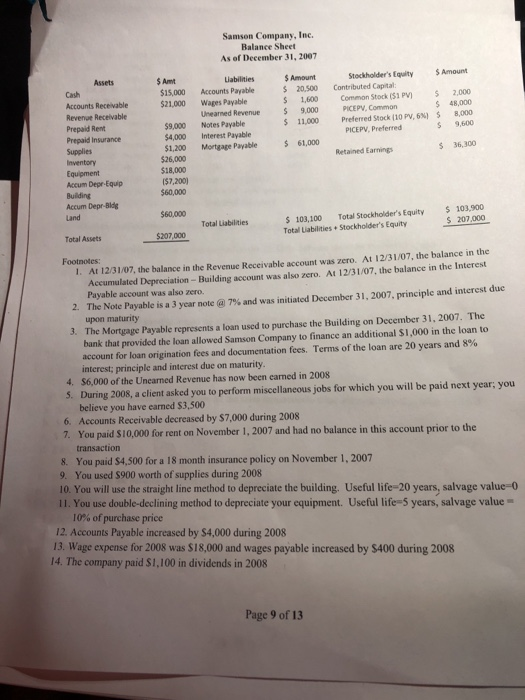

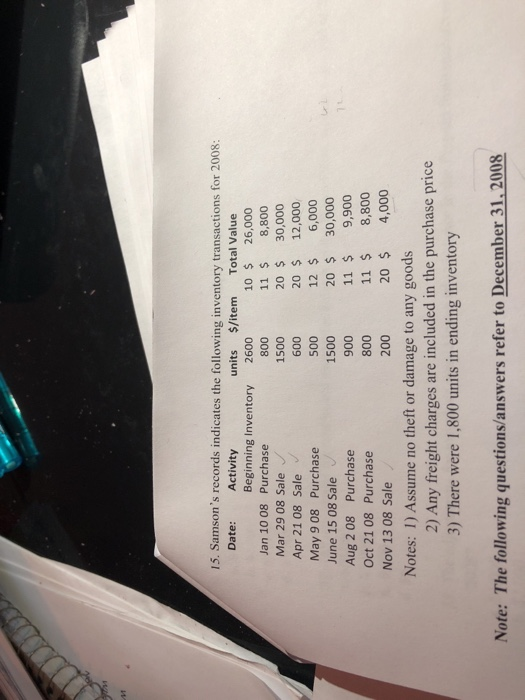

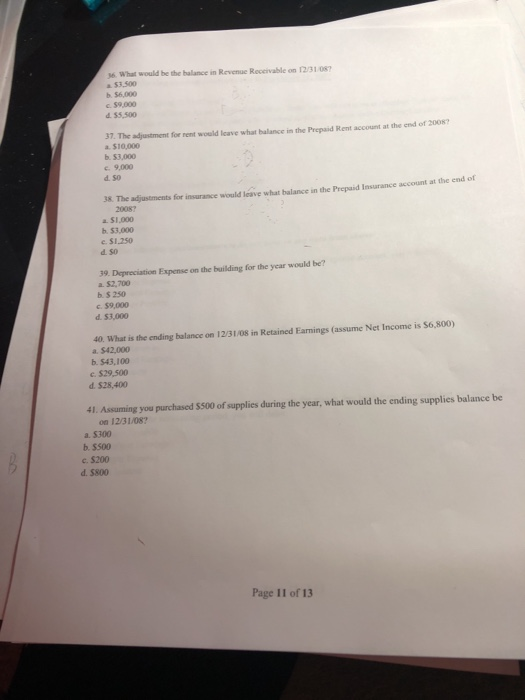

Samson Company, Inc. As of December 31, 2007 uabilities $Amount $1,600 11,000 61,000 Balance Sheet $Amt Stockholder's Equity Amount Assets Cash Accounts Receivable Revenue Receivable Prepaid Rent Prepaid Insurance 20,500 Contributed Capital: 15,000 Accounts Payable $21,000 Wages Payable 2,000 $48,000 Common Stock ($1 PV) Unearned Revenue 9,000 PICEPV, Common Preferred Stock(10 p , 6%, PICE PV, preferred $ S 8,000 9,600 $ 9,000 Notes Payable $4,000 Interest Payable 1,200 Mortgage Payable $ 36,300 Retained Earnings Inventory Equipment Accum Depr-Equip Building Accum Depr-Bldg Land $26,000 $18,000 (57,200) $60,000 5 103,100 Total Stockholder's Equity103,900 S 207,000 1. At 12/31/07, the balance in the Revenue Receivable account was zero. At 12/31/07, the balance in the $60,000 Total Liabilities Total Assets $207,000 Total Liabilities Stockholder's Equity Footnotes: Accumulated Depreciation-Building account was also zero. At 12/31/07, the balance in the Interest Payable account was also zero. 2. The Note Payable is a 3 year note @ 7% and was initiated December 31, 2007, principle and interest due upon maturity 3. The Mortgage Payable represents a loan used to purchase the Building on December 31, 2007. The bank that provided the loan allowed Samson Company to finance an additional $1,000 in the loan to account for loan origination fees and documentation fees. Terms of the loan are 20 years and 8% interest; principle and interest due on maturity 4. $6,000 of the Uncaned Revenue has now been earned in 2008 S. During 2008, a client asked you to perform miscellaneous jobs for which you will be paid next year, you believe you have earned $3,500 6. Accounts Receivable decreased by $7,000 during 2008 7. You paid $10,.000 for rent on November 1, 2007 and had no balance in this account prior to the transaction 8. You paid $4,500 for a 18 month insurance policy on November 1,2007 9. You used $900 worth of supplies during 2008 10. You will use the straight line method to depreciate the building. Useful life-20 years, salvage value-0 11. You use double-declining method to depreciate your equipment. Useful life-5 years, salvage value- 10% ofpurchase price 12. Accounts Payable increased by $4,000 during 2008 13. Wage expense for 2008 was $18,000 and wages payable increased by $400 during 2008 14. The company paid $1,100 in dividends in 2008 Page 9 of 13 15. Samson's records indicates the following inventory transactions for 2008: Date: Activity units $/item Total Value Beginning Inventory 2600 800 1500 600 500 1500 900 800 200 10 $ 26,000 11 $ 8,800 20 $ 30,000 20 12,000 12 $ 6,000 20 $ 30,000 11 $ 9,900 11 $ 8,800 20 $ 4,000 Jan 10 08 Purchase Mar 29 08 Sale Apr 21 08 Sale May 9 08 Purchase June 15 08 Sale Aug 2 08 Purchase Oct 21 08 Purchase Nov 13 08 Sale Notes: 1) Assume no theft or damage to any goods 2) Any freight charges are included in the purchase price 3) There were 1,800 units in ending inventory Note: The following questions/answers refer to December 31.2008 6 What would be the balance in Revenue Reccivable on 12/31 08 a $3,500 b. 56,000 .$9,000 d35,500 37. The adjustment for rent would leave what balance in the Prepaid Rent account at the end of 20087 a. $10,000 $3,000 e. 9,000 38. The adjustments for insurance would leave what balance in the Prepaid Insurance account at 20087 $1,000 53,000 c.$1.250 d.S0 39. Depreciation Expense on the building for the year would be? b. $ 250 c. $9,000 d. $3,000 40. What is the ending balance on 12/31/08 in Retained Earnings (assume Net Income is $6,800) a. $42,000 b. 543,100 c. $29,500 d. $28,400 41. Assuming you purchased $500 of supplies during the year, what would the ending supplies balance be on 12/31/08? a. $300 b.5500 c. $200 d. $800 Page 11 of 13